WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about EC Markets and its licenses.

In an increasingly regulated global trading environment, EC Markets is positioning itself as a broker with credibility, transparency, and compliance deeply embedded in its operational DNA. The broker now holds five regulatory licences in major financial regions, helping it serve both retail and professional traders with greater confidence.

One of EC Markets key licences is from the Australian Securities and Investments Commission (ASIC), with licence number 414198. ASIC is known for its strong rules and high standards, which help protect traders and keep financial companies in check. In Australia, EC Markets operates as a Market Maker (MM), which means it follows strict guidelines that aim to create a safe and fair trading environment.

The company has also expanded its presence in the Asia-Pacific region by getting a Market Maker licence from the Financial Markets Authority (FMA) in New Zealand. This licence, under number 197465, brings more trust to its services. The FMA watches over financial companies, focusing on fair trading, clear communication, and customer protection.

In the UK, EC Markets is authorised by the Financial Conduct Authority (FCA), with licence number 571881. This licence allows the company to use a Straight Through Processing (STP) model, where client orders go directly to the market. The FCA is one of the most respected regulators in the world, known for making sure companies treat clients fairly, keep client money safe, and stay financially stable.

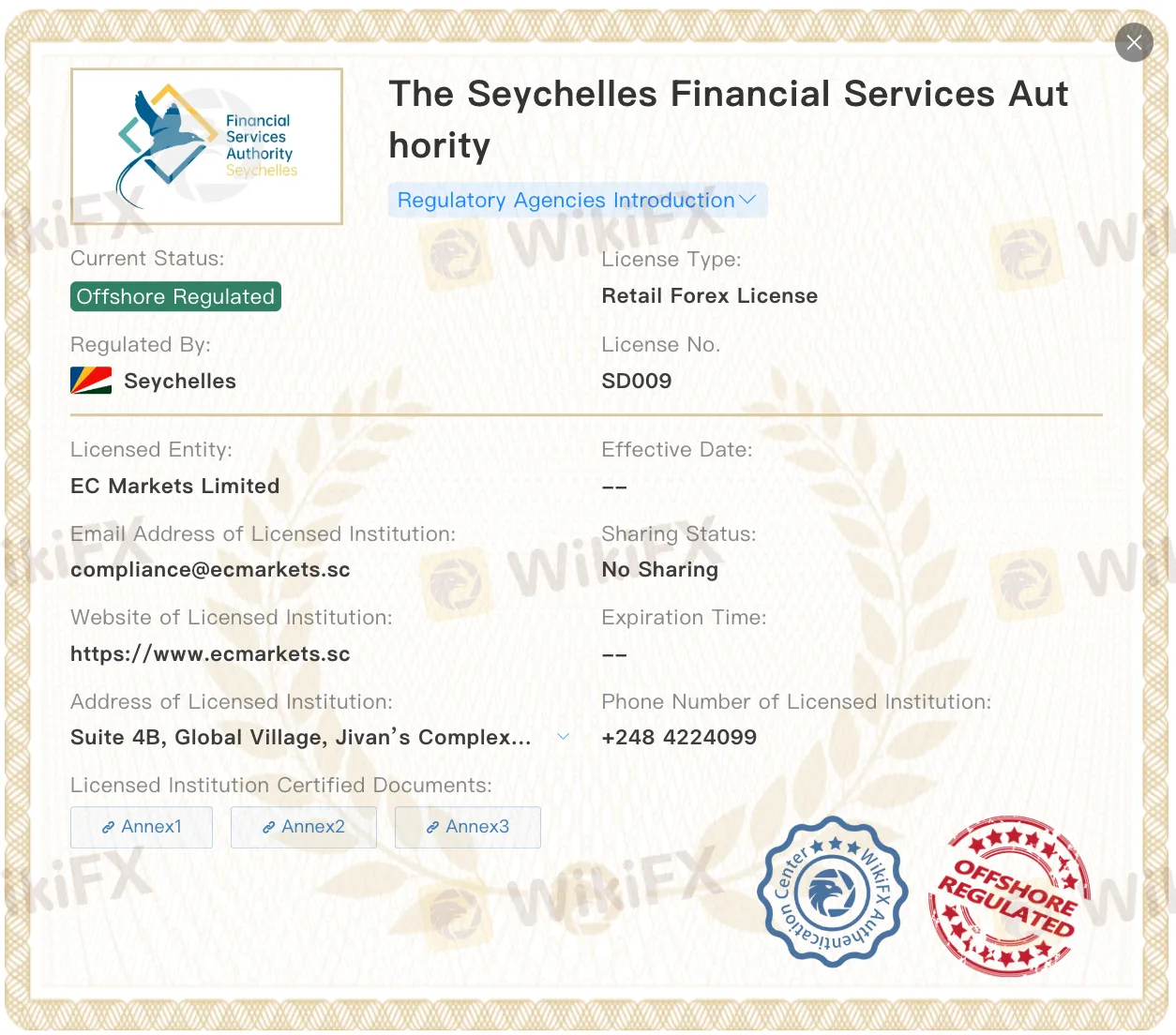

Outside of the usual financial centres, EC Markets also holds a Retail Forex Licence from the Financial Services Authority (FSA) in Seychelles, under licence SD009. Seychelles has become a popular location for forex and CFD brokers who serve clients internationally. This licence gives EC Markets the ability to offer services globally while staying under formal supervision.

