Company Summary

| WorldFirst Review Summary | |

| Founded | 2004 |

| Registered Country/Region | Australia |

| Regulation | ASIC (regulated); FCA (Exceeded) |

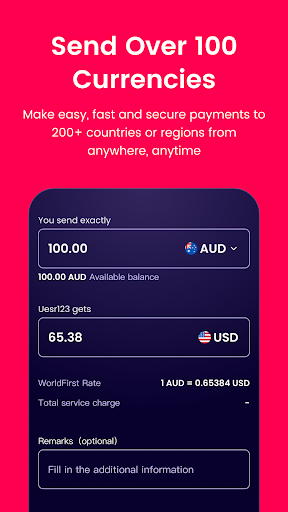

| Products & Services | Currency exchange, international payments, multi-currency accounts, virtual debit card, mass payments, forward contracts |

| Customer Support | Phone (Australia): 1800 326 667 |

| Phone (NZ): 0800 666 114 | |

| Phone (International): +61 2 8298 4990 | |

| Email: media@worldfirst.com | |

WorldFirst Information

WorldFirst, established in 2004, is an Australia-based, ASIC-regulated financial services organization that specializes in global business payments and currency conversion. Its key features include multi-currency accounts, foreign exchange solutions, and virtual debit cards, all with no continuing maintenance fees, making it suitable for e-commerce businesses and SMEs.

Pros and Cons

| Pros | Cons |

| Regulated by ASIC | Primarily tailored to businesses, not individuals |

| Free multi-currency account and same-day transfers | |

| Transparent and capped FX conversion fees | |

| Long operational history |

Is WorldFirst Legit?

WorldFirst is a regulated financial institution. The Australian Securities and Investments Commission (ASIC) has approved World First Pty Ltd as a Market Maker. This licence is active and valid.

Furthermore, the UK Financial Conduct Authority (FCA) granted it a payment services licence. However, its current FCA status is “Exceeded”, implying that the license may no longer be active or in compliance.

| Regulated Authority | Current Status | Regulated Country | License Type | License No. |

| Australian Securities and Investments Commission (ASIC) | Regulated | Australia | Market Maker (MM) | 000331945 |

