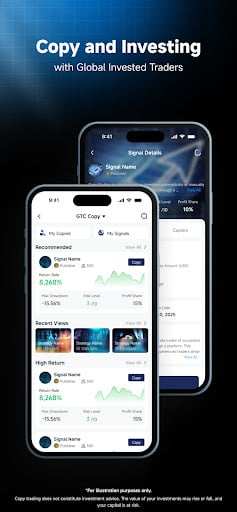

GTCFX Information

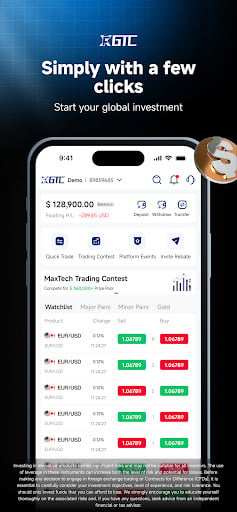

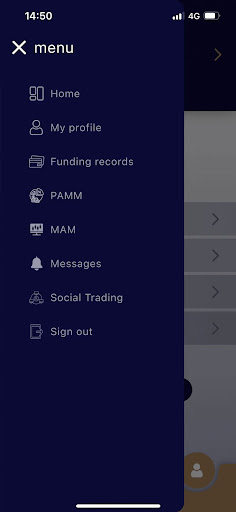

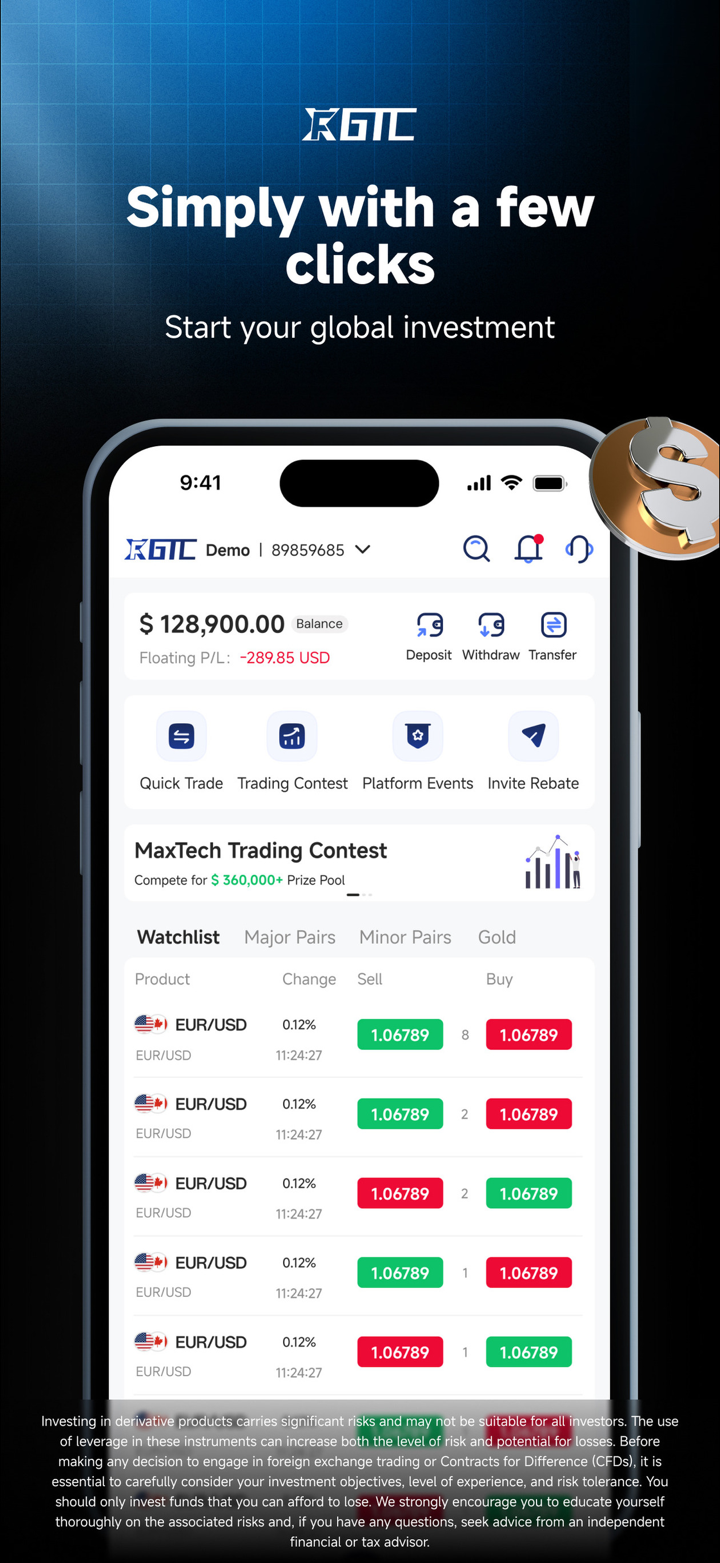

GTCFX is a global provider of financial derivatives, established in 2012. The GTCFX brand encompasses multiple companies that provide a diverse range of online trading products, serving over 985,000 clients across more than 100 countries. At GTCFX, clients can have access to extensive market coverage that includes not just Forex, but also gold, precious metals, CFDs on energy, commodities, stocks, shares and equity indices.

GTCFX offers three main types of trading accounts: Standard, Pro and ECN. Aside from live trading accounts, clients can also use demo accounts on the MetaTrader 4 and MetaTrader 5 platforms to test the trading environment and practice their trading skills.

