Melaka police bust fake investment scam run by Chinese nationals

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:BSN is set to begin payouts next week to victims of an investment scam involving one of its employees, following ongoing follow-ups by Sarawak DAP chairman Chong Chieng Jen. Investigations are continuing, with multiple charges filed and total losses believed to exceed RM11 million.

Sarawak Democratic Action Party (DAP) chairman Chong Chieng Jen has been informed that Bank Simpanan Nasional (BSN) will begin disbursing payouts to some victims of an employee-linked investment scam as early as next week.

In a statement, Chong said his party would continue to closely monitor the payout process to ensure affected victims receive the compensation they deserve. He added that discussions with the bank have been ongoing since the issue first came to light late last year.

“Since my first exposé on Nov 28, I have held several meetings with BSNs executive management and have personally followed up on all the cases that were referred to me,” he said.

Read more

Chong was responding to the emergence of another victim who recently came forward seeking his help after realising he had fallen prey to the scam, which was allegedly carried out by a BSN employee. The victim, identified as Hong, had invested RM300,000 last year in what he believed was a legitimate investment fund recommended by the employee.

According to Chong, Hong only discovered that his investment was a scam after reading media reports about the exposé. Alarmed by the news, Hong immediately went to BSN to verify his investment, only to be told that the bank had no record of him being an investor in the fund.

Following the discovery, Chong said the victim lodged a police report and filed a dispute claim. He also travelled to Kuala Lumpur to submit a report to Bank Negara Malaysia in an effort to recover his losses.

Meanwhile, the Stampin Member of Parliament noted that two charges have so far been brought against the suspects, involving sums of RM16,000 and RM300,000 respectively. However, Chong stressed that the case is far from over.

“Given that the main suspect is believed to have cheated more than RM11 million from over 70 individuals, I expect more charges to be brought against those involved,” he added.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Melaka police raided a call centre run by four Chinese nationals targeting victims with fake investment schemes via a mobile app.

The rise of deepfake scams impersonating national leaders and public figures has caused significant financial losses in Malaysia, prompting the government to propose an AI Governance Bill aimed at strengthening safeguards, restoring public trust and providing regulatory clarity to support responsible AI use and investment.

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

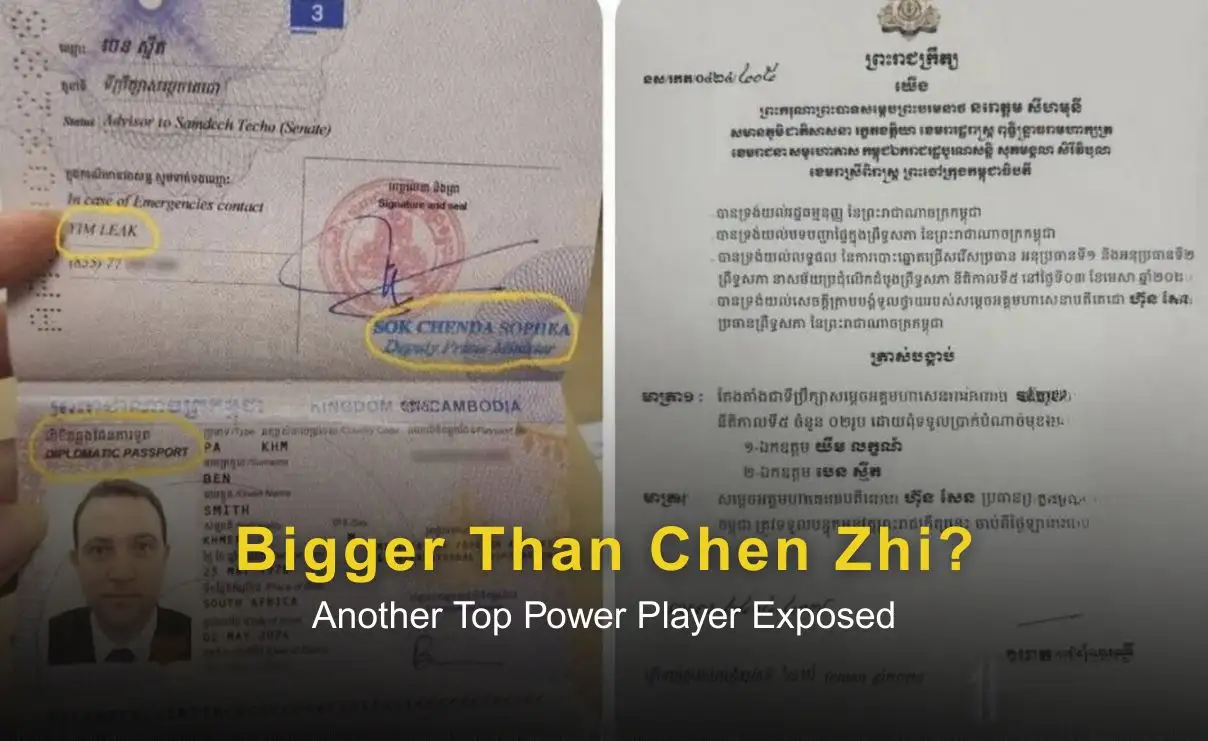

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.