WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The third quarter or Q3 earnings season in the US is now drawing to a close, so what takeaways are there for traders from the results marathon?

The third quarter or Q3 earnings season in the US is now drawing to a close, so what takeaways are there for traders from the results marathon?

The bulk of Q3 earnings was posted throughout October into early November and so a good place to start our investigation is equity index performance during that period.

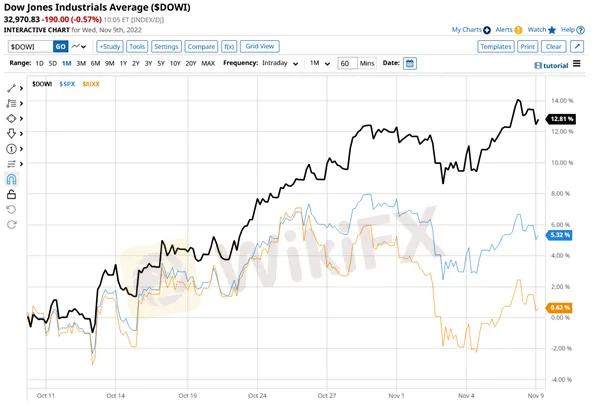

Looking at the chart below there is an obvious divergence between the three main US equity indices.

The Nasdaq 100 index, drawn in orange, fell by as much as -5.27% during October while the S&P 500, the blue line, ranged between a -2.32% loss and a +7.0% gain in that time frame.

However, the best performer by far was the Dow. The narrowest and most established of the three indices, rallied by +14.0% last month, halving its year-to-date losses in the process.

In fact, October was the best month for the Dow since 1976.

Earnings themselves werent necessarily that great but they were a lot better than many analysts were expecting.

As of November 4th, 85% of S&P 500 companies had reported Q3 numbers and 70% of those posted a positive earnings surprise whilst 71% of the companies, reported a beat on revenues. That level of revenue beats is above the 5 -year average of 69.0%.

Earnings growth rates were low but positive

In aggregate S&P 500 companies showed earnings growth of +2.20% according to data from Factset. In terms of valuation, the 12-month forward PE ratio for the S&P 500 is 16.10 times earnings.

That figure is below both the five and ten-year averages for the index, which are found at 18.5- and 17.10-times earnings respectively. So, the S&P 500 stocks are not expensive versus history on this measure.

However, Wall Street analysts dont believe that earnings will grow at all, in the fourth quarter of 2022. So, one might argue that US stocks are cheap for a reason.

And as we can see in the chart above the analysts are now predicting that earnings in the index will shrink by an average of -1.0% in Q4. If thats the case, it would be the first quarter of negative earnings growth since Q3 2020.

Foot on the gas

Its not a bleak picture in every sector of course and the S&P 500 Energy stocks had another bumper quarter over the last the Energy sector has rallied by 11.742% and is up more than 66% year to date.

The best-performing large-cap stock in the US during 2022 is an energy stock.

Occidental Petroleum (OXY) is up 149.50% year to date, whilst oil services group Baker Hughes (BKH) has seen its stock price bounce by almost 33.0% in the last month.

Individual performance

Twenty-five stocks within the S&P 500 made gains of +26.0% or more during October.

Eleven of these stocks were in energy or energy-related industries, but others came from medicine and healthcare, from travel and leisure, and two were old economy names from the industrial sector. Technology was conspicuous by its absence, however.

Overall, there was very little to link these stocks together, other than their performance during October and the affiliation of a large proportion of the names to the energy sector.

However, they did share one common trait and that was that pre, and in many cases, post-earnings momentum.

That momentum was captured and highlighted by the stocks interaction with their 50-period moving average on the 240-minute chart. Such as the one below for Caterpillar (CAT).

A break above that line, ahead of earnings (shown by E in a blue box) invariably lead to significant gains.

In the case of Caterpillar that meant a move from $174 to as high as $232.

Overall then I think that Q3 earnings have shown us that the US equity market can no longer be treated as a single, unified entity and those divergences between indices, sectors, and indeed individual equities are likely to increase in the months ahead

That means its a stock pickers market going forward, as such traders may have to work harder to identify winners and losers. However, if October was anything to go by the rewards for getting that selection right could be significant.

Whats more, we have been able to identify a relatively simple indicator that we can carry forward into the Q4 earnings season to make our life a little easier.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.