| Financial Conduct Authority (FCA) | Exceeded | UK | Payment License | 900508 |

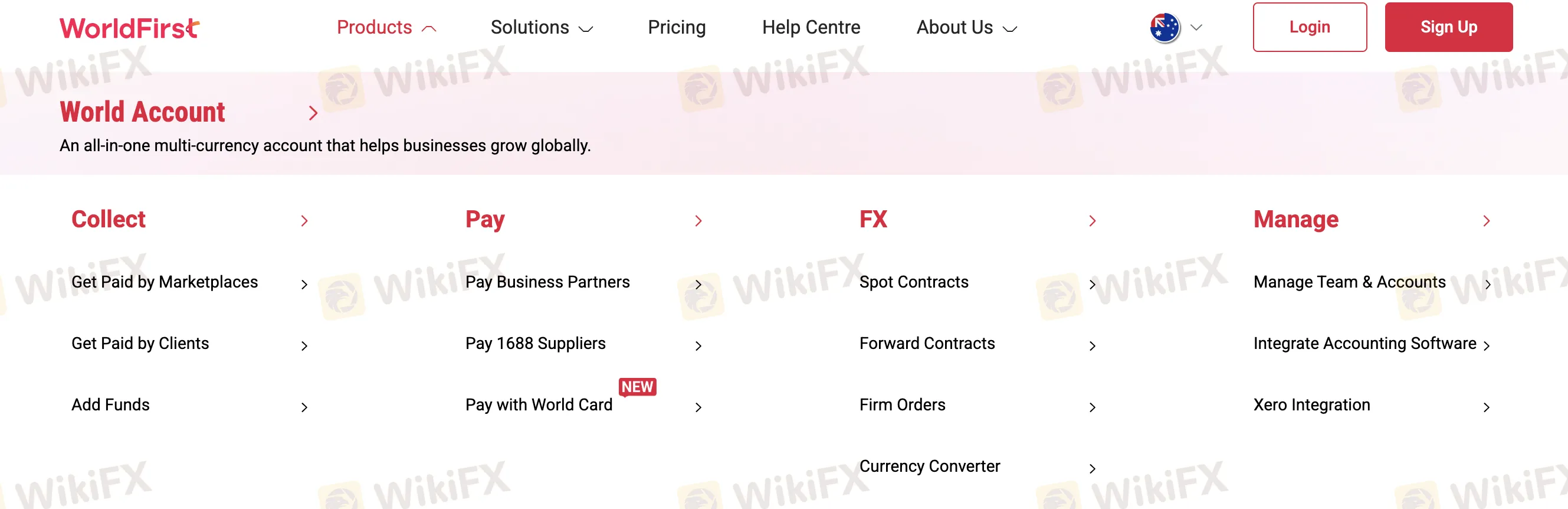

Products and Services

WorldFirst is clearly positioned as a B2B (business-to-business) solution, with a focus on cross-border payments, foreign exchange services, and account management for worldwide trade.

