Perfil de la compañía

| I-Access Resumen de la reseña | |

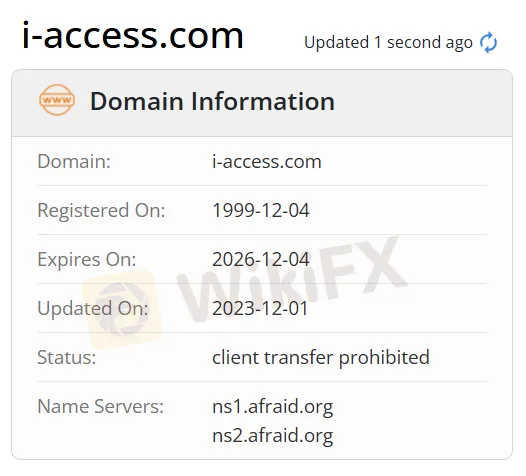

| Establecido | 1999 |

| País/Región Registrada | Hong Kong |

| Regulación | Sin regulación |

| Instrumentos de Mercado | Valores, Acciones, Futuros, Opciones |

| Cuenta Demo | ✅ |

| Plataforma de Trading | ISSNet |

| Soporte al Cliente | |

| Tel: 2890 8019 | |

| Fax: 2850 5786 | |

| Email: info@i-access.com | |

| Dirección: Tsim Sha Tsui Suite 801-3, 8th Floor, Ocean Centre, Harbour City | |

