Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When you search for terms like "Is LTI Safe or Scam," you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

When you search for terms like “Is LTI Safe or Scam,” you are asking the most important question any investor can ask. Picking a broker is not just about fees or trading platforms; it is about trust. You are giving the broker your hard-earned capital, expecting it to handle it honestly and professionally. The internet is full of mixed user reviews, promotional content, and confusing claims, making it hard to find a clear answer. This article is designed to cut through that confusion.

The problem of whether to trust a broker like LTI is real and needs careful thought. A fancy website and promises of high profits can be tempting, but they mean nothing if the company behind them is not secure. The results of choosing a risky or untrustworthy broker can be terrible, ranging from not being able to withdraw your funds to losing your entire investment. This is why your search for clarity is not just smart; it is essential for your financial safety.

This review is not based on personal opinions or paid content. Our conclusions come from a careful, fact-based investigation into LTI's operations and regulatory framework. To do this, we have analyzed the detailed data available on LTI's profile on WikiFX, a global broker regulation inquiry platform. This approach allows us to base our analysis on verified details, public records, and official warnings, giving you the evidence needed to make an informed decision. We will examine LTI's regulatory status, user complaints, and operational transparency to answer the critical question: Can you trust LTI with your capital?

The most critical factor in determining capital safety is assessing the LTI regulation status. Regulation is the foundation of trust in the financial industry. It ensures that the broker follows strict standards for protecting client funds, operational transparency, and fair dealing. Without it, a trader has no protection and no way to get help.

The evidence is clear: LTI is not a regulated broker. According to verifiable data from global inquiry platforms, despite operating for 5-10 years and maintaining a corporate presence in the UK, LTI lacks a valid forex trading license from any reputable financial authority. An “unregulated” status is a major red flag. It means your funds are not protected by compensation schemes, there is no official body to help resolve disputes if you have issues with withdrawals or trade execution, and the broker operates without any oversight. This places your entire investment at the mercy of the company, a risk that no serious trader should ever take.

The risk associated with LTI is not just theoretical; it is documented. On July 29, 2024, the UK's Financial Conduct Authority (FCA) issued a formal warning against London Trading Index Limited. The FCA is one of the world's most respected financial regulators. A warning from this body is a clear and direct statement that the firm is providing financial services or products in the UK without the required authorization. Trading with a firm on the FCA's warning list is an obvious risk. It shows that the regulator has identified potential harm to consumers and is actively advising the public to avoid the entity. Ignoring such a direct warning is gambling with your capital.

High-risk entities often create a false appearance of legitimacy to attract unsuspecting clients. Information found on LTI's WikiFX exposure page reveals a critical discrepancy: the broker claims to offer security measures, but these are meaningless without regulatory oversight. This is a classic tactic used by high-risk entities. LTI mentions it is regulated by “FSA,” but official records show no such valid regulation, making the claim misleading. The table below clearly contrasts the broker's implied professionalism with the documented reality.

| LTI's Implied Claim | The Factual Reality (from WikiFX) | What This Means for You |

| A professional, reliable broker. | Unregulated with a “High potential risk” warning. | Your funds are not protected by any financial authority. |

| Secure and trustworthy. | Listed on the FCA Warning List. | The UK's top regulator explicitly warns consumers against them. |

| Regulated by “FSA”. | Official records show no such valid regulation. | The broker makes misleading or false regulatory claims. |

Beyond the primary red flag of no regulation, a closer look at LTI's operational model reveals a pattern of practices that are clearly unfriendly to users. These issues, often the subject of indirect user complaints and analysis, paint a picture of a broker that is not designed for the success or convenience of the average trader.

A consistent theme in the analysis of LTI is a lack of transparency and the presence of misleading information. This goes beyond the unsubstantiated claims of “FSA” regulation. The broker's branding itself appears designed to create a false sense of security. While it uses “London” in its name and has a registered company in the UK (London Trading Index Limited), its primary registration is in Mauritius (Equivest (Mauritius) Limited).

Mauritius is an offshore jurisdiction known for its weak financial oversight and less stringent regulatory requirements compared to top-tier jurisdictions like the UK, Australia, or the EU. This “offshore” status, combined with a “London” brand, is a common tactic used by high-risk brokers to appear more legitimate than they are. This lack of transparency is quantified by its independent reputation score. On a platform, such as WikiFX, which aggregates data on regulation, business practices, and risk management, LTI holds a very low score of 2.21 out of 10. This score is accompanied by an explicit warning: “Low score, please stay away!”

To summarize our findings and provide a clear, final verdict, we have graded LTI across five key metrics of trustworthiness. This scorecard serves as a quick-reference summary of the risks identified throughout our fact-based investigation.