| Product/Service | Features | Supported |

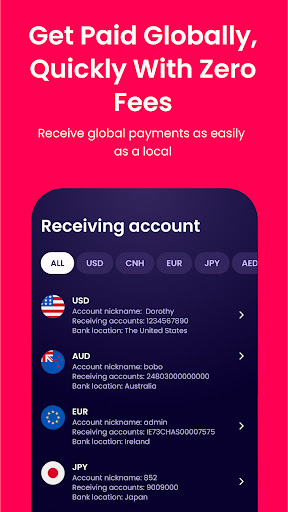

| Multi-Currency Accounts | World Account – for global business needs | ✔ |

| Marketplace Collection | Get paid by Amazon, Etsy, Shopify, etc. | ✔ |

| Client Invoicing | Receive payments directly from clients | ✔ |

| Fund Transfers | Send funds to business partners or suppliers | ✔ |

| FX Services | Spot contracts, forward contracts, firm orders | ✔ |

| World Card Payments | Pay using World Card | ✔ |

| Corporate Payments | Solutions for importers/exporters | ✔ |

| China Payments | Direct payments into China | ✔ |

| Team & Account Management | Admin tools for internal teams | ✔ |

| Software Integration | Integrate with accounting systems like Xero | ✔ |

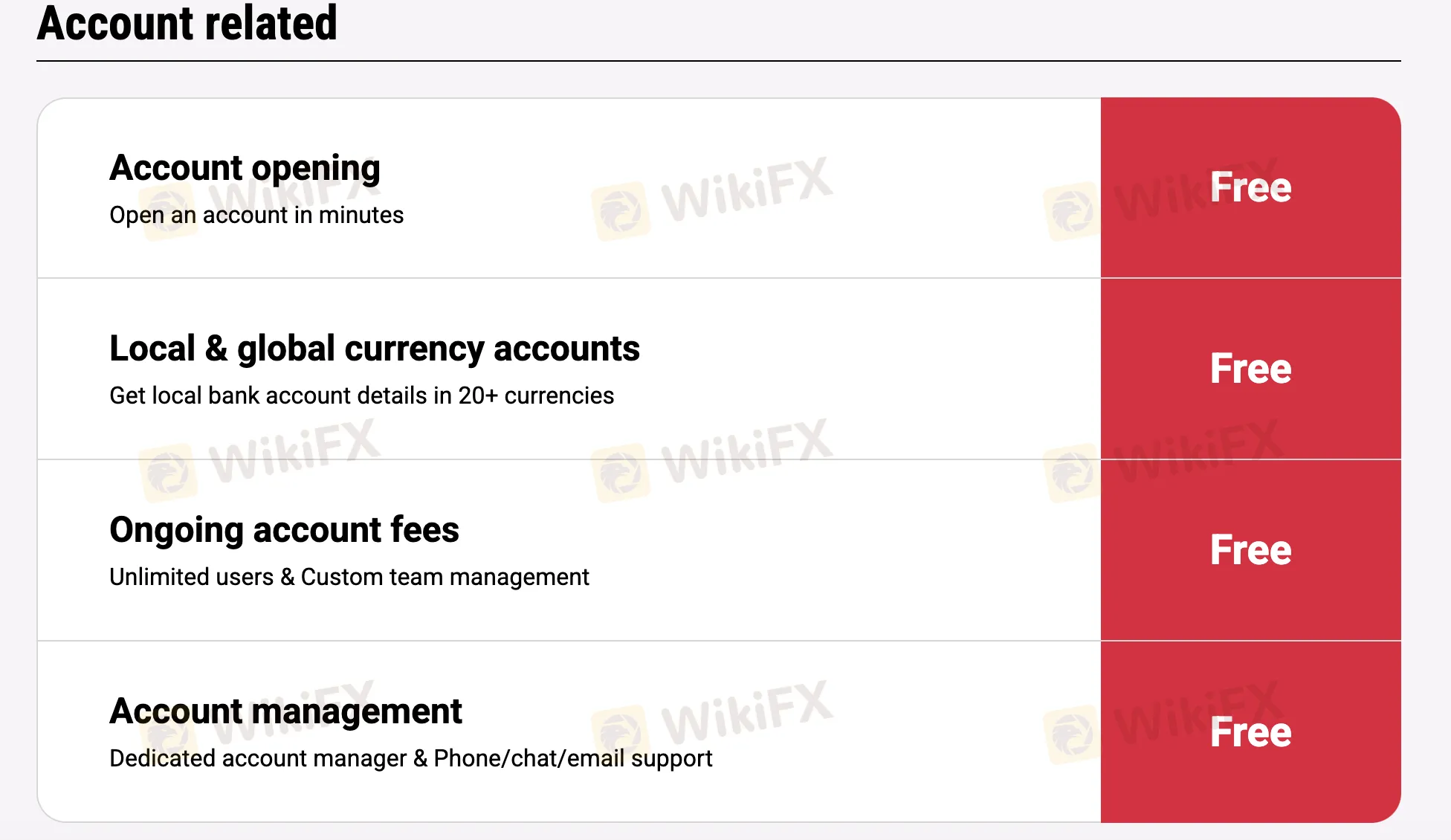

WorldFirst Fees

WorldFirst's rates are often lower than industry standards, particularly for organizations that handle cross-border payments and FX. The majority of essential services are free, and where costs do apply (for example, currency exchange), they are clearly capped or maintained to a minimal percentage.

