Company Summary

Company Summary

Company Profile

| Registered Country/Region | United Kingdom |

| Regulation | FCA, FSA |

| Minimum Deposit | US$10/R160 ZAR |

| Maximum Leverage | 1:500 |

| Minimum Spreads | From 0.0 pips |

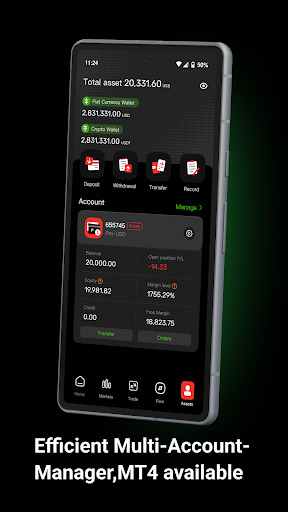

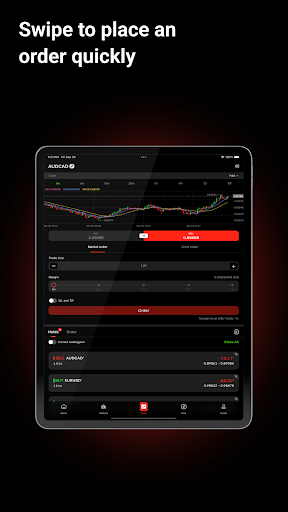

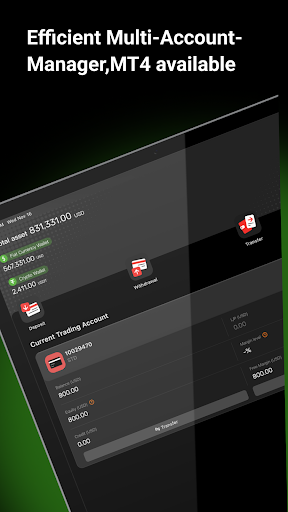

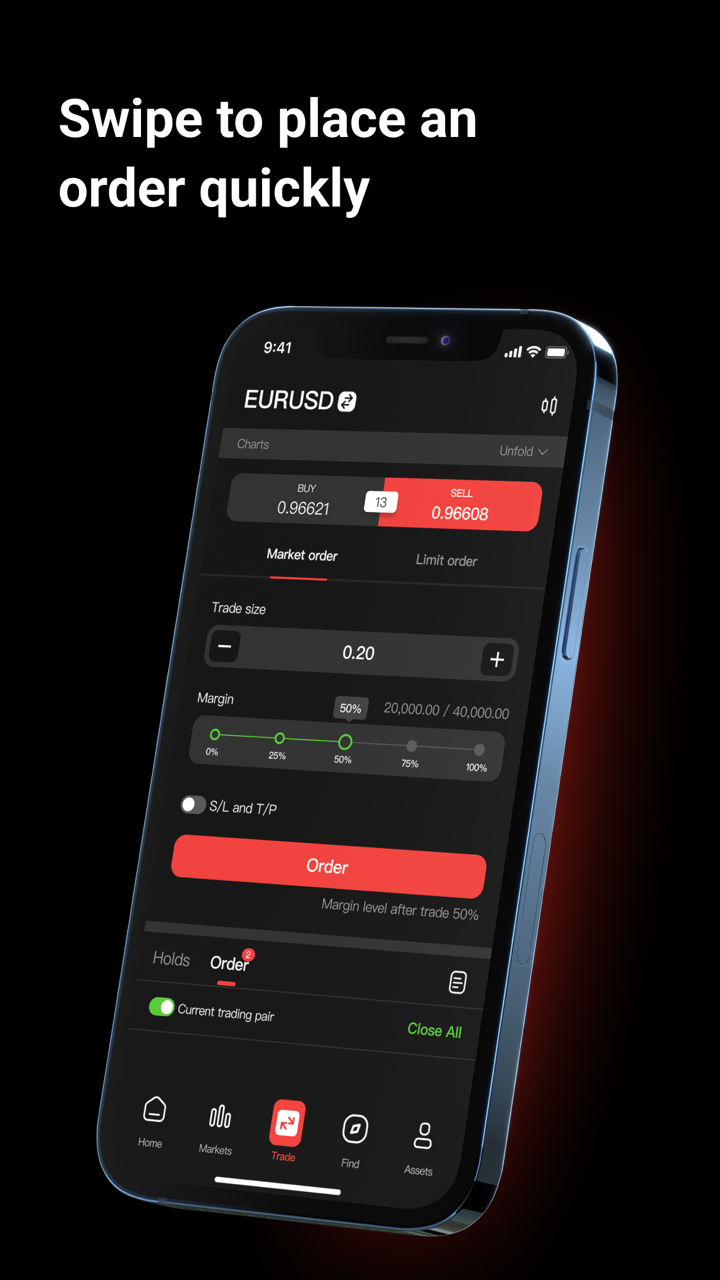

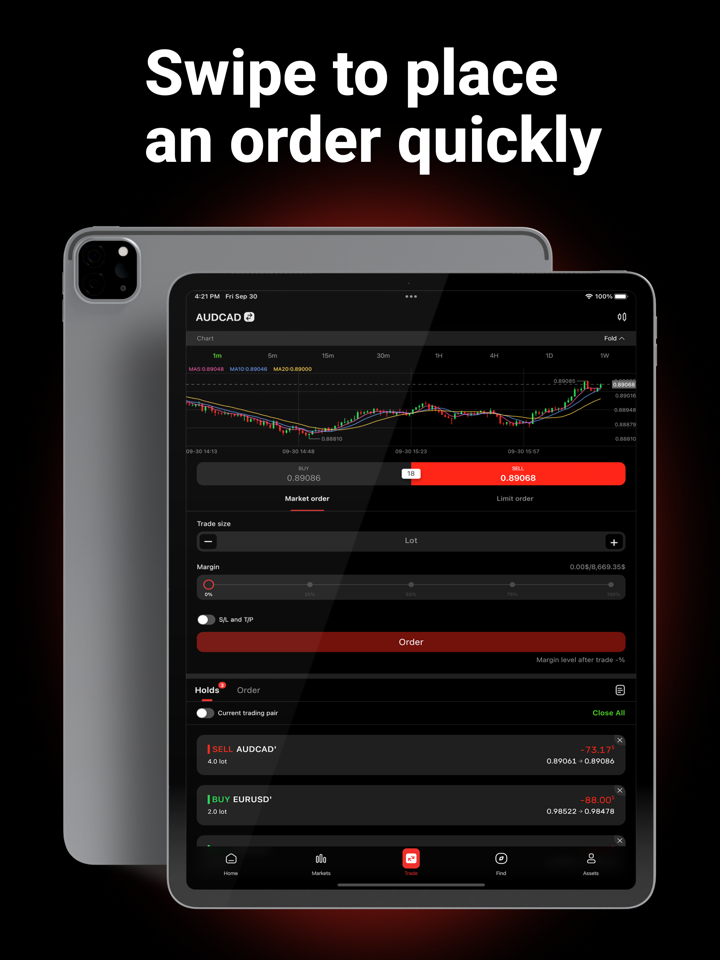

| Trading Platform | MT4, Mobile and Webtrader |

| Demo Account | Yes |

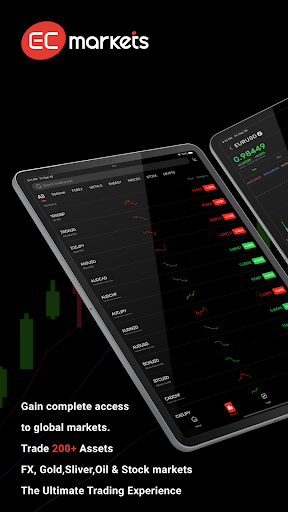

| Trading Assets | Major FX Pairs, Minor FX Pairs, Precious Metals, CFD Indices, Crude Oil |

| Payment Methods | Bank Transfer |

| Customer Support | Phone, Email, Online chat |

General Information & Regulation

EC Markets is the trading name of EC Markets Group Ltd is authorised and regulated by the Financial Conduct Authority (FCA), FRN: 571881. EC Markets Group Ltd is incorporated in England and Wales (no. 07601714). The trading address is New Broad Street House, 35 New Broad Street, EC2M 1NH, London, United Kingdom.