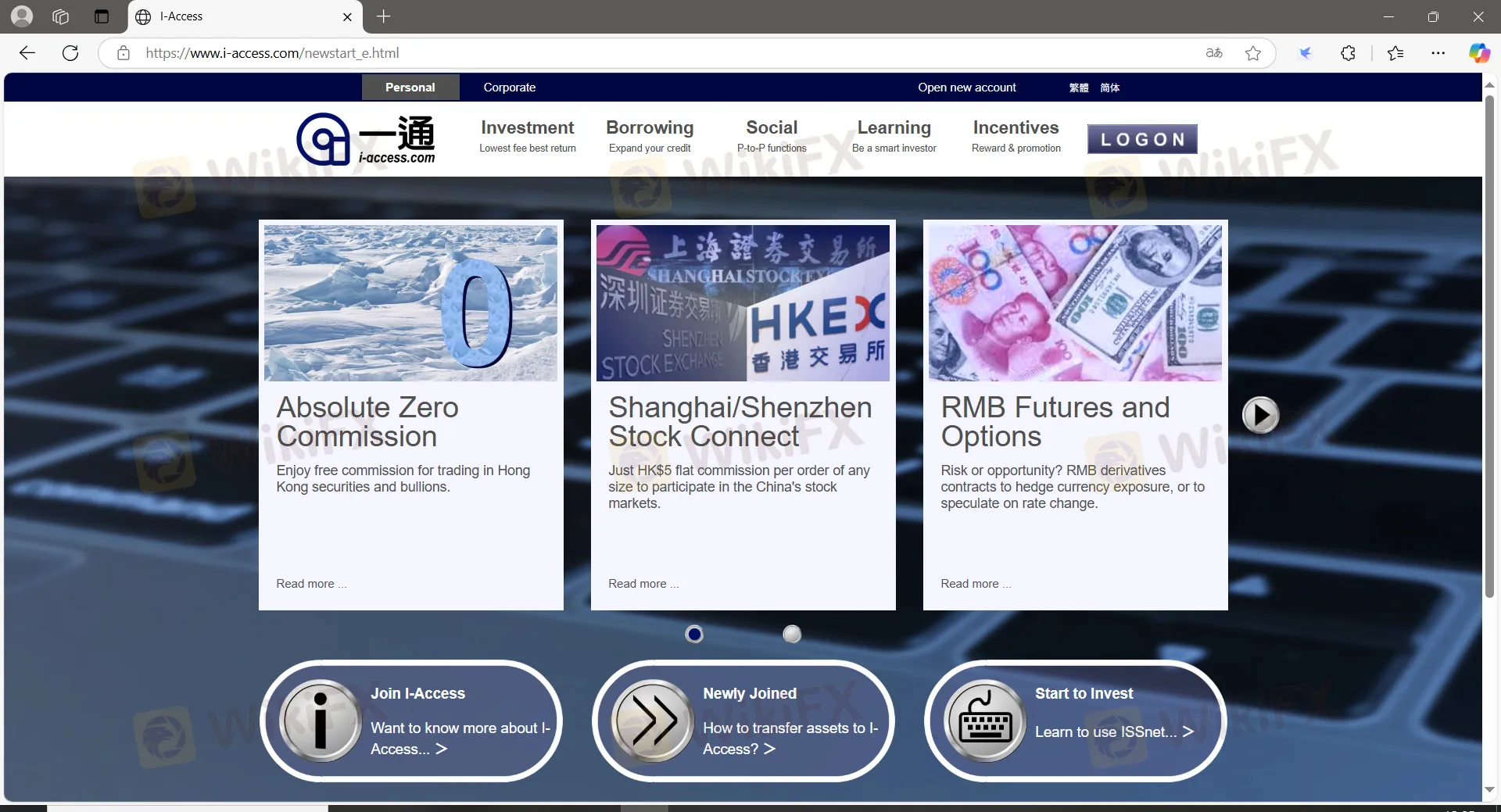

Información de I-Access

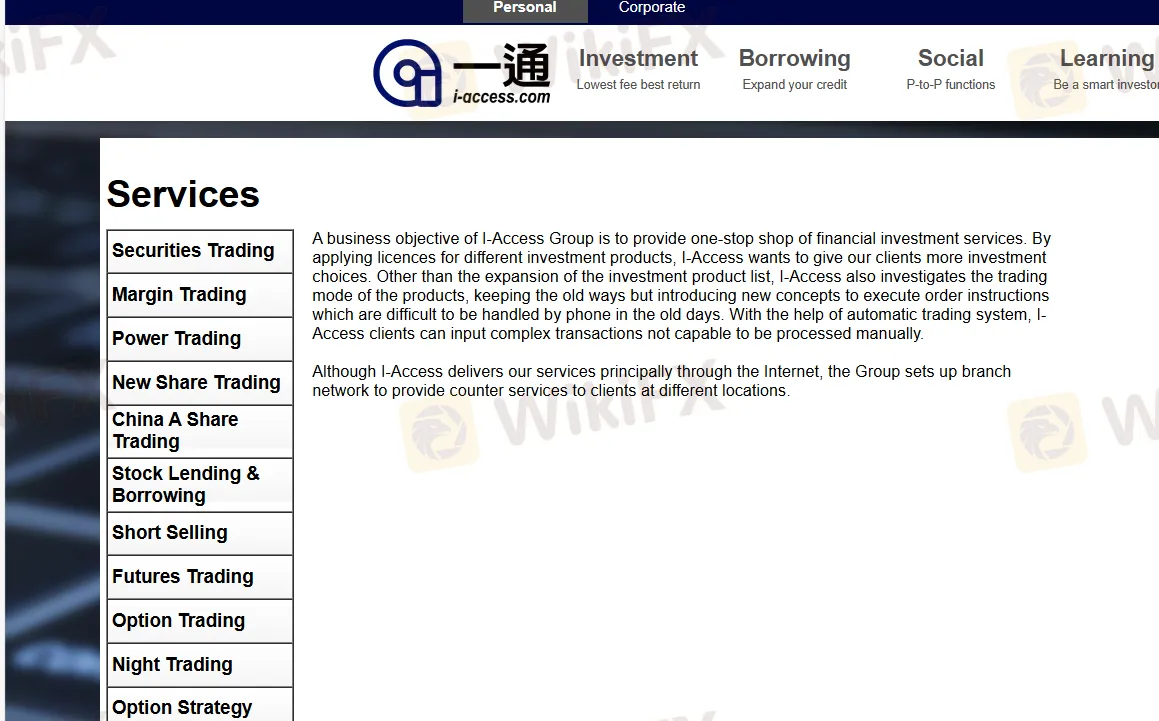

I-Access es un proveedor de servicios no regulado de corretaje y servicios financieros de primera calidad, fundado en Hong Kong en 1999. Ofrece productos y servicios para Trading de Valores, Trading de Margen, Trading de Energía, Trading de Nuevas Acciones, Trading de Acciones Chinas A, Préstamo y Préstamo de Acciones, Venta en Corto, Trading de Futuros, Trading de Opciones, Trading Nocturno, Estrategia de Opciones, Alto Rendimiento, Renovación, Oro, Trading de Lotes Impares, Plan Mensual, eIPO, Suscripción de Bonos en Línea, Cotización en Tiempo Real, Servicios en Ventanilla, Entrada/Salida de Fondos y Préstamos.

Pros y Contras

| Pros | Contras |

| Largo tiempo de operación | Falta de regulación |