Pros & Cons

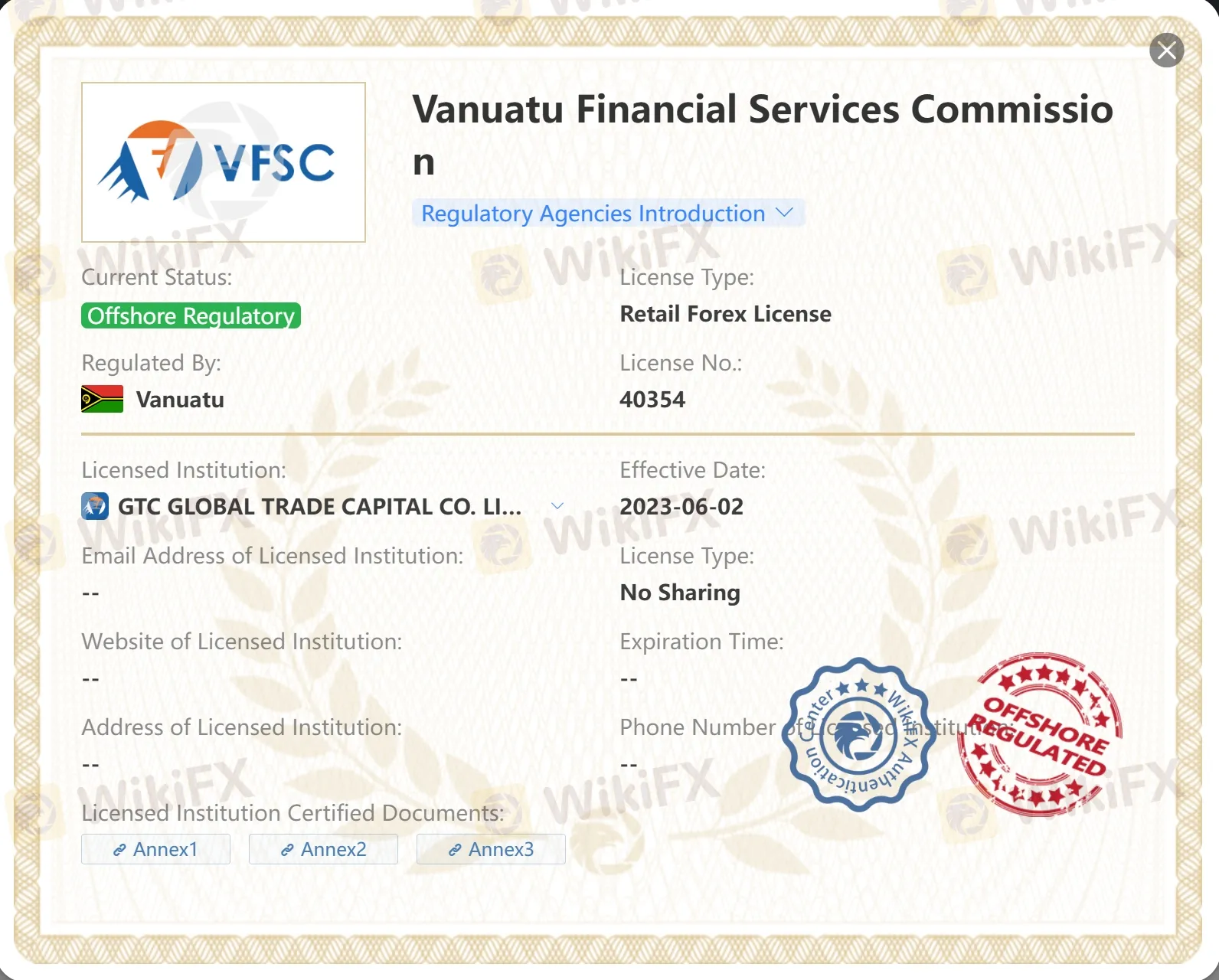

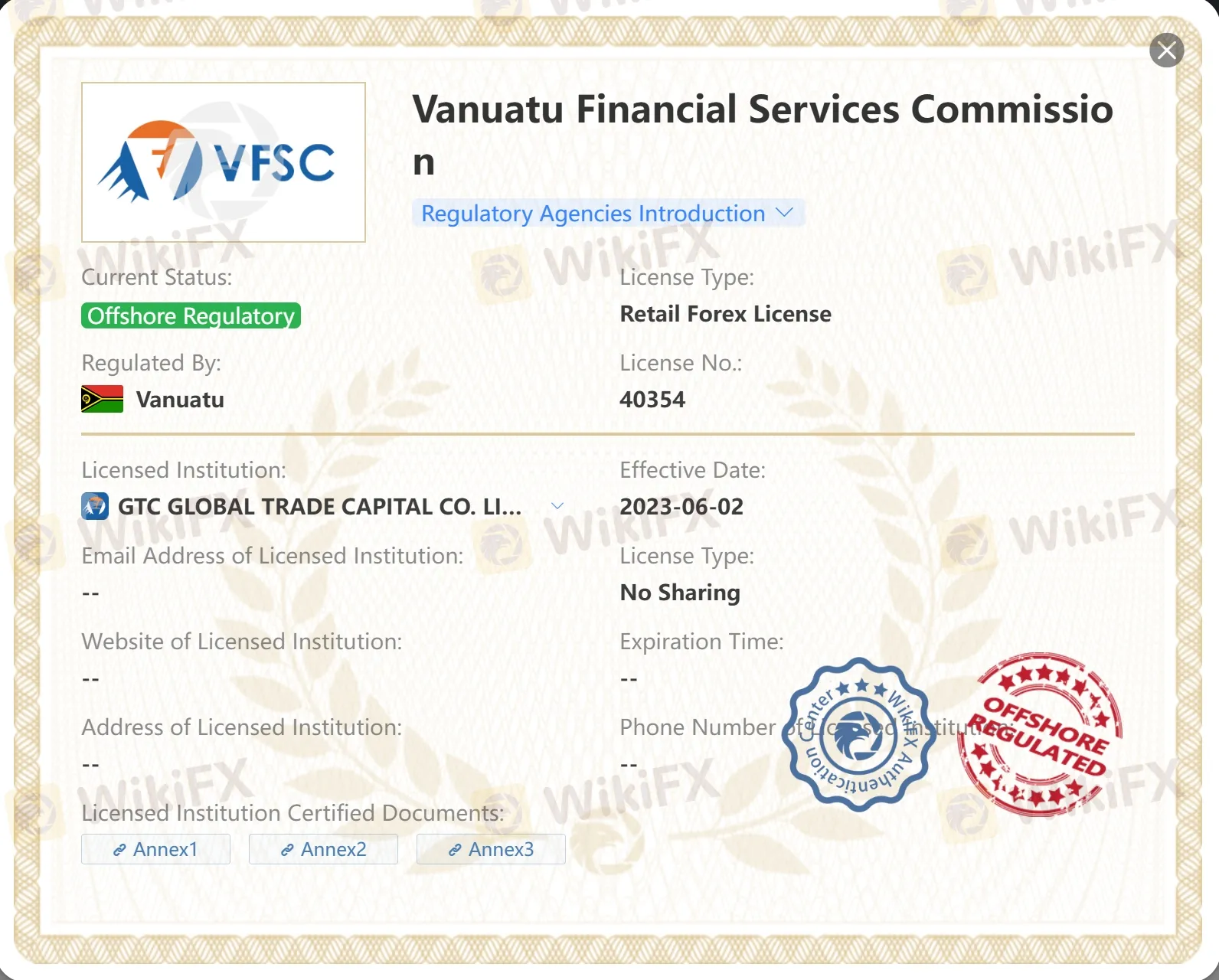

Is GTCFX Legit?

Yes. GTCFX operates under stringent regulatory oversight, with multiple companies under the GTCFX brand regulated across different regions worldwide. The company is licensed by the Financial Conduct Authority (FCA) in the United Kingdom and the Australia Securities & Investment Commission (ASIC).

GTCFX also holds a regulated Retail Forex License from the Securities and Commodities Authority (SCA) in the United Arab Emirates and an offshore license from the Vanuatu Financial Services Commission (VFSC).

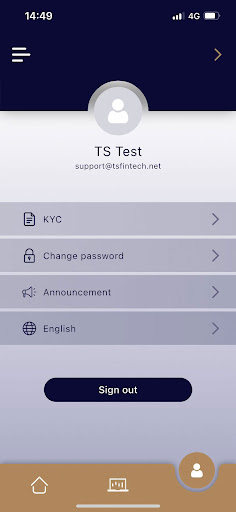

The company adheres to high standards of anti-money laundering (AML) and know-your-customer (KYC) practices, maintaining its integrity and reliability in the fintech industry.

