WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:On December 13, Canada's provincial and territorial securities regulators, CSA, announced that it is forbidding all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients.

On December 13, Canada's provincial and territorial securities regulators, the Canadian Securities Administrators (CSA), released a statement that it has forbidden all Canadian-based cryptocurrency trading companies to provide margin or leveraged trading services to any Canadian clients. This also applies to foreign platforms offering services to Canadians residing within the country's border.

Furthermore, the CSA requires that Canadian cryptocurrency exchanges keep their custody assets separate from the platform's proprietary company.

Additionally, the CSA considers labelling stablecoins as securities and/or derivatives as it strengthens its oversight of the crypto industry. These refer to those cryptocurrencies pegged to fiat or other fundamentally stable and reliable assets.

eToro's co-founder, Ronen Assia, also sees an evident shift within retailers' preferences on his multi-asset trading platform, wherein individuals are cashing out from cryptocurrencies and opting for securities and bonds.

Therefore, it is sufficient to say that, at the moment, regulators worldwide are striving to strengthen their oversight of this seemingly shaky and risky cryptocurrency industry. In conjunction with this, let us take a look at what exactly CSA does do.

Aiming to enhance, coordinate, and harmonise the regulation of the Canadian capital markets, the Canadian Securities Administrators (CSA) is the umbrella body for Canada's provincial and territorial securities regulators.

It seeks to reach an agreement on policy choices that have an impact on the Canadian capital market and its players. Additionally, it seeks to cooperate in the execution of regulatory initiatives across Canada, such as the evaluation of continuous disclosure and prospectus filings. While provincial or territorial authorities in each jurisdiction address all complaints relating to securities infractions, the CSA coordinates initiatives on a national level. As a result, each regulator may offer a more direct and effective service to the local investors and market participants. Each province or territory also handles its own enforcement of securities laws respectively.

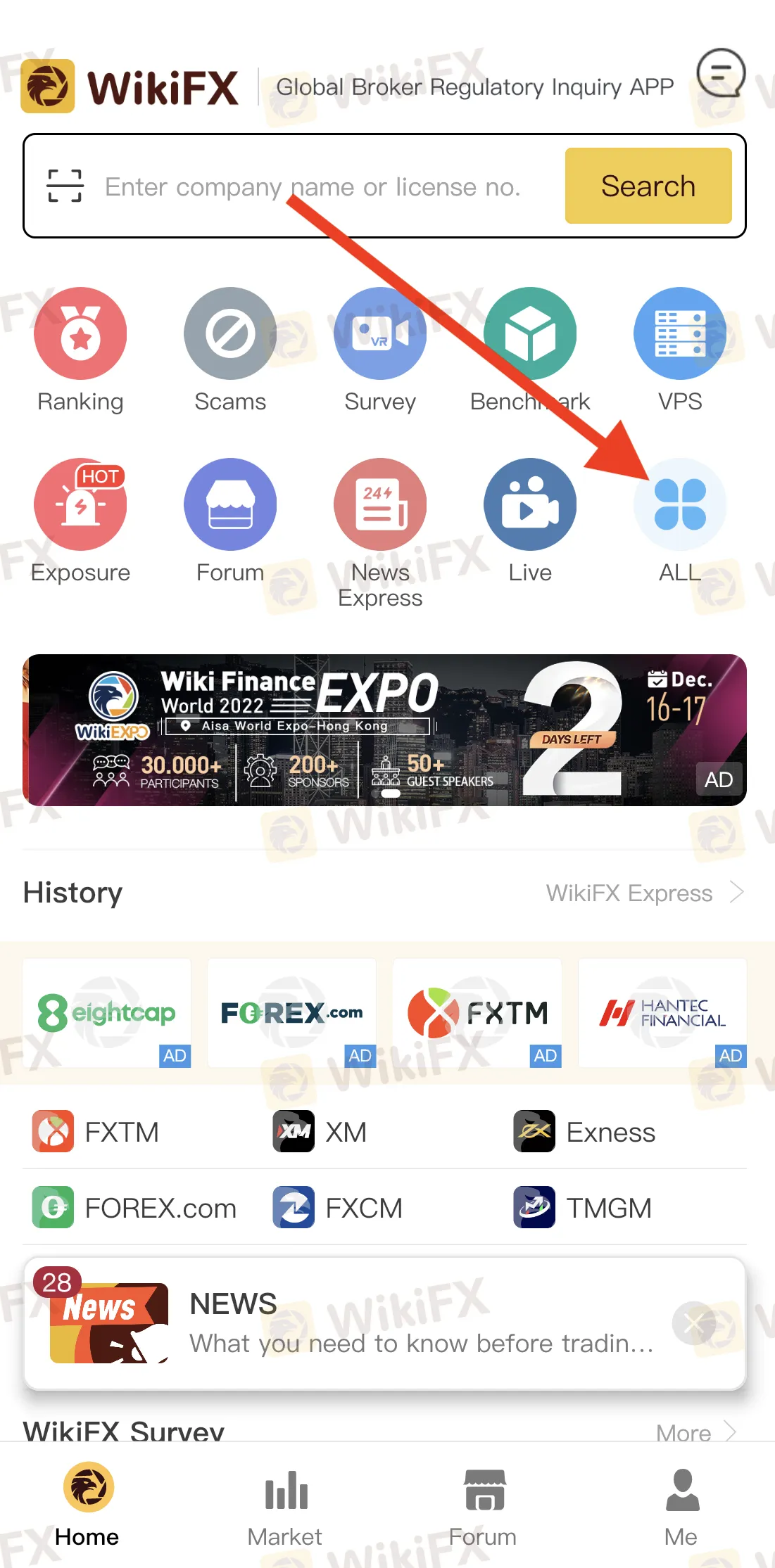

Here's a useful tip to utilise the free WikiFX app to the fullest. There is a function named “Regulatory Disclosure” where you can stay informed about the warnings and sanctions imposed by national regulators throughout the globe on concerning (forex) brokers.

WikiFX is a global forex broker regulatory query platform that holds verified information of over 40,000 forex brokers in collaboration with more than 30 national regulators, including CSA, ASIC, FCA and more.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.