| Varios productos de trading | Cobro de comisiones |

| Cuentas demo disponibles |

¿Es I-Access Legítimo?

No. I-Access actualmente no tiene regulaciones válidas. ¡Por favor, tenga en cuenta el riesgo! Además, su estado de dominio muestra que la transferencia de clientes está prohibida.

¿Qué puedo negociar en I-Access?

| Instrumentos de Trading | Soportado |

| Valores | ✔ |

| Acciones | ✔ |

| Futuros | ✔ |

| Opciones | ✔ |

| Forex | ❌ |

| Productos Básicos | ❌ |

| Índices | ❌ |

| Criptomonedas | ❌ |

| Bonos | ❌ |

| ETFs | ❌ |

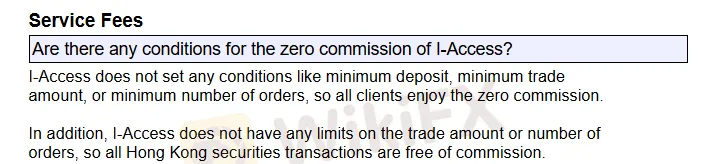

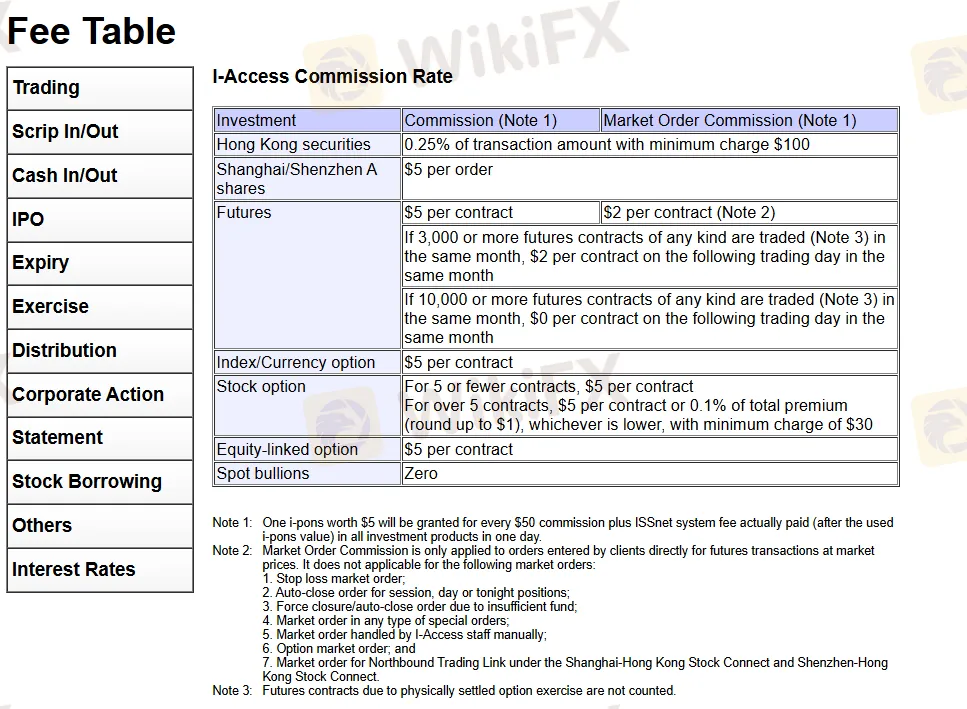

I-Access Tarifas

| Inversión | Comisión | Comisión de Orden de Mercado |

| Valores de Hong Kong | 0.25% del monto de la transacción con un cargo mínimo de $100 | |

