Mazi Finance Scam Exposure: A Warning to Indian Traders

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:When choosing a forex broker, traders prioritize transparency, reliability, and fund security. A forex broker, named NAJM Capital, recently presents itself as a global trading platform offering access to forex, commodities, indices, and cryptocurrencies. However, with an increasing number of unregulated brokers, the question remains: Is NAJM Capital a legitimate broker or a potential scam?

When choosing a forex broker, traders prioritize transparency, reliability, and fund security. A forex broker, named NAJM Capital, recently presents itself as a global trading platform offering access to forex, commodities, indices, and cryptocurrencies. However, with an increasing number of unregulated brokers, the question remains: Is NAJM Capital a legitimate broker or a potential scam?

NAJM Capital markets itself as a professional trading platform designed for both beginners and experienced traders. It offers several account types with varying deposit requirements and claims to deliver advanced technology and personalized support.

Yet, after investigating the brokers background, regulation, and user feedback, we found out that its transparency is lacking, which is a major red flag for any trading platform handling client funds.

NAJM Capital offers four types of trading accounts, each catering to different capital levels:

| Account Type | Minimum Deposit | Target Trader | Features |

| Prestige Account | $50,000 | Professional traders | Premium features, VIP support |

| Premiere Account | $20,000 | Advanced traders | Dedicated account manager |

| Elite Account | $10,000 | Intermediate traders | Access to trading webinars |

| Smart Account | $1,000 | Beginner traders | Basic trading access |

At first glance, this tiered structure seems flexible. However, the high minimum deposits, especially compared to reputable regulated brokers that often start at $50 or less, make NAJM Capital an unusually expensive choice for newcomers.

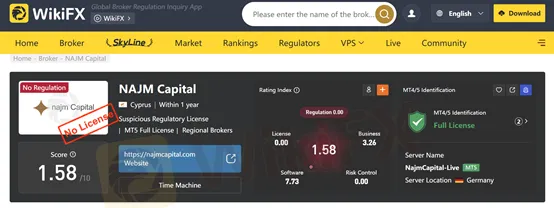

According to WikiFX, an authoritative forex broker review platform, NAJM Capital has a very low credibility score of 1.25 out of 10.

WikiFXs investigation shows that NAJM Capital does not hold any license from recognized financial regulators such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or FSCA (South Africa). This lack of regulation means the broker operates without investor protection or oversight, increasing the risk of fund mismanagement.

WikiFX Rating: 1.25 / 10: Extremely High Risk

A major concern with NAJM Capital is its lack of clarity regarding trading software. The broker does not specify whether it uses MetaTrader 4 (MT4), MetaTrader 5 (MT5), or any proprietary platform. Furthermore, there are no transparent details about:

Without this critical information, traders cannot make informed decisions. These omissions often signal unreliable or fraudulent operations.

The cornerstone of a safe broker is regulation. Unfortunately, NAJM Capital fails to provide any verifiable regulatory details or license number. The absence of regulation means:

Although NAJM Capital claimed that it uses segregated accounts, the lack of transparency makes it difficult to check more details.

NAJM Capital‘s website lists limited contact information, with no physical office address or corporate identity disclosed. User feedback across online forums indicates poor communication, slow responses, and unfulfilled withdrawal requests. This lack of accountability reinforces doubts about the broker’s legitimacy.

Several online users have come forward with disturbing experiences related to NAJM Capital, claiming the broker blocked withdrawals and delayed fund access after profits were made. Below are some reported issues:

These patterns are consistent with known tactics used by unregulated scam brokers, which enticing traders with high returns, delaying withdrawals, and then cutting off communication once significant amounts are deposited.

If you have been affected by NAJM Capital, you are encouraged to file a report on WikiFXs complaint section to assist in future investigations and warn other traders.

| Broker Name | WikiFX Score | Minimum Deposit | Regulatory Status | Verdict |

| NAJM Capital | 1.25 / 10 | $1,000 – $50,000 | Unregulated | High Risk |

| Supremtrade | 1.09 / 10 | $500 – $10,000 | Unregulated | High Risk |

| Duttfx Markets | 1.62 / 10 | $250 – $10,000 | Offshore License (Comoros) | Suspicious |

| WeOwnTrade | 1.05 / 10 | $100 – $5,000 | Unregulated | Unsafe |

| BCRPRO | 1.04 / 10 | $500 – $10,000 | Not Licensed | Potential Scam |

This comparison highlights that NAJM Capital shares many of the same high-risk traits as other unregulated brokers exposed by WikiFX.

Key Red Flags Identified

All these factors strongly suggest that NAJM Capital may not be a trustworthy platform for real-money trading.

Based on comprehensive research, NAJM Capital displays multiple red flags that indicate potential scam activity. The absence of regulation, limited transparency, and high deposit thresholds make it unsuitable for any trader who values fund security and operational integrity.

While NAJM Capital promotes itself as a premium trading provider, its WikiFX score, lack of verified credentials, and poor transparency point toward it being an unregulated and potentially unsafe broker.

Trusted Broker Alternatives (Regulated & Reliable)

For traders seeking safe and transparent trading conditions, here are a few trusted, regulated alternatives to consider:

| Broker Name | Regulator | Minimum Deposit | Trading Platforms | WikiFX Score |

| Exness | FCA, CySEC, FSCA | $10 | MT4 / MT5 | 9.31 / 10 |

| HFM (HotForex) | FCA, FSCA, DFSA | $5 | MT4 / MT5 | 9.27 / 10 |

| FP Markets | ASIC, CySEC | $100 | MT4 / MT5 / cTrader | 9.16 / 10 |

| IC Markets | ASIC, CySEC, FSA | $200 | MT4 / MT5 / cTrader | 9.24 / 10 |

| Pepperstone | FCA, ASIC | $0 | MT4 / MT5 / cTrader | 9.38 / 10 |

These brokers are fully regulated, offer transparent trading conditions, segregated client funds, and responsive customer support, making them far safer choices than unregulated entities like NAJM Capital.

Bottom Line

While NAJM Capital attempts to appear as a premium trading service, its unregulated status, lack of transparency, and negative trader feedback tell a different story. Investors are strongly advised to avoid this broker and trade only with licensed, verified platforms backed by strong regulatory oversight.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Latest India Mazi Finance scam: Failed XAUUSD execution despite margin, costing $675—fake “insufficient balance” excuse. Protect funds, read the full report now!

Does Pemaxx prevent you from withdrawing funds once you make profits? Has the Mauritius-based forex broker disabled your trading account upon your withdrawal request? Do you fail to withdraw funds despite meeting the trading lot requirements? These scam-like trading activities have allegedly become a part of the broker’s operation, as many traders have complained about them online. In this Pemaxx review article, we have highlighted their comments against the forex broker. Keep reading!

Did Fortune Prime Global deduct all your profits by accusing you of market manipulation? Are you struggling to access withdrawals for months? Has the forex broker disabled your forex trading account upon the withdrawal application? Does the broker stipulate tax payments as a condition for fund withdrawals? You are not alone! In this Fortune Prime Global review article, we have highlighted these complaints. Read on!

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.