Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority. The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Read on!

When choosing a forex broker, the most important question is always about regulation. For traders looking into the London Trading Index (LTI), the issue of LTI Regulation is not simple. In fact, there are conflicting claims, official warnings, and major red flags. According to data from global regulatory tracking platforms, LTI operates without proper regulation from any top-level financial authority.

The main problem comes from the difference between what the broker claims and what can actually be verified. While LTI presents itself as a professional company based on London's financial standards, independent research shows a different story. This article will examine the claims about the LTI License, look closely at the broker's company structure, and analyze the warnings issued by financial watchdogs. Our investigation aims to provide a clear, fact-based picture to help you make an informed decision and protect your capital.

Our analysis is based on detailed information available on platforms, such as WikiFX, which brings together regulatory data, company records, and user feedback. The platform currently marks LTI with “No Regulation” and a “Suspicious Regulatory License,” giving it a very low score.

A broker's license is its most important credential. It determines the rules it must follow, the protections offered to clients, and the legal options available if there are disputes. LTI regulation is a main area of concern, marked by a lack of credible authorization and official warnings.

The clearest sign of LTI's status comes from regulatory verification tools, which label the broker with “No Regulation.” This designation is critical. It means that LTI is not overseen by a reputable financial authority that enforces standards for client fund protection, operational transparency, and fair trading practices.

For a trader, the consequences are serious:

· No Investor Protection: Your funds are not covered by compensation schemes like the UK's FSCS or Cyprus's ICF, which protect clients if a broker becomes bankrupt.

· No Separated Funds Guarantee: Top-level regulators require that brokers hold client funds in accounts separate from their own operational capital. Without this oversight, there is a higher risk that a broker could misuse client deposits.

· No Formal Dispute Resolution: If you have a dispute with an unregulated broker over a withdrawal or trade execution, there is no official ombudsman or regulatory body to appeal to.

These factors contribute to the “High potential risk” and “Warning: Low score, please stay away!” advisories prominently displayed on its profile.

One of the most serious red flags is an official warning from a major regulator. The United Kingdom's Financial Conduct Authority (FCA) has placed LONDON TRADING INDEX LIMITED on its warning list of unauthorized firms. The disclosure, dated July 29, 2024, is a clear statement from one of the world's most respected financial watchdogs.

An FCA warning means that the firm is targeting UK residents and providing financial services without the required authorization. This is illegal in the UK. The FCA issues these warnings to alert the public to firms that pose a significant risk to consumers. Working with a firm on this list means you will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS).

Adding to the confusion is the label of a “Suspicious Regulatory License.” As experts in broker analysis, we see this tag applied when a broker's only claim to regulation is a registration in an offshore location with weak or non-existent financial oversight. These are often simple business registrations, not financial licenses.

In LTI's case, its primary company is listed as Equivest (Mauritius) Limited, registered in Mauritius. While Mauritius has a financial regulator (the FSC), it is not considered a top-level authority in the same league as the UK's FCA, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). Furthermore, the WikiFX profile clearly states LTI has “No forex trading license found.” This suggests that even its offshore registration may not provide any meaningful regulatory oversight for its forex and CFD trading activities, making the “suspicious” label entirely appropriate in the context of LTI regulation.

High-risk brokers often use a complex and confusing company structure to hide their true location and avoid accountability. Analyzing this structure is a crucial skill for checking brokers. LTI's setup, which spans multiple countries, is a classic example of this tactic and a significant red flag. It creates deliberate confusion between where the company is registered and where it is actually regulated—or, in this case, not regulated.