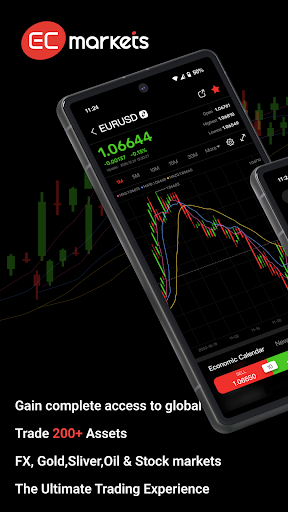

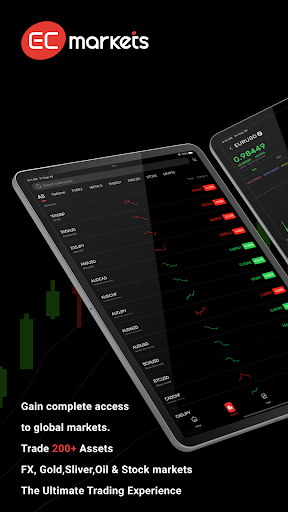

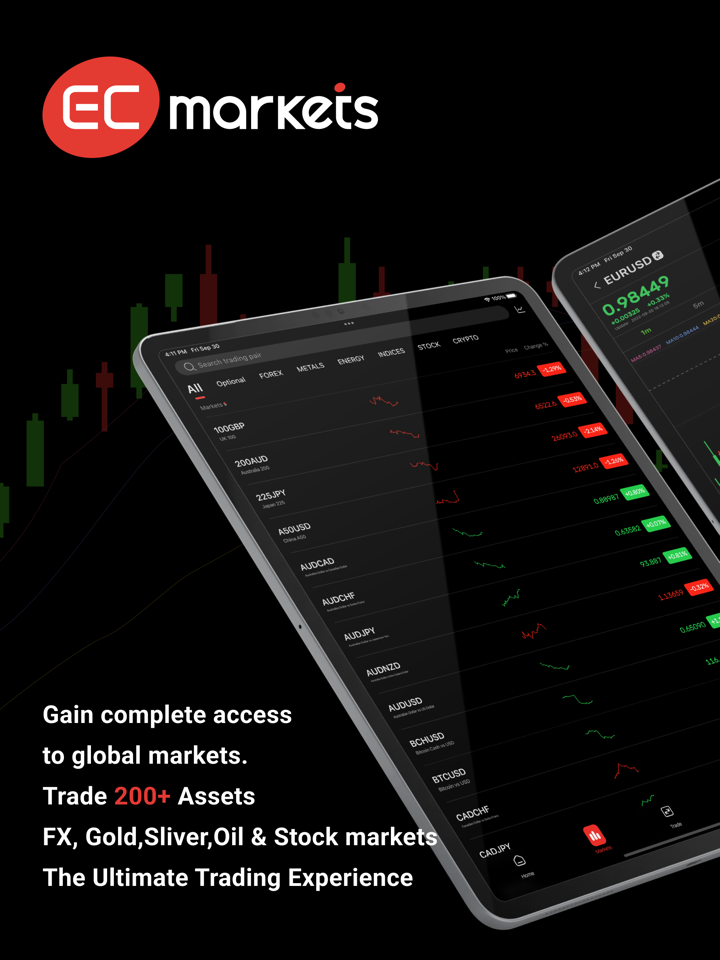

Markets Instruments

EC Markets provides investors with popular tradable financial instruments, mainly major currency pairs, minor currency pairs, exotic currency pairs, precious metals, CFD stock indices, crude oil, etc.