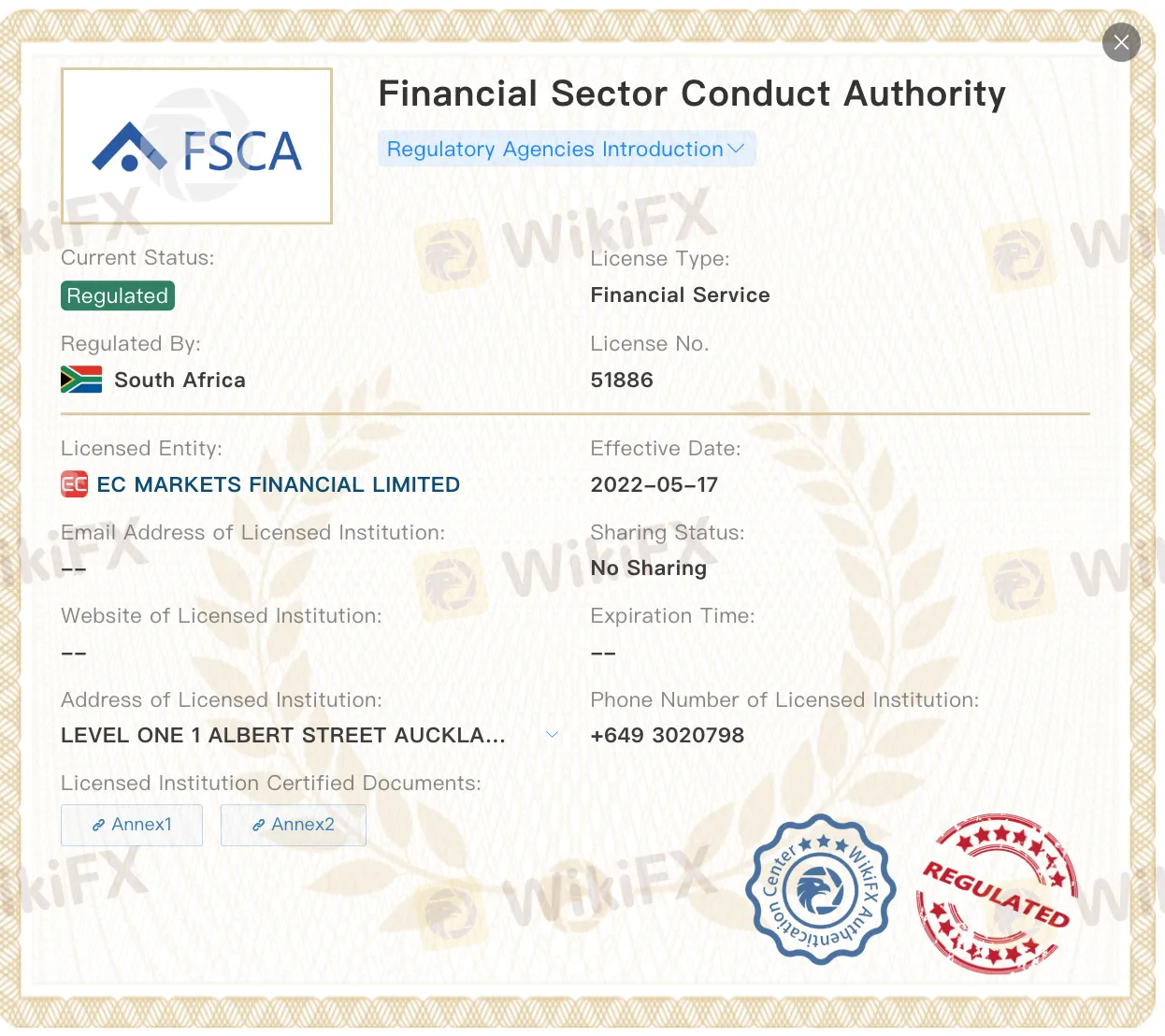

In Africa, the company is authorised by South Africa‘s Financial Sector Conduct Authority (FSCA), with licence number 51886. The FSCA’s job is to make sure financial firms are honest, transparent, and treat clients fairly.

By holding licences in multiple regions, EC Markets is one of the few brokers with strong global coverage while still following local rules. This allows the company to offer services across many countries without lowering its standards.

Adding to its credibility, EC Markets has earned a high WikiScore of 9.07 out of 10 on WikiFX, a global platform that rates brokers. This score reflects the brokers strong performance in areas like regulation, risk management, software quality, and business strength.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.