Our investigation, cross-referencing information from LTI's own disclosures and public records, reveals a web of entities designed to create an illusion of legitimacy. A clear breakdown of the known company details highlights this complexity.

| Entity Name | Registered Region | Registration Number | Notes |

| Equivest (Mauritius) Limited | Mauritius | (not specified) | The primary registered company, located in an offshore location with weaker financial oversight. |

| LONDON TRADING INDEX LIMITED | United Kingdom | 12227660 | This is a company registration, not FCA financial regulation. The FCA has issued a warning against this entity. |

| (Address Provided) | St. Vincent & the Grenadines | (not applicable) | A listed address in a popular offshore location with no forex regulation whatsoever. The SVG FSA has stated it does not regulate forex brokers. |

This multi-country setup is a common tactic. The UK company name gives an air of credibility, the Mauritius entity provides a base in a low-regulation environment, and the St. Vincent and the Grenadines address further distances the operation from any strict regulatory scrutiny.

It is absolutely critical for traders to understand the difference between company registration and financial regulation. Registering a company in the United Kingdom (as LONDON TRADING INDEX LIMITED is) is a simple, inexpensive administrative process that can be completed online in a matter of hours. It provides a company number and a registered address.

This is not the same as being authorized and regulated by the Financial Conduct Authority (FCA). FCA authorization is a rigorous and extensive process that requires a firm to prove it meets strict standards for capital adequacy, risk management, and client protection.

High-risk brokers exploit this distinction. They register a company in a reputable location, such as the UK, to use the name and address in their marketing, hoping that potential clients will mistake this for genuine FCA regulation. The fact that the FCA has explicitly warned against this very entity confirms it is not authorized and is operating outside the law in the UK. This confusing structure is clearly laid out on LTI's WikiFX profile, which visually connects these different entities. Cross-referencing these details is a key step in checking the LTI regulation.

Beyond the critical issues with the LTI License and company structure, several other aspects of LTI's service offering serve as additional warning signs. These operational red flags reinforce the overall high-risk assessment and should be carefully considered by any potential client.

LTI's profile notes that it holds a “Full License MT5.” It is easy for an inexperienced trader to mistake this for a credential that ensures safety. However, this is potentially misleading information.

A “Full License MT5” is a software license purchased from MetaQuotes, the company that develops the MetaTrader 5 trading platform. It simply means that the broker has paid for a legitimate, non-pirated version of the software. It has absolutely nothing to do with financial regulation. This license does not guarantee that the broker's business practices are fair, that your funds are safe, or that the broker is financially stable. It is a technical credential, not a regulatory one. While it's better than using pirated software, it should never be confused with genuine financial oversight.

A lack of transparency and an abundance of conflicting information are hallmarks of untrustworthy operations. LTI's case is a prime example:

· It claims to be built on the professional standards of London's financial centre, yet it is on the FCA's warning list for operating illegally.

· It claims regulation but has no verifiable license from a top-level authority.

· It operates through a tangled web of companies in the UK, Mauritius, and St. Vincent and the Grenadines, hiding its true operational base.

This pattern of inconsistency makes it impossible for a client to perform effective checking and should be viewed as a deliberate attempt to mislead.

Our investigation into LTI's regulatory status has uncovered a consistent pattern of red flags and a clear lack of legitimate financial oversight. The evidence points overwhelmingly to a high-risk operation that traders should approach with extreme caution.

The key points against LTI are clear and backed by public records and regulatory warnings:

· No Top-Level Regulation: LTI lacks a valid license from any respected financial authority like the FCA, ASIC, or CySEC.

· Official FCA Warning: The UK's financial regulator has publicly warned that LTI is an unauthorized firm, making its operations in the UK illegal.

· Suspicious Licensing: Its registration in an offshore location like Mauritius provides no meaningful protection for traders.

· Hidden Company Structure: The use of multiple entities in the UK, Mauritius, and St. Vincent & the Grenadines is a classic tactic to hide accountability.

· High-Risk Operations: The demand for high minimum deposits significantly increases a client's initial financial risk.

Traders must prioritize protecting their capital by independently verifying a broker's regulatory claims *before* opening an account or depositing funds. This is not an optional step; it is the fundamental principle of risk management in the online trading world. Never take a broker's claims at face value. Always verify it with an independent source.