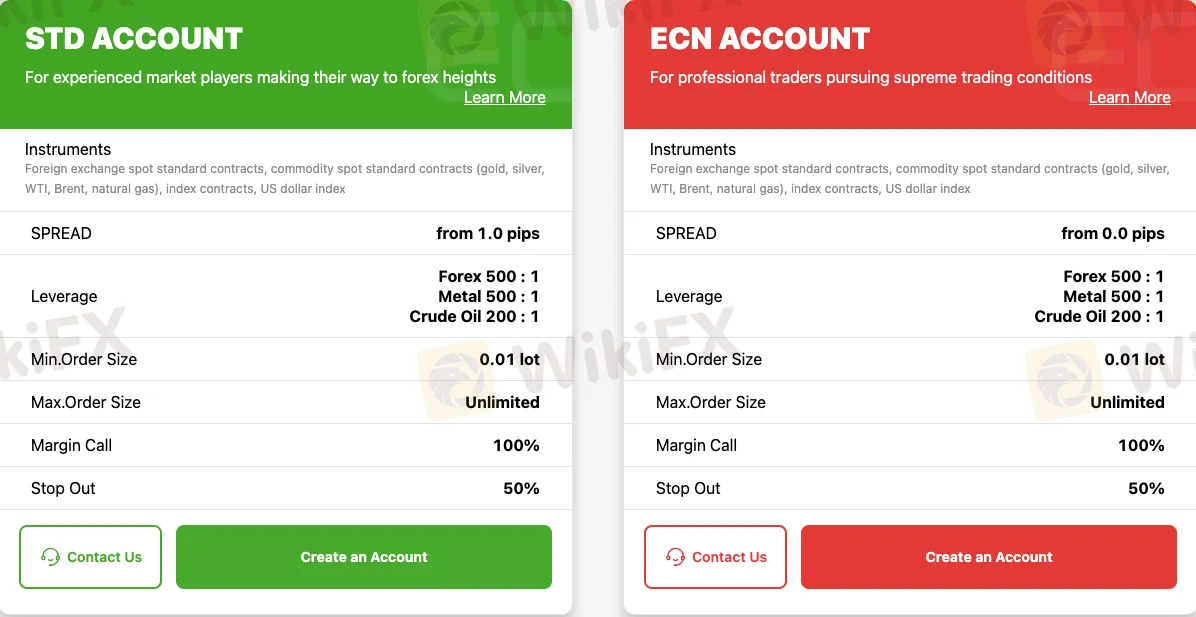

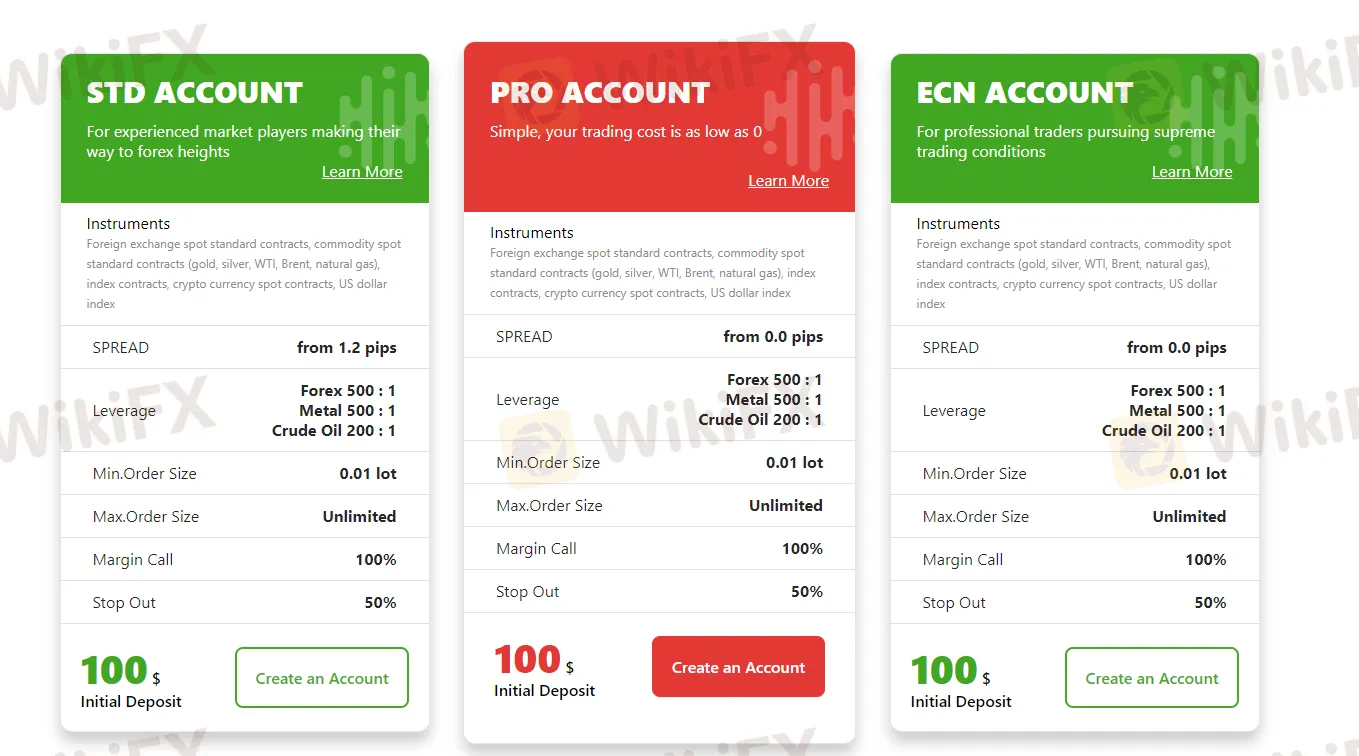

Account Types

Ec Markets website says it provide several account types structure to meet various traders' trading experience, including STD account, Pro account and ECN account. To open a STD account, an initial deposit of $100 is required, and this types of account is suitable for all types of traders. The Pro account is designed for traders who pursue competitive spreads, requiring the same amount of initial deposit as the STD account. The ECN account is for professional traders pursuing superb trading conditions, and traders who want to try this account only need to fund at least $100.

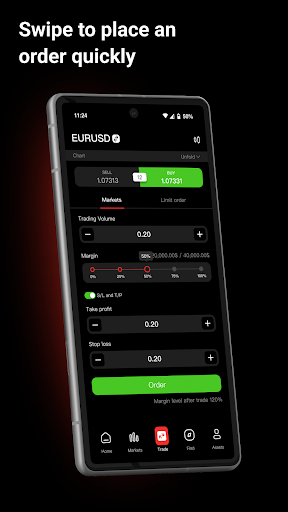

Leverage

Trading leverage varies depending on various trading instruments, and the maximum trading leverage for forex trading is up to 1:500, Metals trading up to 1:500, Crude Oil trading up to 1:200.

Spreads & Commissions