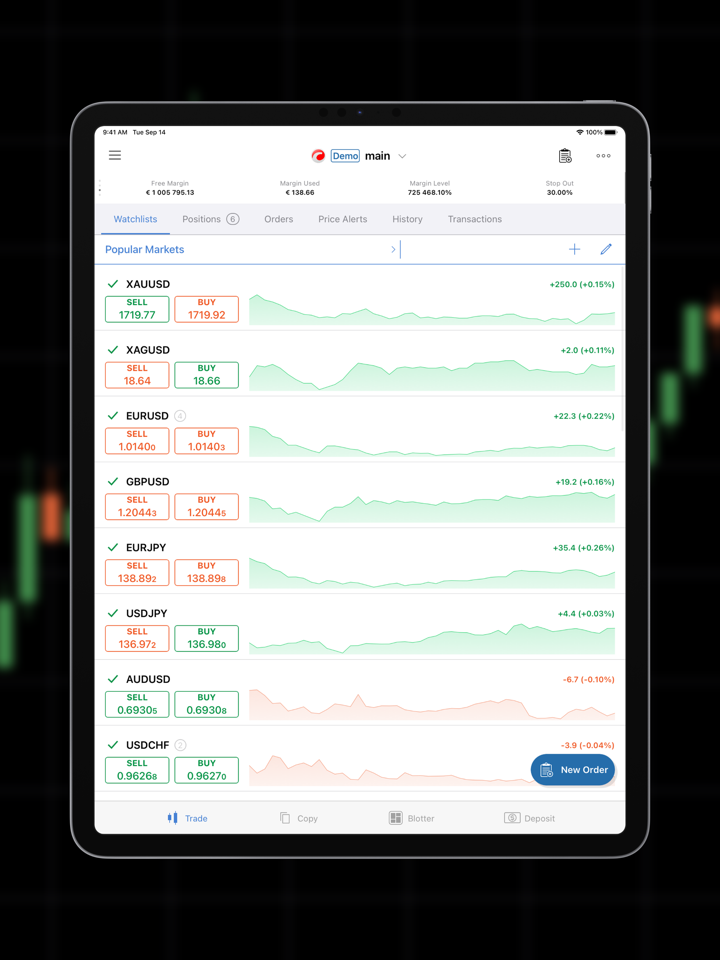

Market Instruments

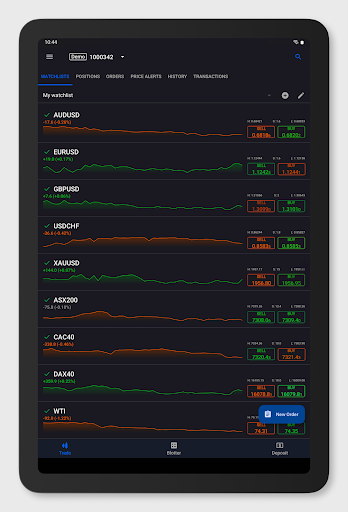

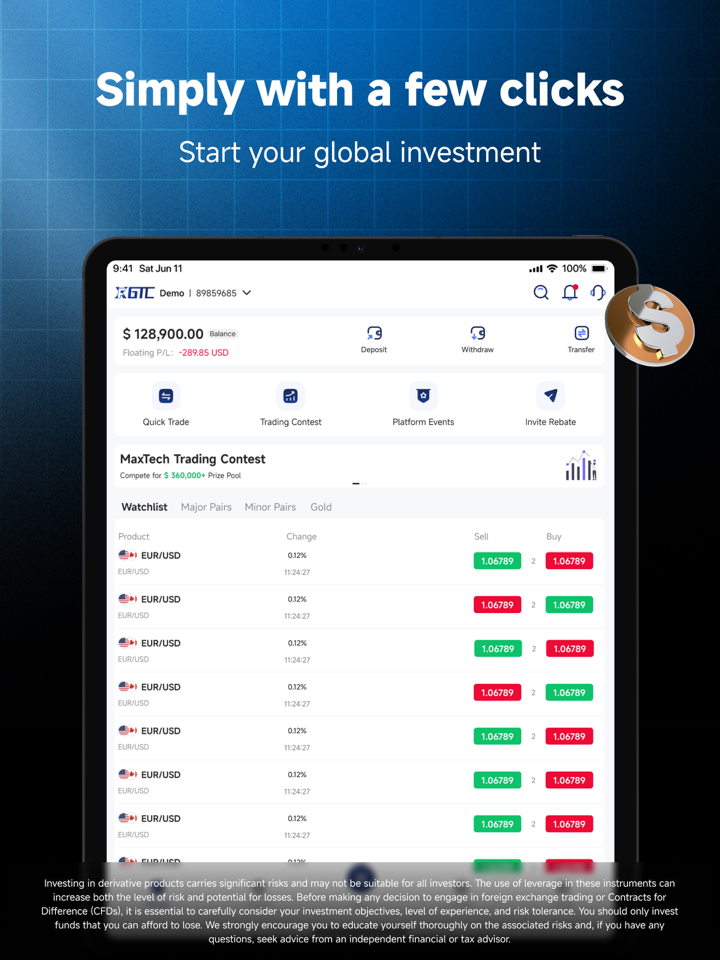

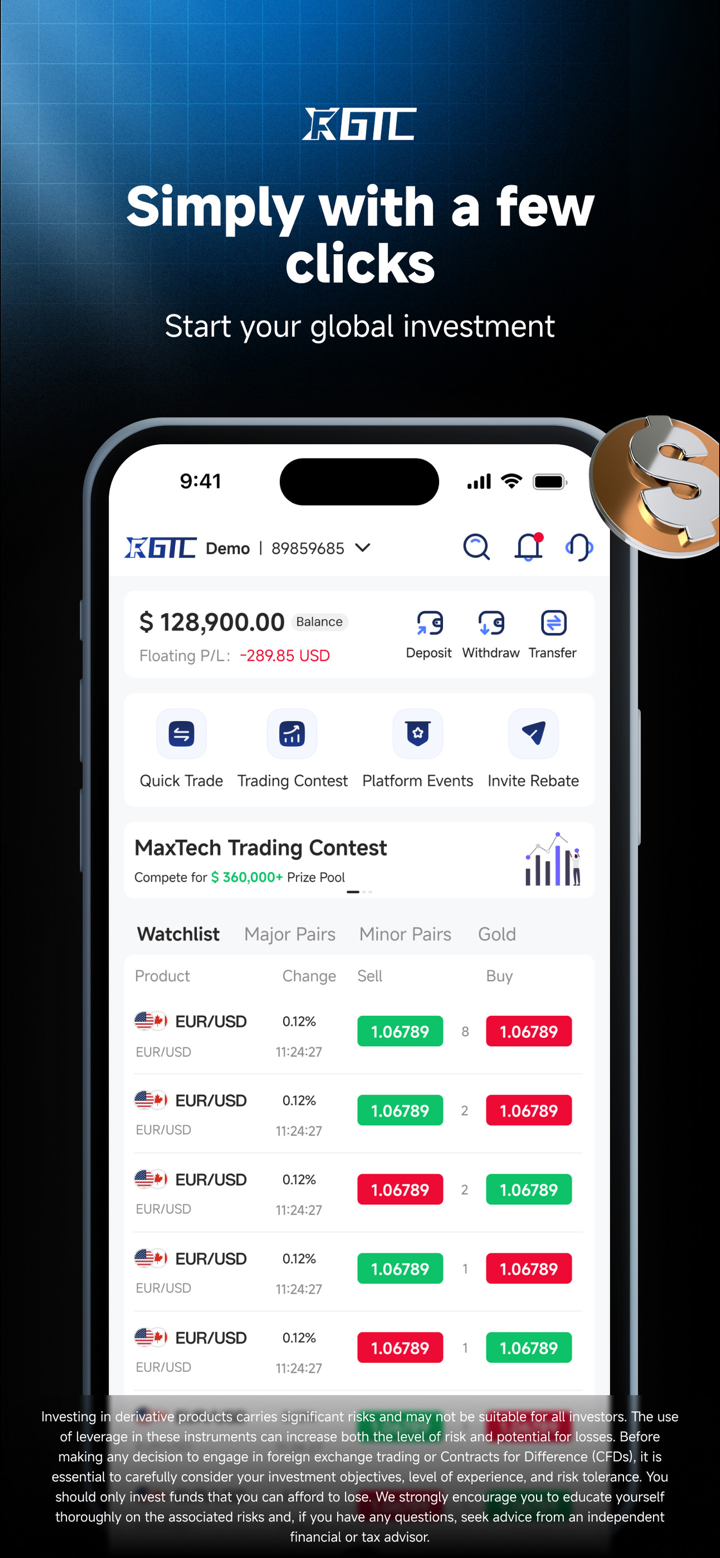

GTCFX offers an extensive and diverse range of market instruments, providing access to 8 different asset markets with over 27,000 trading options available. This vast selection includes traditional forex trading pairs, valuable commodities such as gold and other precious metals, and CFDs on energy sources like oil and natural gas. Additionally, traders can engage with a wide array of commodities, explore equity markets through stocks and shares, and speculate on the movements of major and minor equity indices.

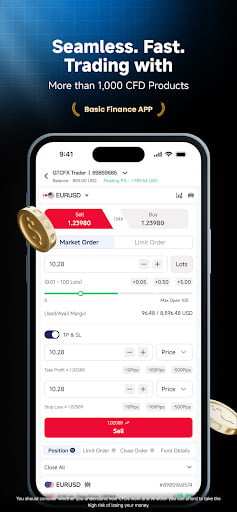

Account Types

GTCFX provides a tailored range of account options to suit various trading preferences and levels of investment, featuring Standard, Pro, and ECN accounts.

The Standard account is accessible with no minimum deposit requirement, making it ideal for beginners or those testing the platform.

Stepping up, the Pro account requires a $50 minimum deposit and offers enhanced features such as over 80 technical analysis tools and the support of a dedicated relationship manager, adding significant value for more serious traders who need deeper analytical capabilities and personalized service.

For advanced traders, the ECN account, with a $3,000 minimum deposit, delivers top-tier liquidity using ECN technology. This account also includes comprehensive market analysis, free VPS for faster and more reliable automated trading, advanced trading tools and signals for strategic trading, along with a dedicated relationship manager to provide expert guidance and support.

Leverage

GTCFX provides highly competitive leverage options tailored to different types of trading accounts, enabling traders to significantly amplify their trading capacity.

For traders using Standard and Pro accounts, GTCFX offers an exceptionally high leverage of up to 1:2000. This level of leverage is particularly appealing for those looking to maximize their potential returns on smaller initial investments, though it also involves higher risk.

On the other hand, the ECN accounts, which typically cater to more experienced traders who prefer direct market access, offer a lower but still substantial leverage of up to 1:500. This reduced leverage on ECN accounts aligns with the needs of advanced traders focusing on larger volumes and more significant capital, where the balance between opportunity and risk management is crucial.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