| Service Category | Details | Fee |

| Account Opening & Maintenance | Open and maintain World Account | 0 |

| Local & Global Currency Accounts | 20+ currencies | |

| Ongoing Account Fees | Unlimited users, team management | |

| Dedicated Support | Phone, chat, and email support | |

| Receiving & Holding Payments | Receive payments from marketplaces/clients | |

| Fund Your Account | From personal or business account | |

| Hold Funds | Up to 20+ currencies | |

| Payments & Currency Conversion | Local AUD/NZD payments | |

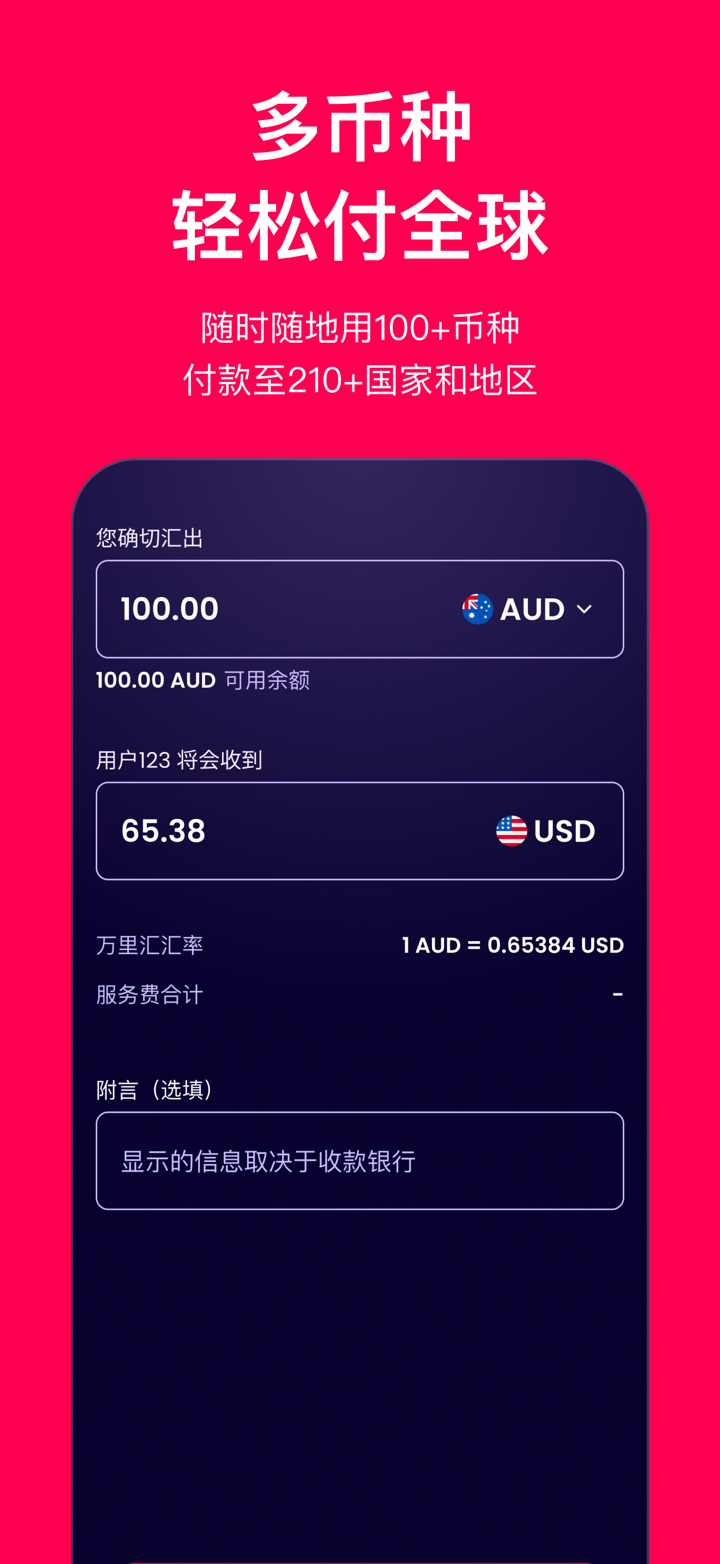

| Other Currency Payments | Local/cross-border (non-AUD/NZD) | From 0.4%, capped at AUD 15 |

| Payments to Other World Accounts | Anywhere, instant | 0 |

| Payments to 1688 | Instant to suppliers | Up to 0.8% |

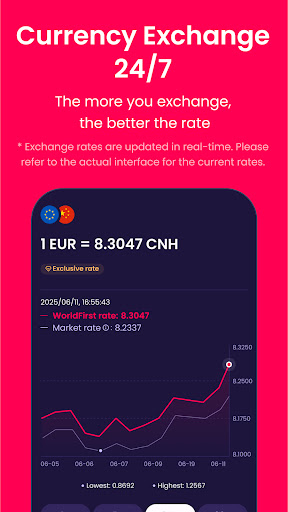

| FX for Major Currencies | USD, EUR, GBP, AUD, CAD, JPY | Up to 0.6% |

| FX for Minor Currencies | 40+ currencies | From 0.67% |

| Forward Contracts | Risk management solution | Up to 0.2%/month |

| Full Value Transfer (FVT) - USA/UK/EEA | Ensures full amount is received | 0 |

| FVT - Other Countries | Fixed AUD 25 | |

| World Card (Debit Card) | Application, 25 users, usage | 0 |

| Currency Not Held in Balance | FX conversion at WorldFirst or Mastercard | Up to 1.5% |