The minimum spread for a standard account is 2.2 pips for EURUSD, 2.9 pips for GBPUSD, 2.9 pips for EURGBP, 5.4 pips for XAUUSD, 5.4 pips for XGUUSD, and 5.7 pips for Crude Oil. The standard account adopts a pure spread mode, with commission built into spreads. ECN account has 0.1 pips spread for EURUSD, minimum spread on GBPUSD 0.5 pips , minimum spread for AUDUSD 0.2 pips , minimum spread for XAUUSD 3.0 pips, minimum spread for XGUUSD 2.6 pips , and minimum spread for Crude Oil 4.7 pips, with a commission of $7 per standard lot on this account.

Trading Platform

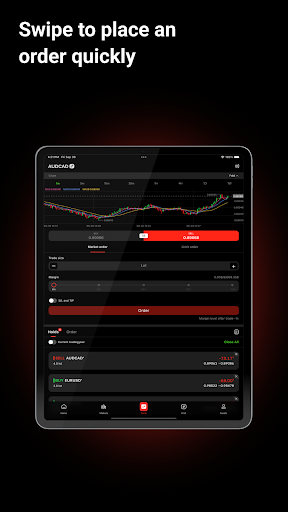

EC Markets offers traders the world's most respected and widely used online trading platform in the forex sector - the MT4 trading platform, which allows EA automated trading, supports EA backtesting, provides charts with different time frames. Moreover, it has over 50 built-in technical analysis tools, supports multiple languages, and sets stop loss/stop gain orders/tracking stop orders. EC Markets' MT4 trading platform is available for Android and iOS versions.