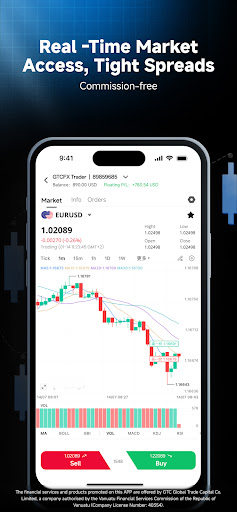

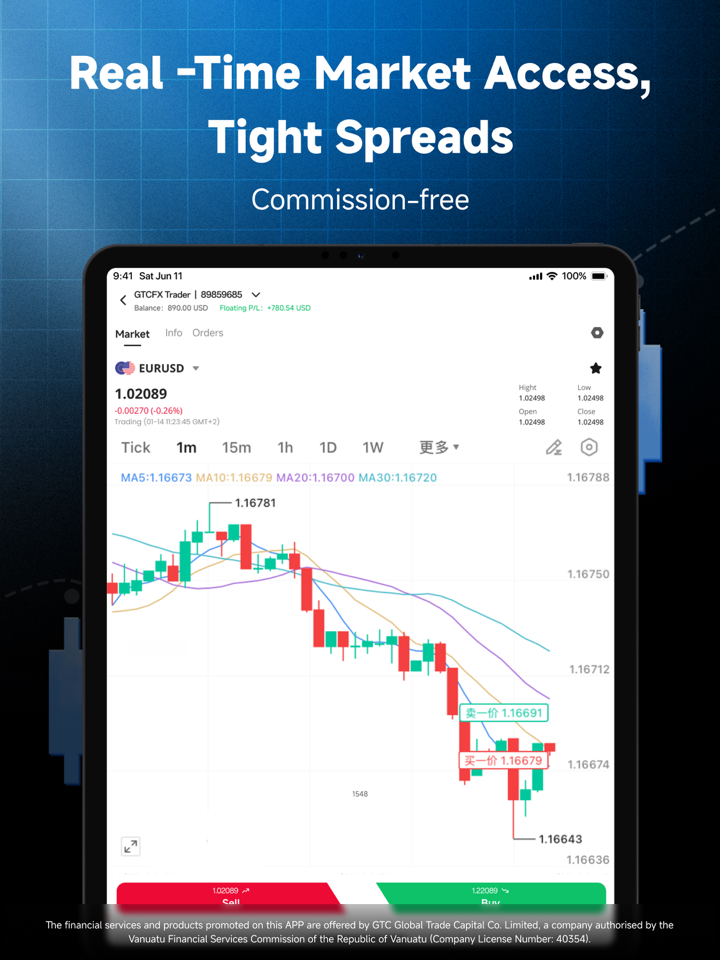

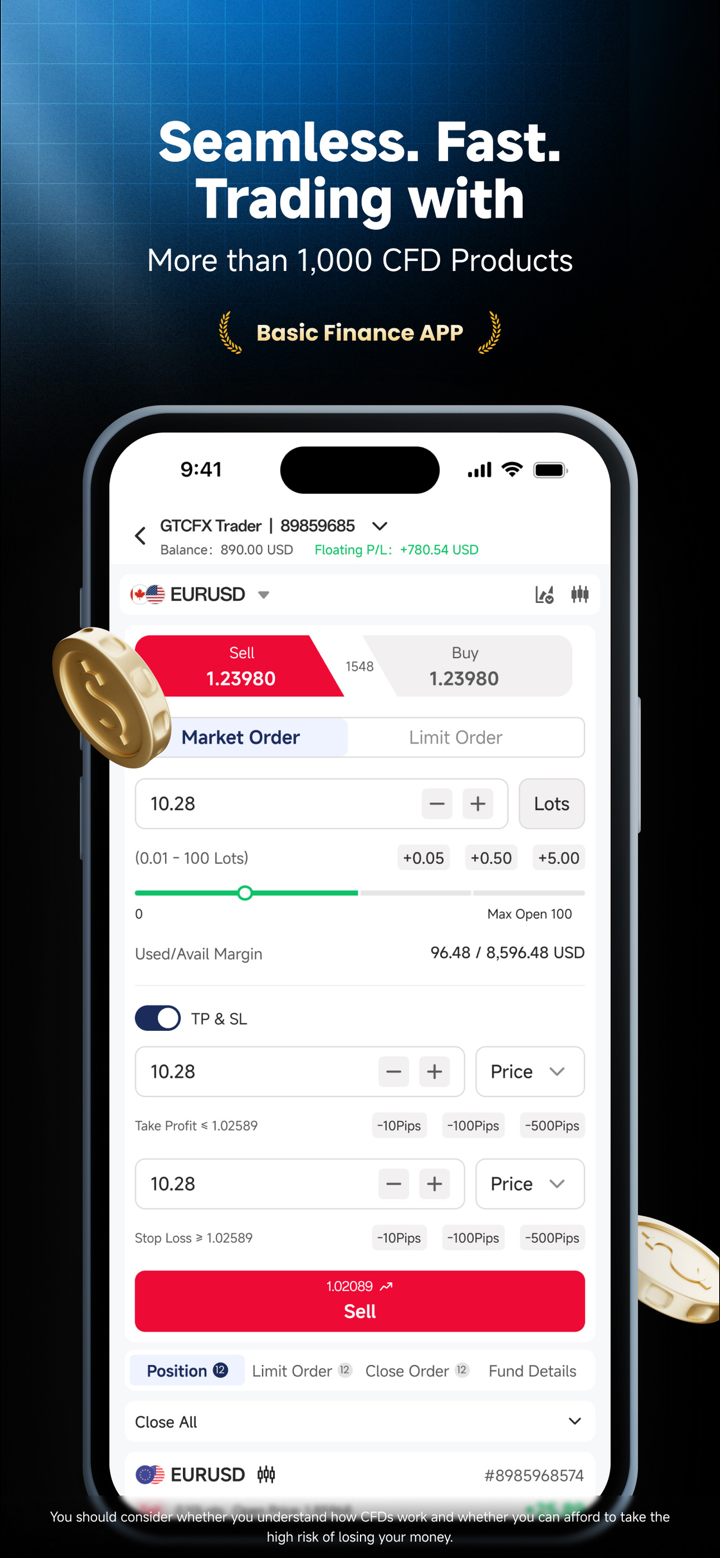

Spreads & Commissions

GTCFX offers a structured approach to spreads and commissions across its various account types.

For traders using the Standard account, the average spread is set at 1.4 pips, providing a cost-effective option without any commission charges.

The Pro account offers tighter spreads averaging 0.9 pips, also without any commission.

For those opting for the ECN account, GTCFX provides raw spreads starting from 0.0 pips, enabling direct access to market prices. However, this account does incur a commission of $5 per standard lot traded.