| Tools & Integrations | Mass payments, Xero, NetSuite integration | 0 |

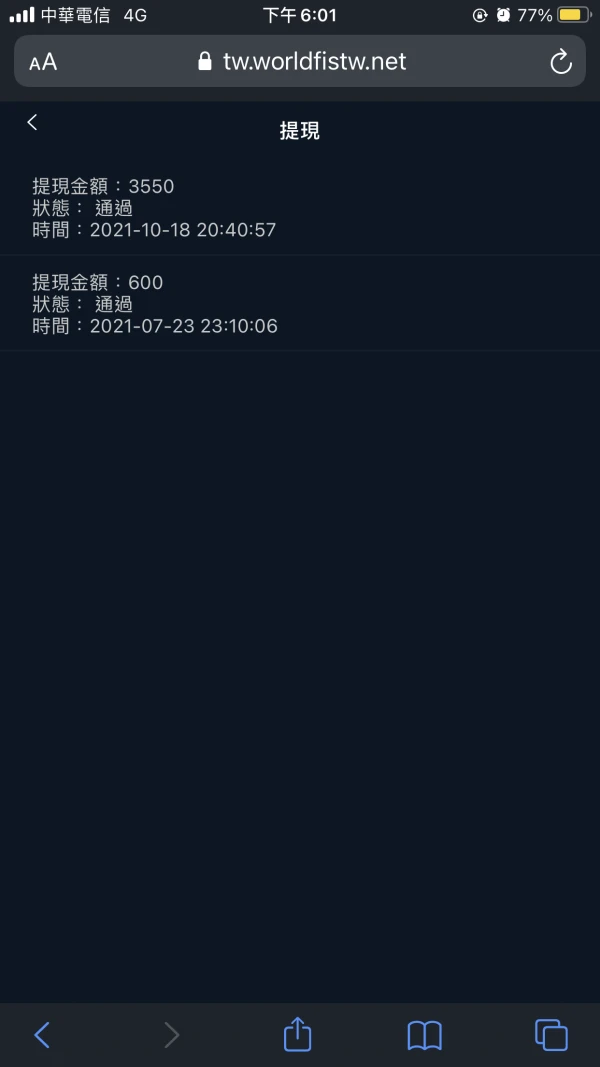

蘇義盛

Taiwan

Customer service replied and asked me to pay $10,000 to unlock the deposit. Because the financial regulatory authorities have stricter requirements of account and asset security, there requires more deposits. There are no clear regulations on the platform. It seems unreasonable to withdraw the unfreezing deposit.

Exposure

蘇義盛

Taiwan

Customer service reply: Hello, the company informed that because the technical department detected an abnormal problem with your account, which might be stolen. So the withdrawal did not pass the review, and you need to pay $5000 risk fund . Question: I did not operate abnormally, and the withdrawal of $20,572 was unsuccessful. The customer service asked me to pay $5,000 because of improper operation. Is this reasonable?

Exposure

蘇義盛

Taiwan

Unable to withdraw. The platform asked me to deposited $5,000 for risk fee. This made no sense. We were just investors, and unable to control withdrawals and deposits on the platform. I supposed it was a fraud platform. Only the official customer service responded. No telephone. I still had $25,124 in my account, but was unable to withdraw.

Exposure

FX1485573802

Philippines

WorldFirst has been my go-to for international transfers. It's reassuring to know they're regulated by ASIC and registered with AUSTRAC. Transferring money is hassle-free, and they're pretty clear about any fees involved.

Positive

Alfred

Indonesia

Honestly, WorldFirst could be given 5 stars, but my funds have not arrived until now, since it has been five days. I am writing this review while waiting…

Positive

葉翰隆

Taiwan

I though it was a foreign exchange platform but my account was locked when I withdrew. It asked me to pay $5000 as the margin but I could only contact it on line. I’m not sure about whether I could get the margin back.

Exposure