Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Just2Trade and its licenses.

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Just2Trade and its licenses.

At first glance, JustTrade looks like a well-established global broker. It claims to be licensed in several countries, including Cyprus, the U.S., and Russia. But while this might seem reassuring, a deeper look reveals several concerns, ranging from regulatory overreach to questionable claims, that traders should not ignore.

JustTrades most reliable license comes from CySEC, the financial regulator in Cyprus. The broker holds license number 281/15, which allows it to operate as a Market Maker within the European Economic Area (EEA). CySEC regulation means the broker must follow rules on transparency, client fund safety, and fair operations. This offers some protection for traders in Europe and is generally considered trustworthy.

In the U.S., JustTrade is registered with the National Futures Association (NFA) under license number 0430385. However, this license is not for Forex or high-risk trading services. It's for more general financial services under a different category, and its status is marked as “Exceeded”, suggesting the company might be offering services its not legally allowed to provide in the U.S.

This is a major red flag. Offering services beyond a license's scope can lead to legal trouble, fines, or even shutdowns. It also shows a lack of respect for regulatory rules, which could put clients at risk.

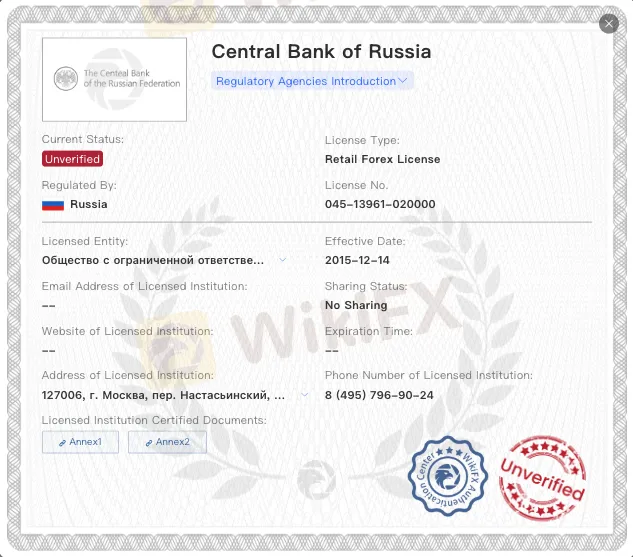

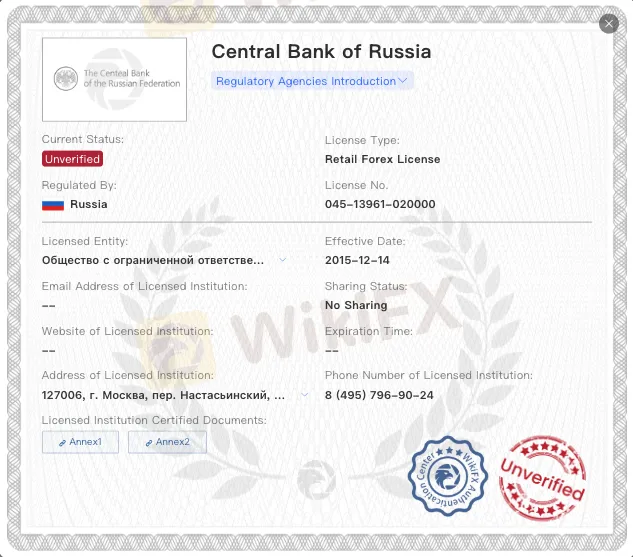

JustTrade also states that it‘s registered with the Central Bank of Russia (CBR) under license 045-13961-020000. But there’s no confirmed record of this license being active or even valid. This doesnt automatically mean fraud, but using unverified claims to build trust is a common trick among less reliable or scam brokers.

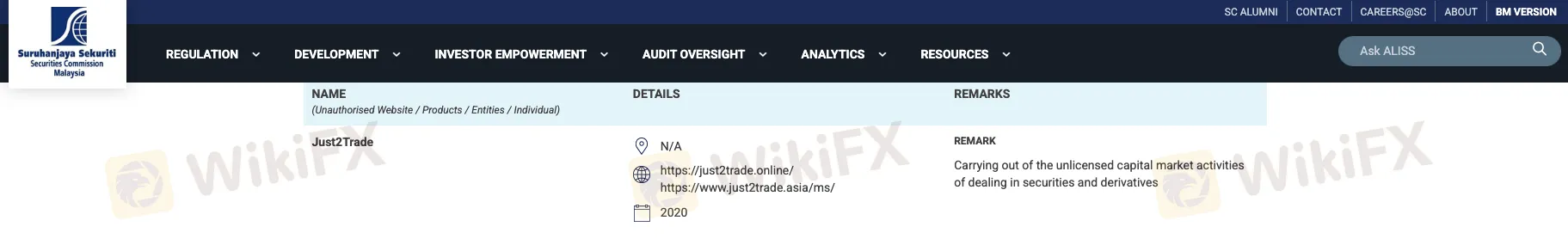

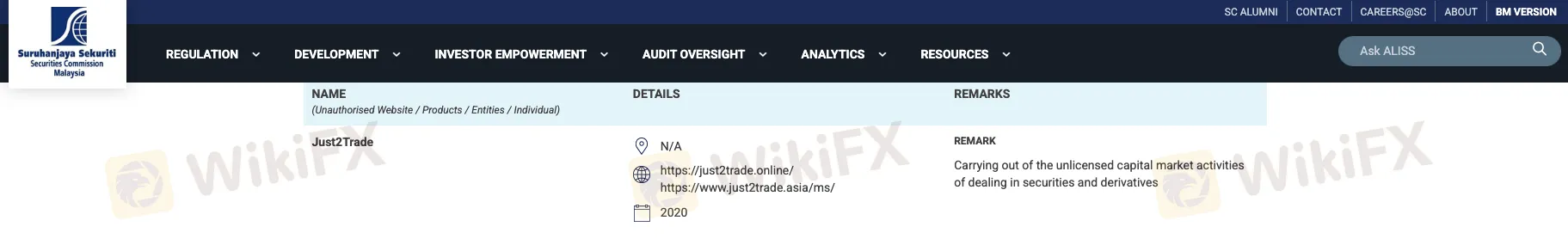

Most concerning is that JustTrade has been flagged by the Securities Commission Malaysia (SC Malaysia). Although no detailed reason was given, such warnings usually mean the broker is either operating without a license in Malaysia or has engaged in suspicious activity. These public alerts are meant to protect investors and should be taken seriously.

JustTrade offers a mix of regulated and unclear operations. While its CySEC license provides some safety, its U.S. overreach, unverified Russian claims, and regulatory warning in Malaysia create a risky picture.