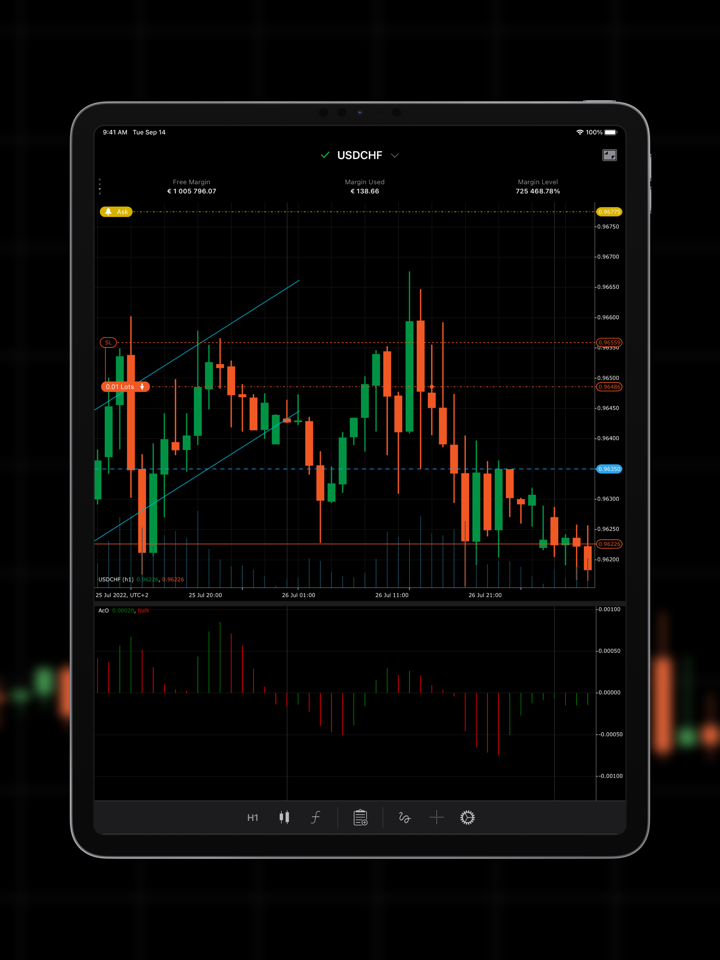

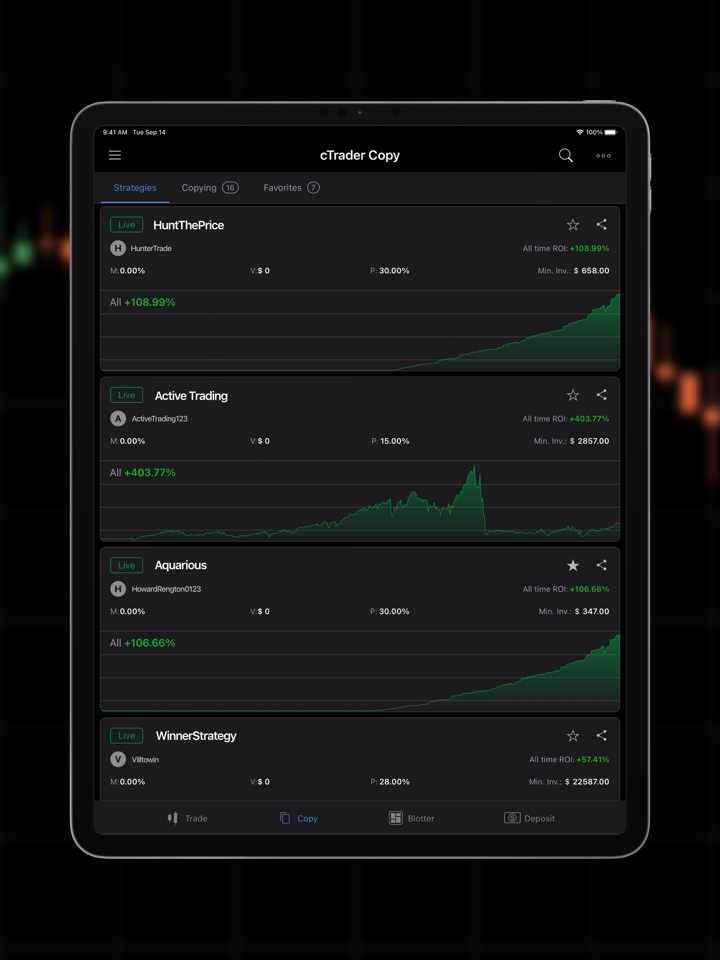

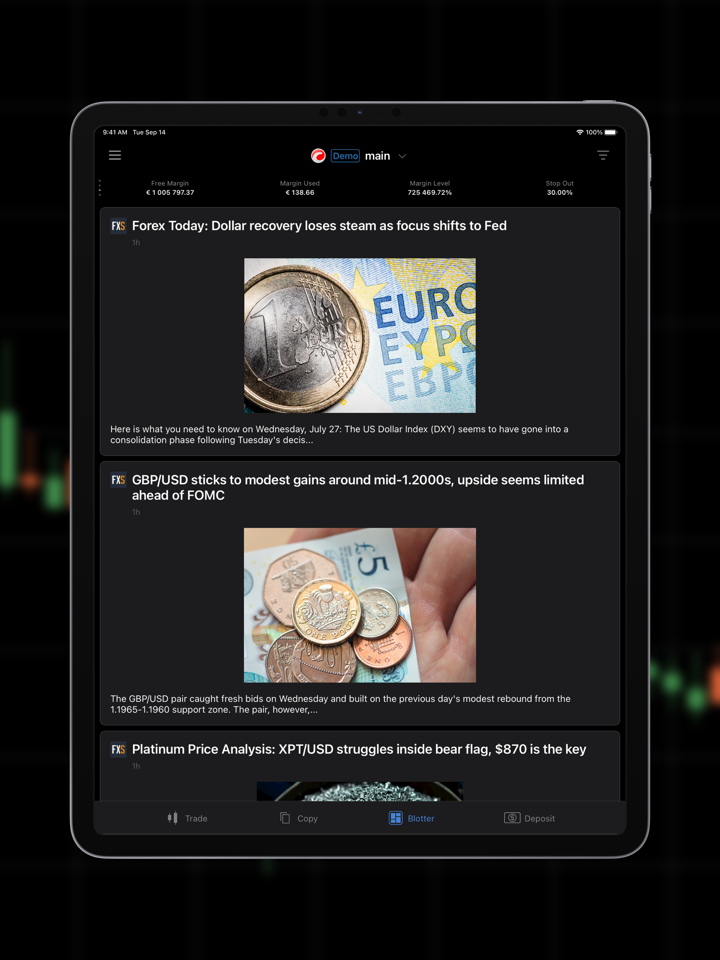

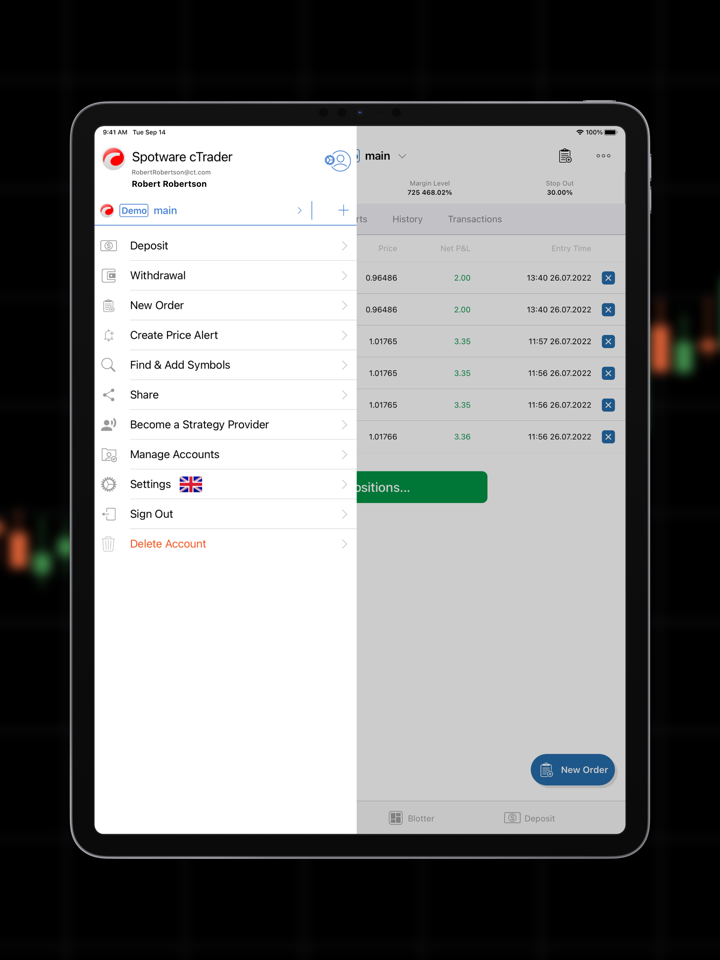

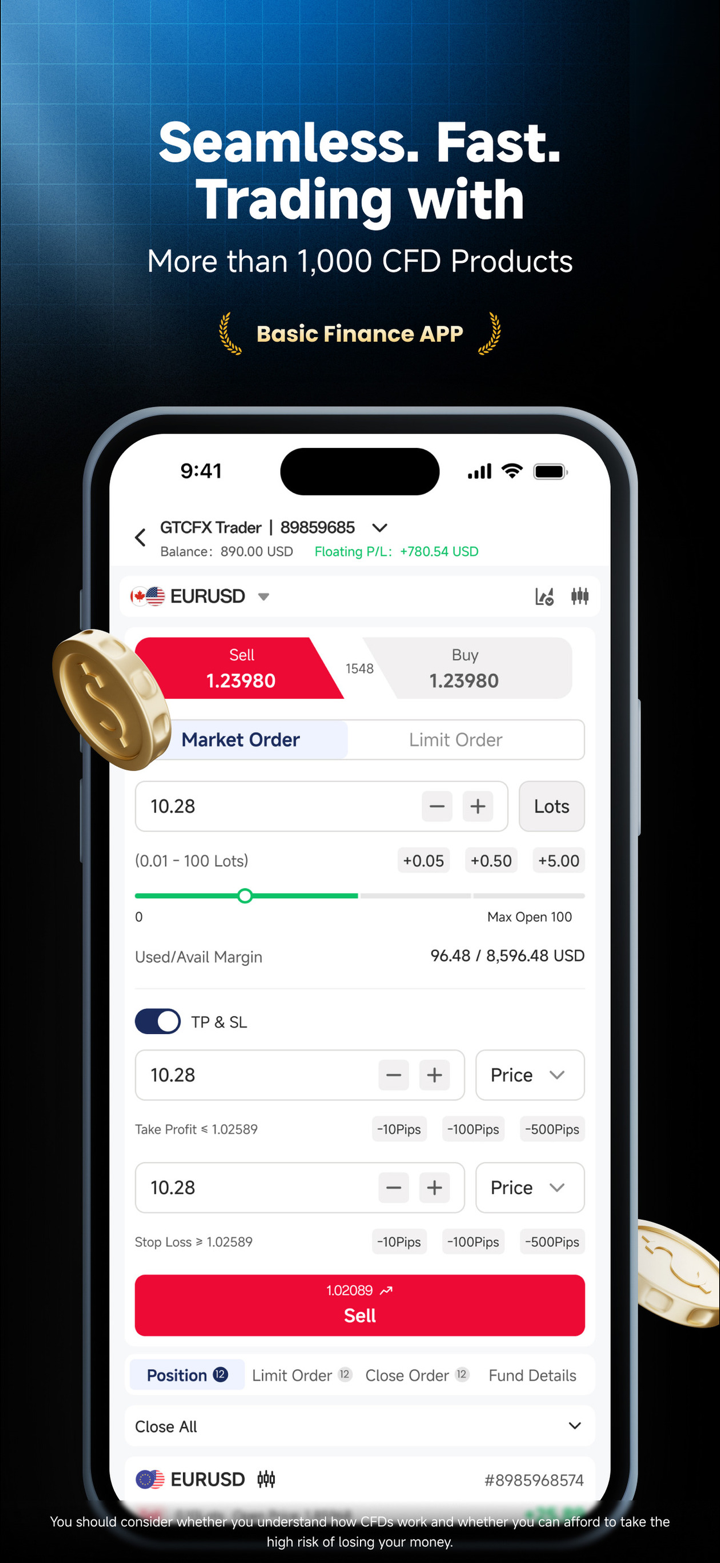

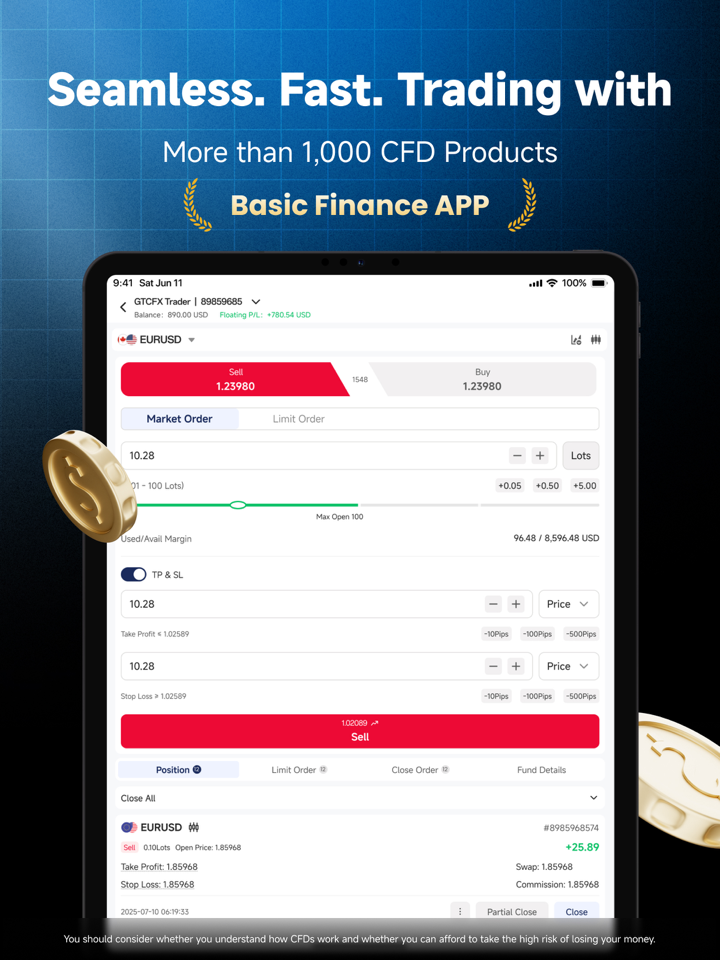

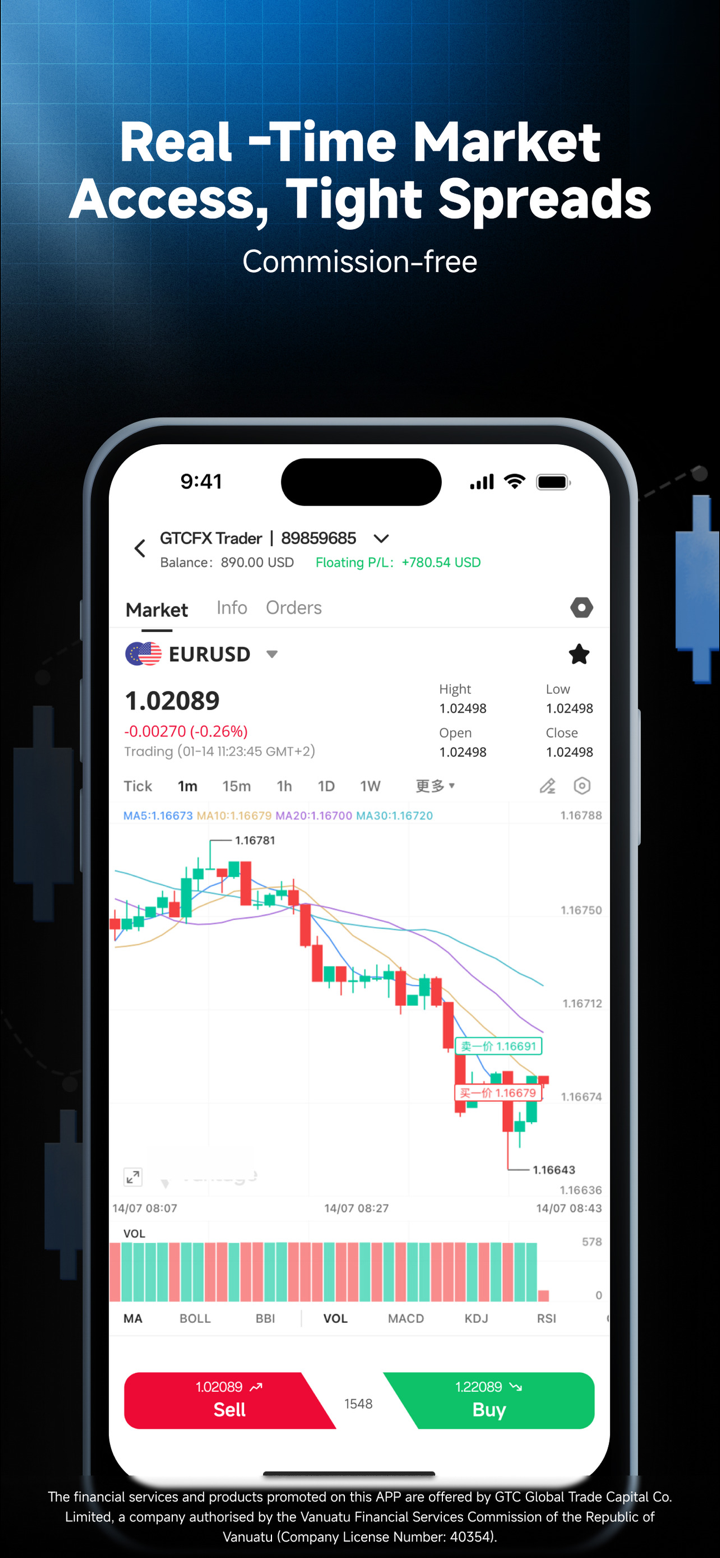