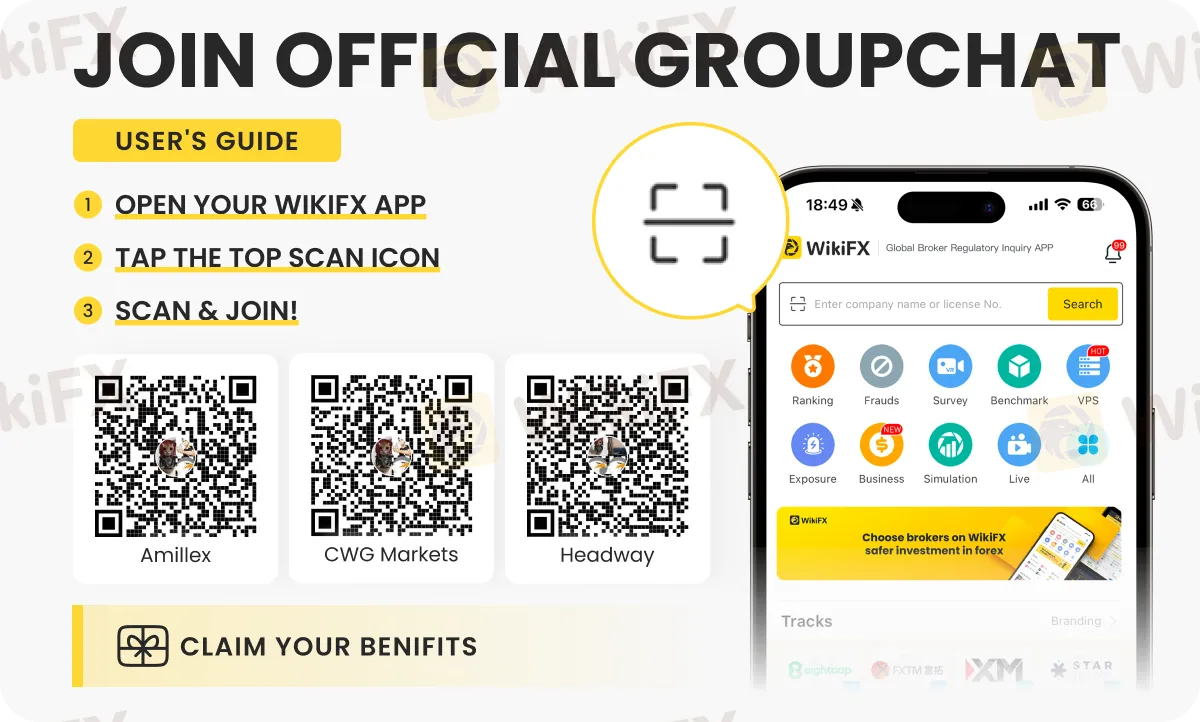

A global broker regulatory inquiry tool, such as WikiFX, is an essential asset for this verification process. It brings together data from regulators worldwide and provides a simple, at-a-glance risk assessment. Here is how to use it for your verification process:

1. Go to the WikiFX website or download the app.

2. Enter the broker's name (e.g., “LTI”) into the search bar.

3. Carefully review the entire profile by paying close attention to:

· The Score and any prominent Warnings at the top of the page.

· The Regulatory Information section to see the authorities regulating the broker and, crucially, which are not.

· Any Exposure or user comment sections, which can reveal issues with withdrawals or service.

· The Company Information to check for offshore registrations and complex company structures.

The LTI profile is a perfect case study of what to look for. By examining the LTI details, you can see all these red flags in one place, from the FCA warning to the low score, providing a complete risk assessment that empowers you to make a safe and informed decision.

Make the most of the forex market movement by implementing tips and insights shared on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join the group/s by following the instructions shown below.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Investment scams recorded the highest amount of losses, at about $145.4 million, in the first half of 2025.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!