· Regulatory Compliance & Safety: FAIL

· *Reason: LTI is completely unregulated. More alarmingly, it is the subject of a direct public warning from the UK's Financial Conduct Authority (FCA), a top-tier regulator.*

· Transparency & Honesty: FAIL

· *Reason: The broker makes misleading claims about being regulated by the “FSA” and uses “London” branding while being registered in an offshore jurisdiction (Mauritius). This demonstrates a clear lack of operational transparency.*

· Independent Reputation Score: FAIL

· *Reason: The broker holds an extremely low score of 2.21/10 on the global inquiry platform WikiFX, which comes with an explicit recommendation to “please stay away,” reflecting a consensus of high risk.*

After a thorough, evidence-based analysis, we can now provide a definitive answer to the question, “Is LTI Safe or Scam?” The conclusion is clear and supported by verifiable facts.

Based on the overwhelming evidence—a complete lack of valid regulation, an official warning from the UK's FCA, and misleading claims about its regulatory status—LTI cannot be considered a safe broker for any trader. While the term “scam” has a specific legal definition, LTI exhibits numerous red flags and engages in practices commonly associated with untrustworthy and high-risk financial operations. The combination of these factors places client capital in a position of extreme danger. The risk of encountering issues with fund withdrawals, unfair trade practices, or a total loss of investment is unacceptably high.

The financial markets are naturally risky, but your choice of broker should not be one of those risks. The investigative process used in this article should be a standard part of every trader's research. Protecting your capital begins before you ever make a deposit.

Before considering any broker, make it a non-negotiable step to verify its credentials. Use a comprehensive tool, such as WikiFX, to instantly check a broker's regulatory status, license details, and user exposure reports. A five-minute check on a platform like the LTI profile we analyzed can save you from significant financial loss and profound stress. Always prioritize brokers that are authorized and regulated by a top-tier authority in your jurisdiction, offer transparent terms, and have a long-standing positive reputation. Your financial security depends on it.

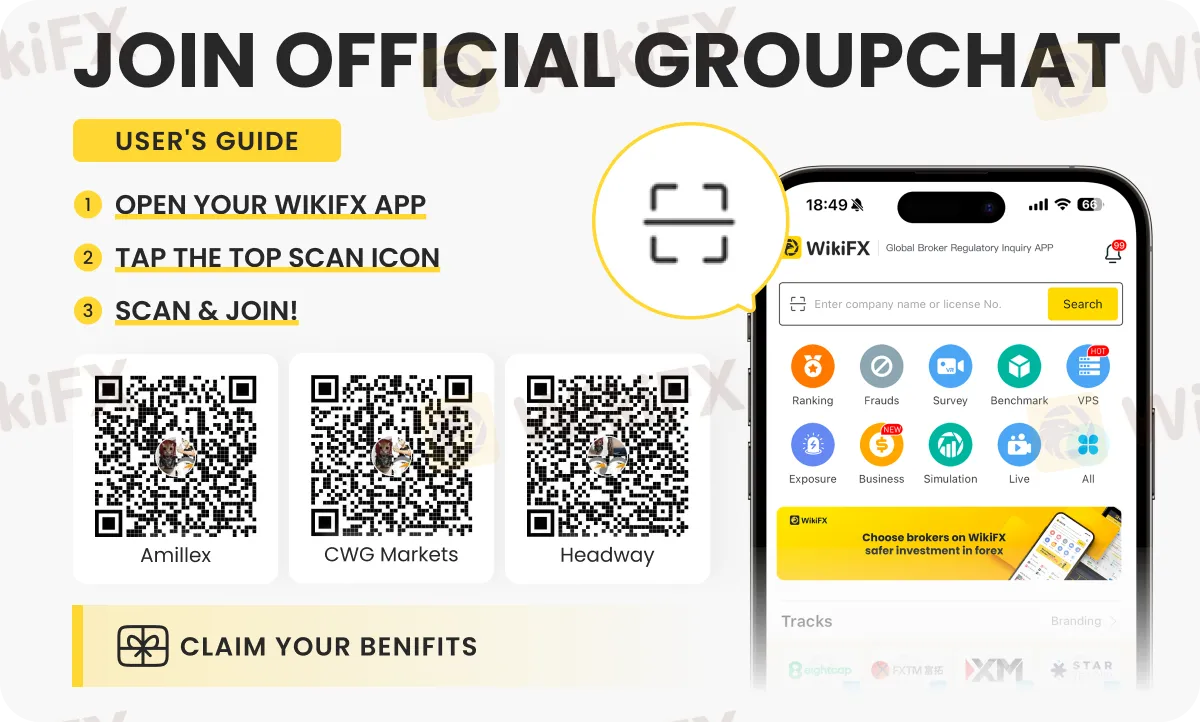

Make the most of the forex market movement by implementing tips and insights shared on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.