Trading Platforms

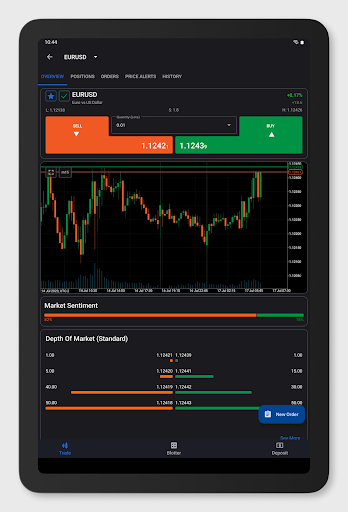

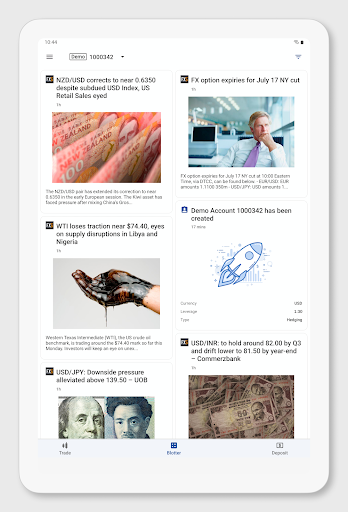

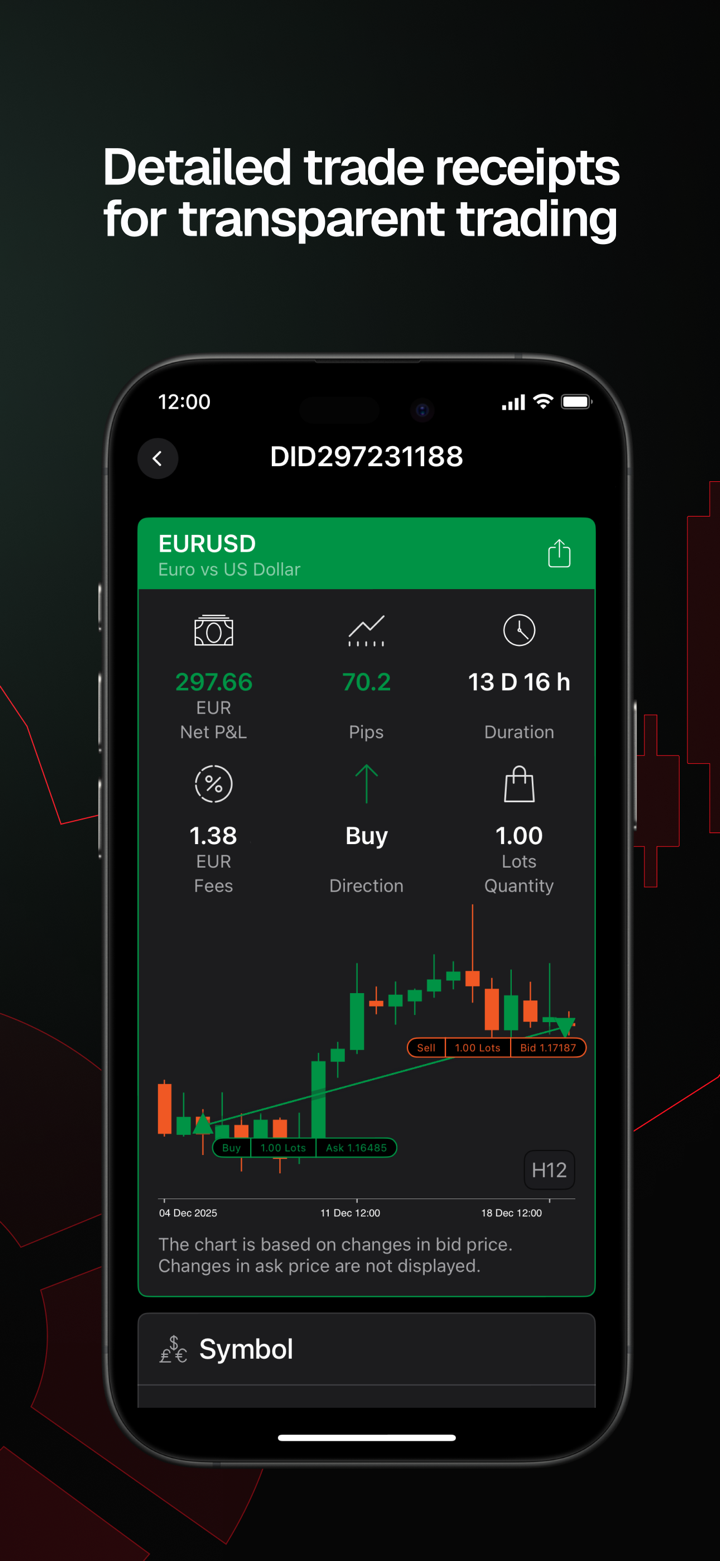

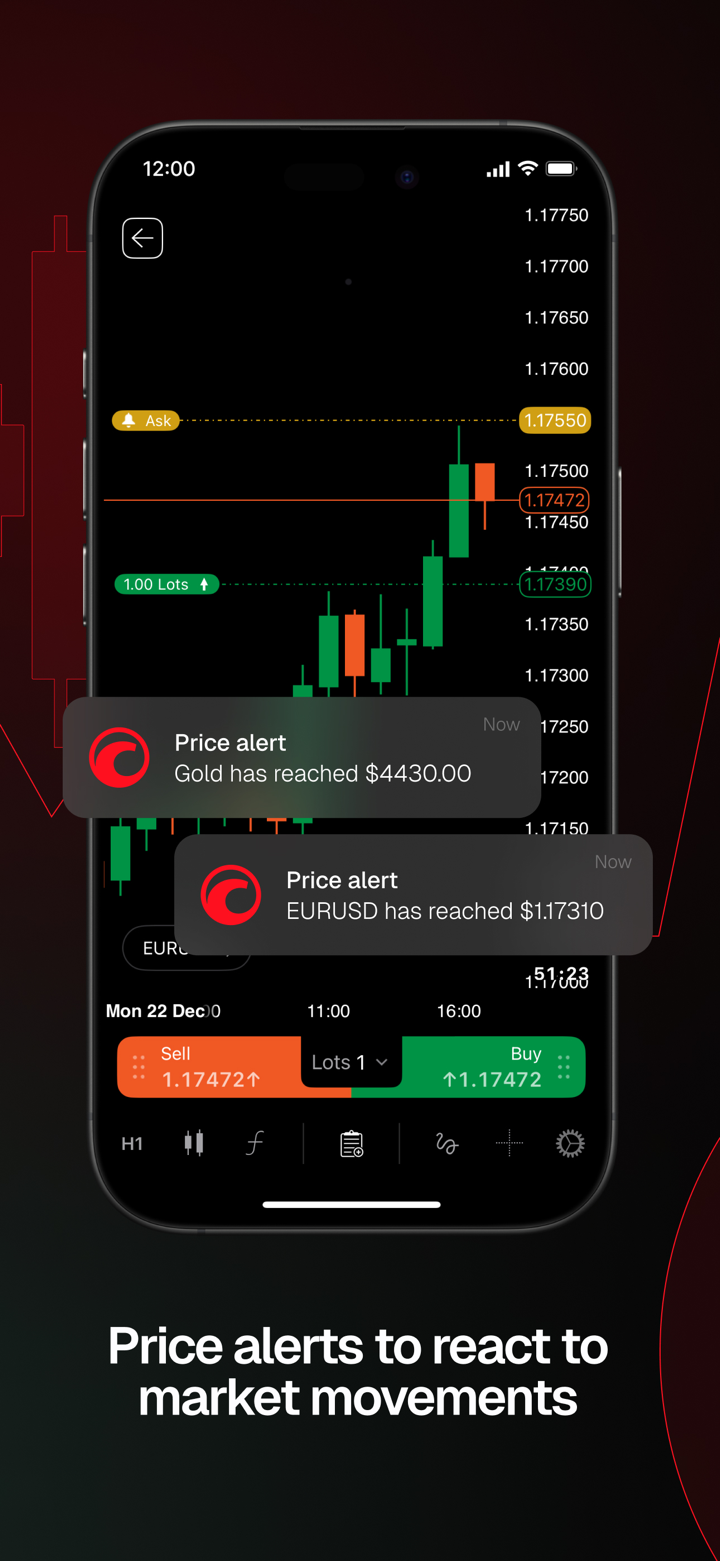

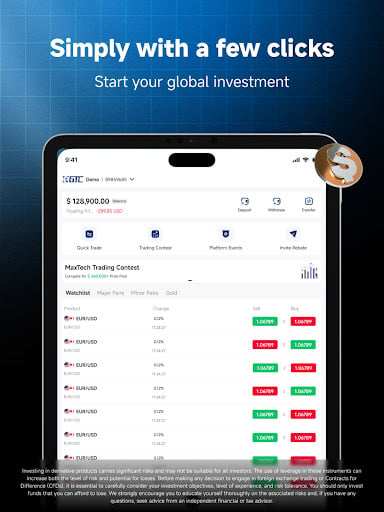

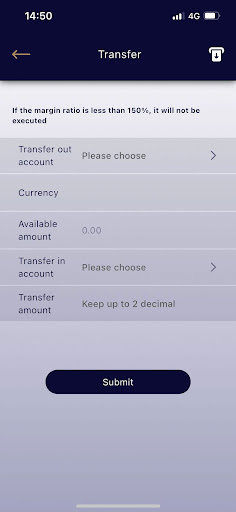

GTCFX offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), available on PC, Android, and iPhone. These platforms are renowned for their robust functionality, including comprehensive charting tools, a multitude of technical indicators, and automated trading capabilities through Expert Advisors (EAs).