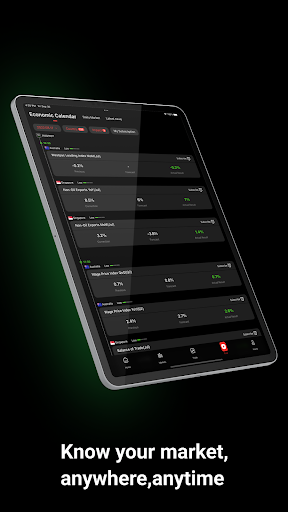

Trading Tools

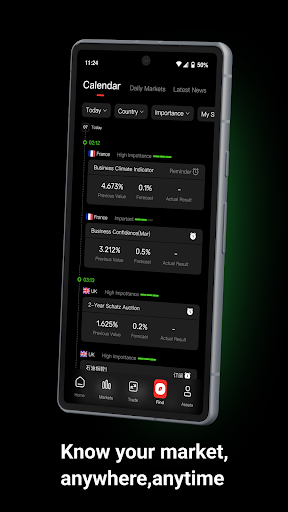

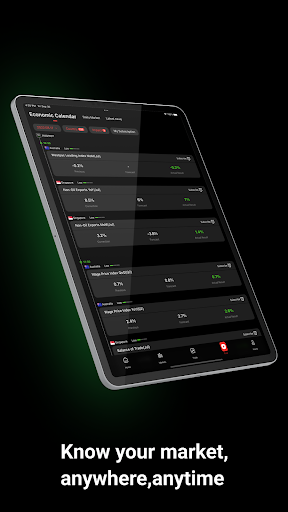

Aside from trading platforms, some trading tools including News & Analysis, Trading Central, Economic Calendar are also provided.

Deposit & Withdrawal

The minimum deposit to trade with EC Markets is $100, and clients are allowed to make a deposit and withdrawal through the following payment options, including China Union Pay, Tether, Wire Transfer, Bank Transfer Malaysia, VN Pay, PoLi. No deposits fees are charged with the EC Markets platform.

Customer Support

If you have any inquiries or trading-related issues, you can get in touch with EC Markets throuh the following contact channels:

Telephone: +248 4224099

Email: support@ecmarkets.sc

Online Chat

A Contact Form

Or you can also follow this broker on some social media platforms, such as Facebook, Twitter, Linkedin, Youtube, and Instagram.

Pros & Cons

| Pros | Cons |

| FCA -regulated | Sign-up and welcome bonus not offered |

| MT4 trading platform supported | Marked-up spreads |

| Social trading supported | Verification is complicated and time-consuming |

| Low initial deposit requirements for all account types | |

| Commission-free trading | |

| High leverage up to 1:500 |

Frequently Asked Questions

Is EC Markets regulated ?

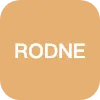

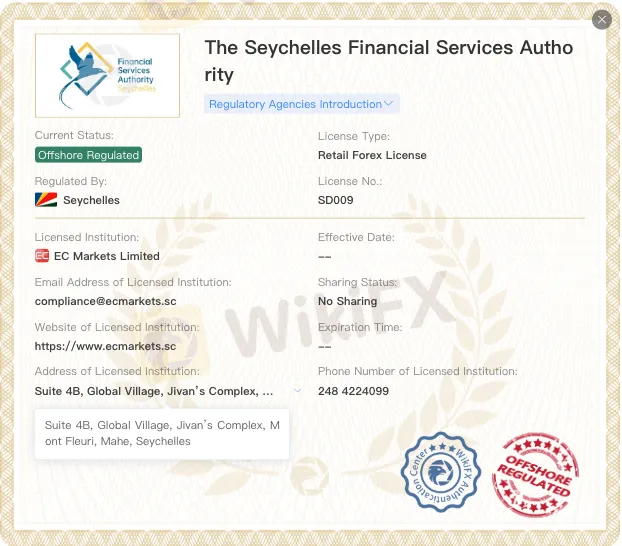

EC Markets Group Ltd is authorized and regulated by the FCA in the U.K., EC Markets Limited, authorized by the FSA in Seychelles under License No.: SD009.

What is the overall rate for EC Markets?

The overall score for EC Markets is 7.27/10 on WikiFX based on its License Index, Business Index, Risk Management Index, Software Index, and Regulatory Index.

Does EC Markets offer leverage?

EC Markets gives leverage up to 1:500.

Does EC Markets offers a demo account?

Yes. A demo account option is available for EC Markets.