Abstract: Mitrade has added Apple Pay and Google Pay as funding options for its Australian customers.

AI-Powered Trading Among Gen Z Crypto Traders

Younger Australians are not only changing how they pay but also how they invest. A recent report reveals that 67 % of Gen Z crypto traders activated at least one AI-powered trading bot within Q2 2025. Moreover, Gen Z users engage with AI tools an average of 11.4 days per month. This embrace of automation has tangible benefits: during periods of market stress, AI bot users logged 47 % fewer panic‑sell events compared to manual traders.

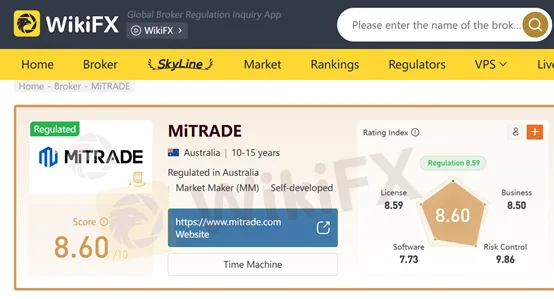

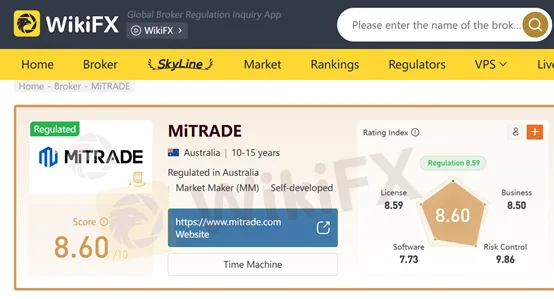

Mitrades Integration of Apple Pay and Google Pay

Responding to these dual trends, Mitrade has added Apple Pay and Google Pay as funding options for its Australian customers. Announced on July 24, 2025, this move aims to streamline deposits, reduce funding delays, and cater to mobile-first users seeking instant trade execution. Elven Jong, CEO of Mitrade Australia, noted that integrating biometric authentication and tokenisation enhances security—an essential safeguard as card-not-present fraud rises and younger traders demand frictionless, trustworthy platforms.

Gen Zs Shift to US Markets

Mitrades payment upgrade aligns with a broader change in trading preferences: Gen Z and younger millennial investors in Australia are increasingly funneling capital into the volatile US markets, diverging from the traditionally dominant ASX. Industry data from The Australian highlights that traders aged 18–40 are drawn to CFD opportunities on US equities and indices, attracted by geopolitical volatility and the potential for outsized short-term gains. This trend underscores the importance of seamless funding rails, ensuring that traders can swiftly capitalise on cross-border market moves.

Conclusion

Mitrades introduction of Apple Pay and Google Pay for Australian clients not only reflects these shifting preferences but also positions the platform to capture a growing segment of tech-savvy, risk-tolerant traders targeting global markets.