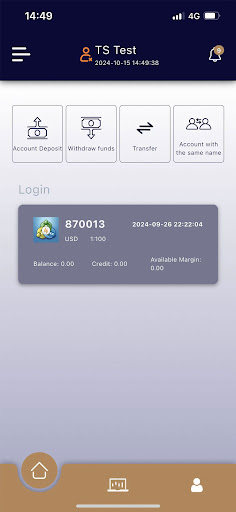

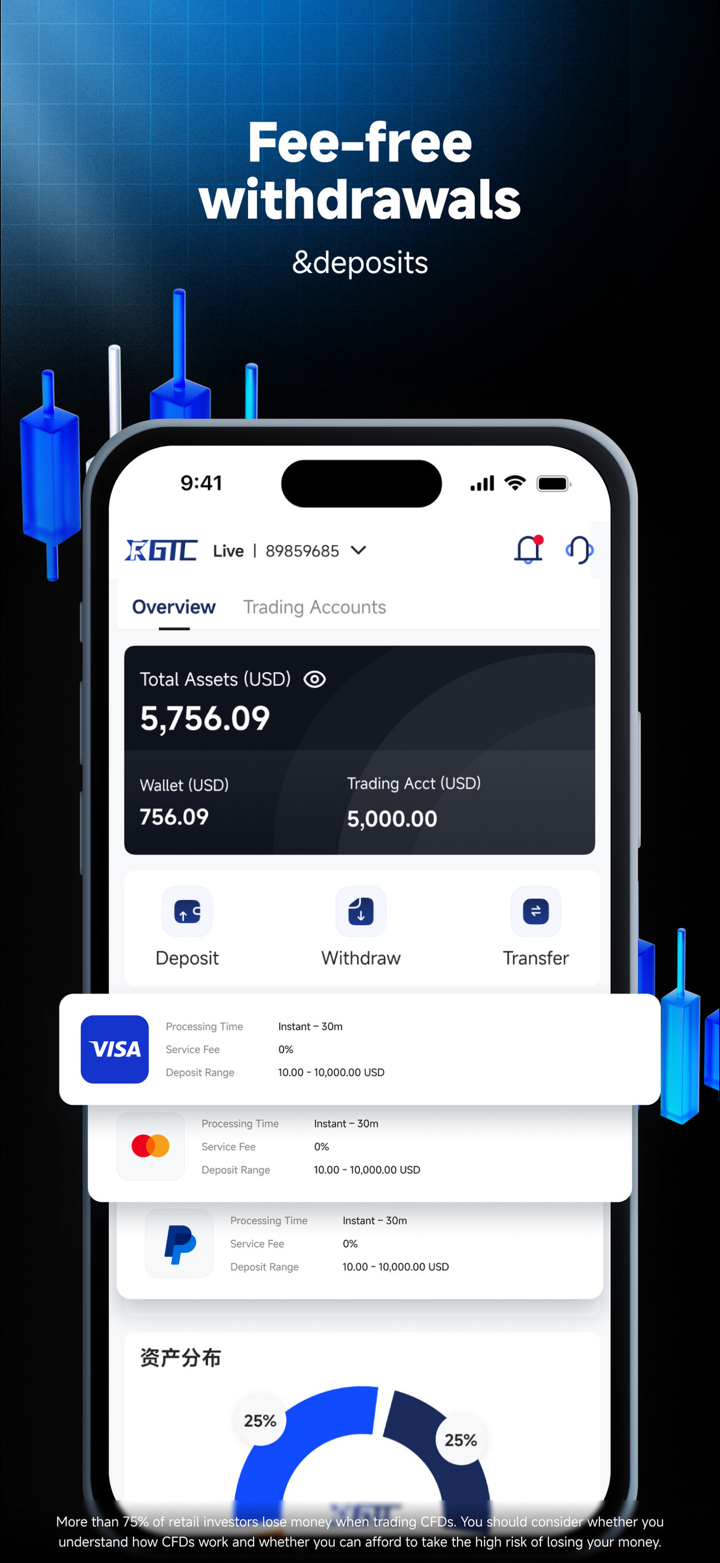

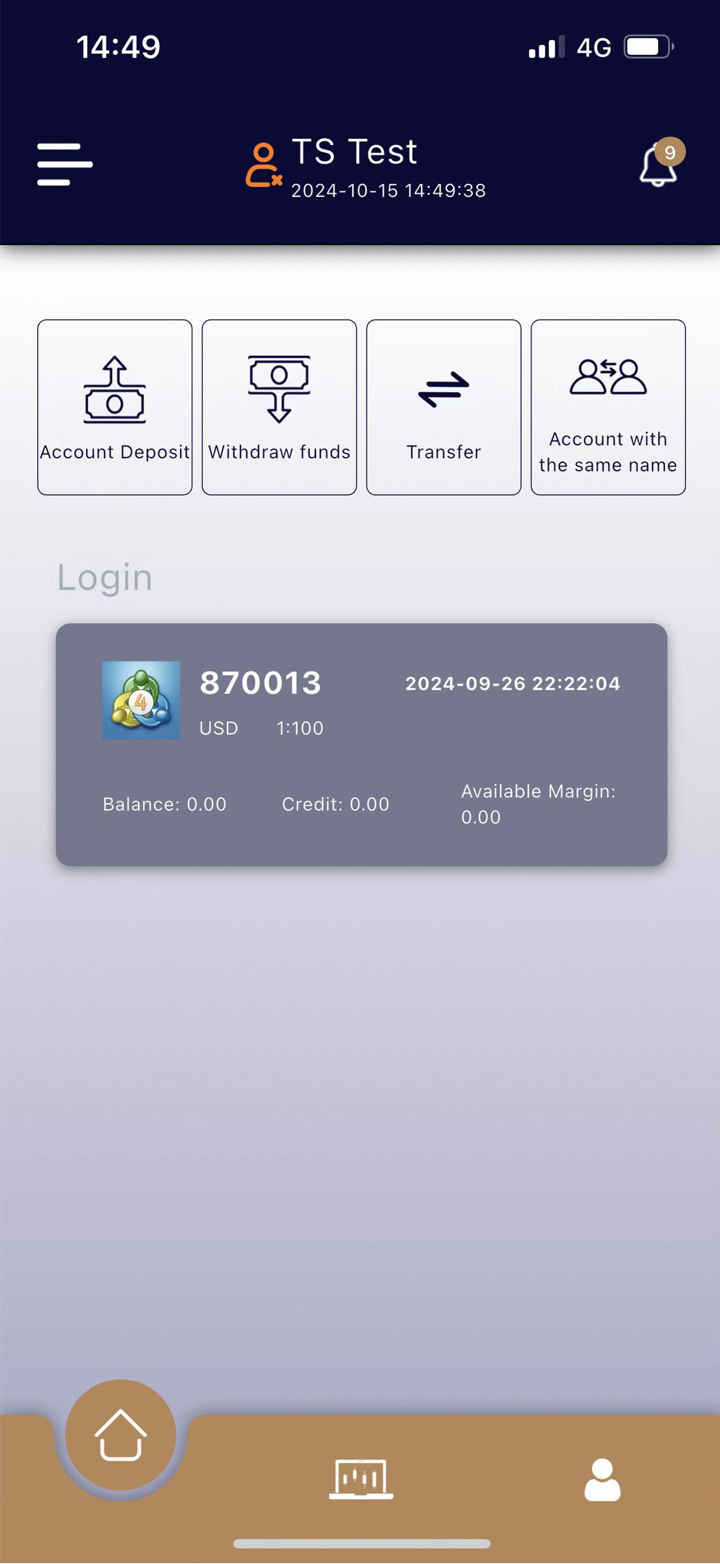

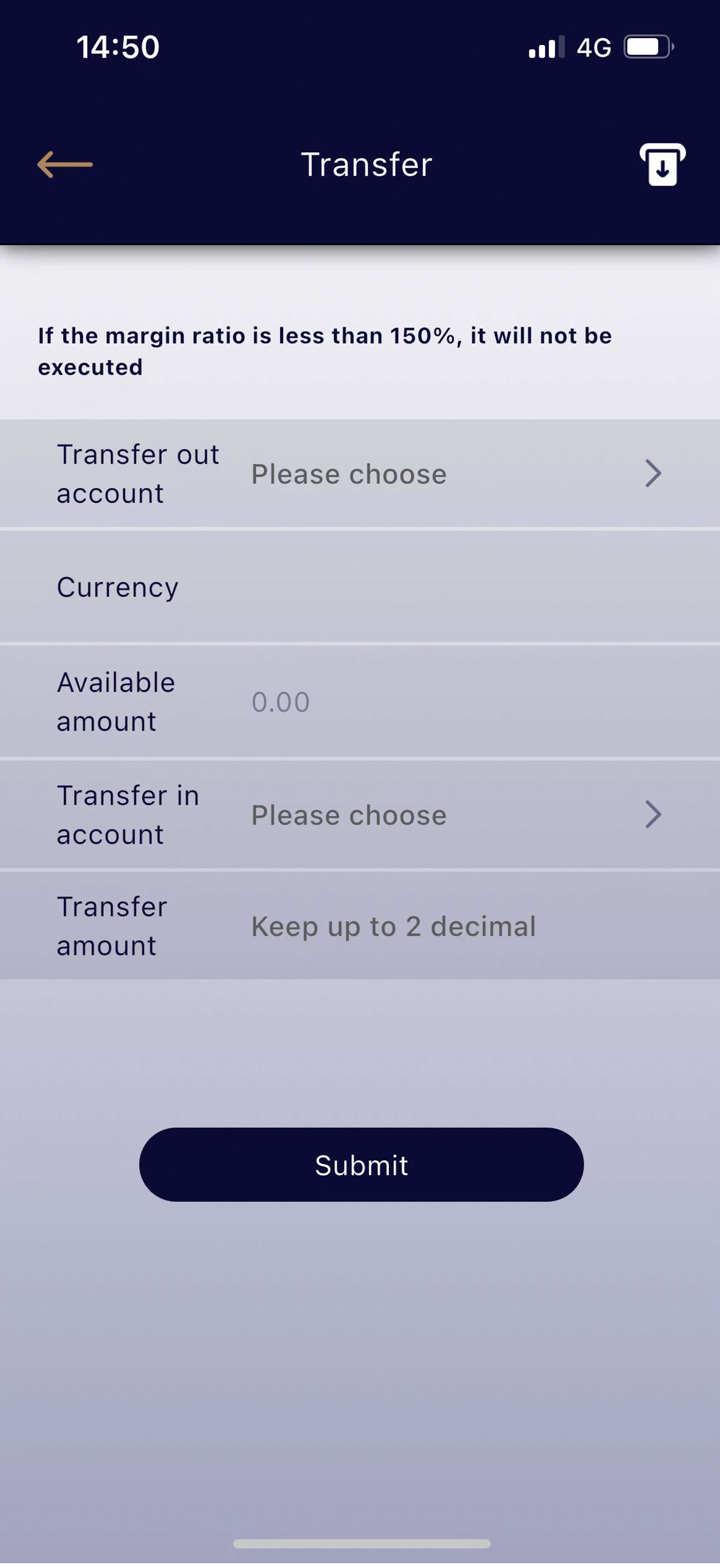

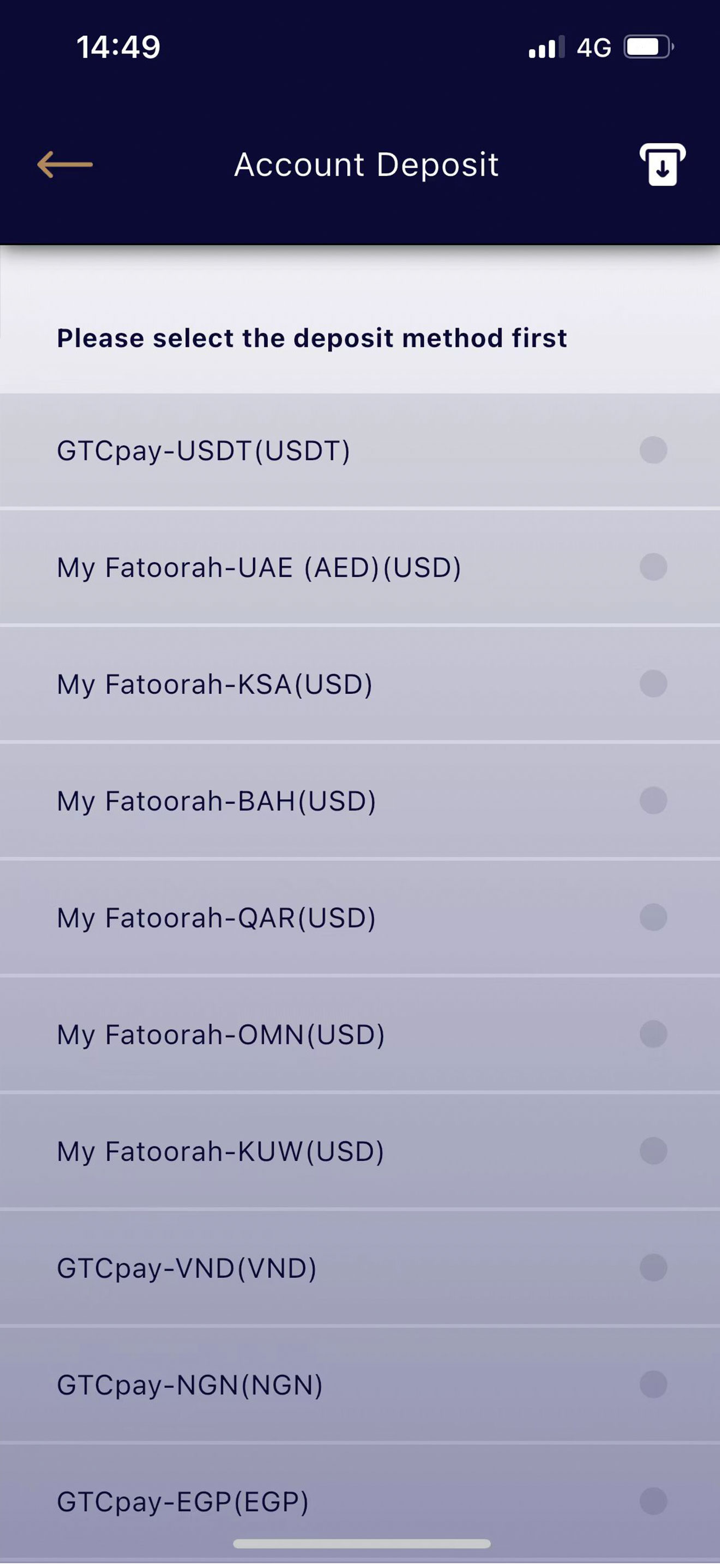

Deposit & Withdrawal

GTCFX offers a wide array of payment methods for deposits and withdrawals. These options include traditional methods such as credit cards (Visa, MasterCard) and bank transfers, as well as a range of digital and mobile payment solutions like FXPAY88, CASH, PayTrust, PayPort, Fasapay, dragonpay, PayTrust, and Payment Asia.

Customer Support

The GTCFX customer support can be reached through email: support@gtcup.com, telephone: 800 667788, live chat or contact form to get in touch, as well as some social media platforms like Facebook, X, YouTube, LinkedIn, Instagram, WhatsApp, Skype, TikTok, Threads.

Frequently Asked Questions (FAQs)

Is GTCFX regulated?

Yes. It is regulated by FCA, ASIC, SCA, and VFSC (offshore).

Does GTCFX offer demo accounts?

Yes.

Does GTCFX offer the industry-standard MT4 & MT5?

Yes. Both MT4 and MT5 are available.

What is the minimum deposit for GTCFX?

$0.