Melaka police bust fake investment scam run by Chinese nationals

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A 66-year-old woman in Malaysia has lost over RM311,000 after falling for a fake stock investment promoted on TikTok.

A 66-year-old woman in Malaysia has lost over RM311,000 after falling for a fake stock investment promoted on TikTok.

According to Pahang police chief Datuk Seri Yahaya Othman, the woman was told to download a mobile application linked to the so-called investment. Between 5 January and early April, she transferred her savings in 16 different payments to six separate bank accounts.

The scam began to unravel when the investment app suddenly stopped working. The woman was then told to send more money to release her funds, with scammers claiming it was needed to clear banking “risk controls.” At that point, she realised something was wrong and filed a police report. The case is now being investigated for cheating under Section 420 of the Penal Code.

This incident shows a growing problem: social media is becoming a popular tool for investment scams. Many scammers use platforms like TikTok, Instagram, and Facebook to promote fake opportunities. They often appear as successful traders or financial coaches. Some show pictures of luxury cars or big profits to appear trustworthy. Others post fake reviews or pretend to be connected to well-known figures.

These scams usually start with small promises. Victims may be shown fake results to make them believe their investment is growing. Once the scammers gain their trust, they ask for more money. By the time the victim starts asking questions, its often too late as the money is gone, and the scammers disappear.

One common trick is asking victims to use unofficial apps or websites. These apps may look real, but they are designed to steal personal and banking details. In many cases, the scammers also make up extra charges to delay withdrawals and keep victims sending more money.

Police and financial experts warn the public to be careful with any investment offer found online. They say it is important to check if a platform is registered with financial authorities and to avoid dealing with unlicensed individuals.

Older adults are often the main targets of these scams, as they may be less familiar with how social media scams work. Social media can make investing seem easy and exciting. But behind a flashy video or a friendly message, there may be a scam waiting to happen.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

The rise of deepfake scams impersonating national leaders and public figures has caused significant financial losses in Malaysia, prompting the government to propose an AI Governance Bill aimed at strengthening safeguards, restoring public trust and providing regulatory clarity to support responsible AI use and investment.

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

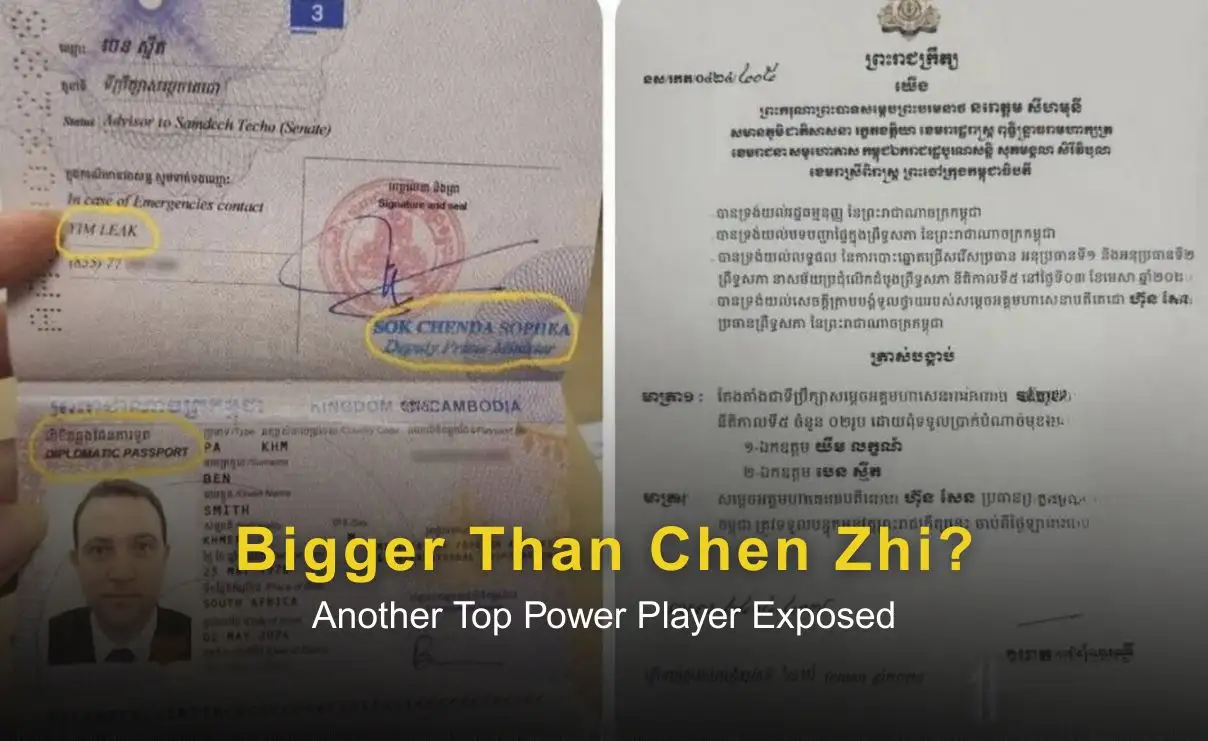

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.