| Ashares de Shanghai/Shenzhen | $5 por orden | |

| Futuros | $5 por contrato | $2 por contrato |

| Si se negocian 3.000 o más contratos de futuros de cualquier tipo en el mismo mes, $2 por contrato en el siguiente día hábil del mismo mes | ||

| Si se negocian 10.000 o más contratos de futuros de cualquier tipo en el mismo mes, $0 por contrato en el siguiente día hábil del mismo mes | ||

| Opción de Índice/Moneda | $5 por contrato | |

| Opción de Acciones | Para 5 o menos contratos, $5 por contrato. Para más de 5 contratos, $5 por contrato o 0.1% del total de la prima (redondeado a $1), lo que sea menor, con un cargo mínimo de $30 | |

| Opción Vinculada a Acciones | $5 por contrato | |

| Metales Preciosos al Contado | ❌ | |

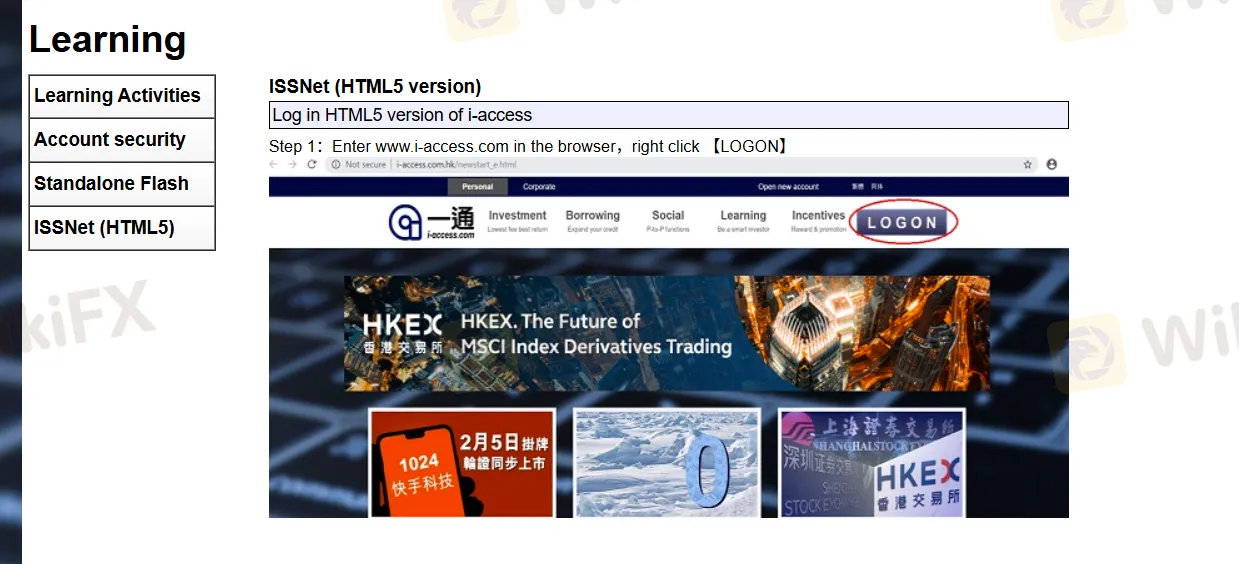

Plataforma de Trading

| Plataforma de Trading | Compatible | Dispositivos Disponibles |

| ISSNet APP | ✔ | Móvil |

| ISSNet web | ✔ | PC, portátil, tableta |

Depósito y Retiro

En cuanto al depósito mínimo, I-Access no establece ninguna condición. Aparte de eso, otros detalles como el tiempo de procesamiento, opciones de pago y monedas aceptadas, no están claros.