WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

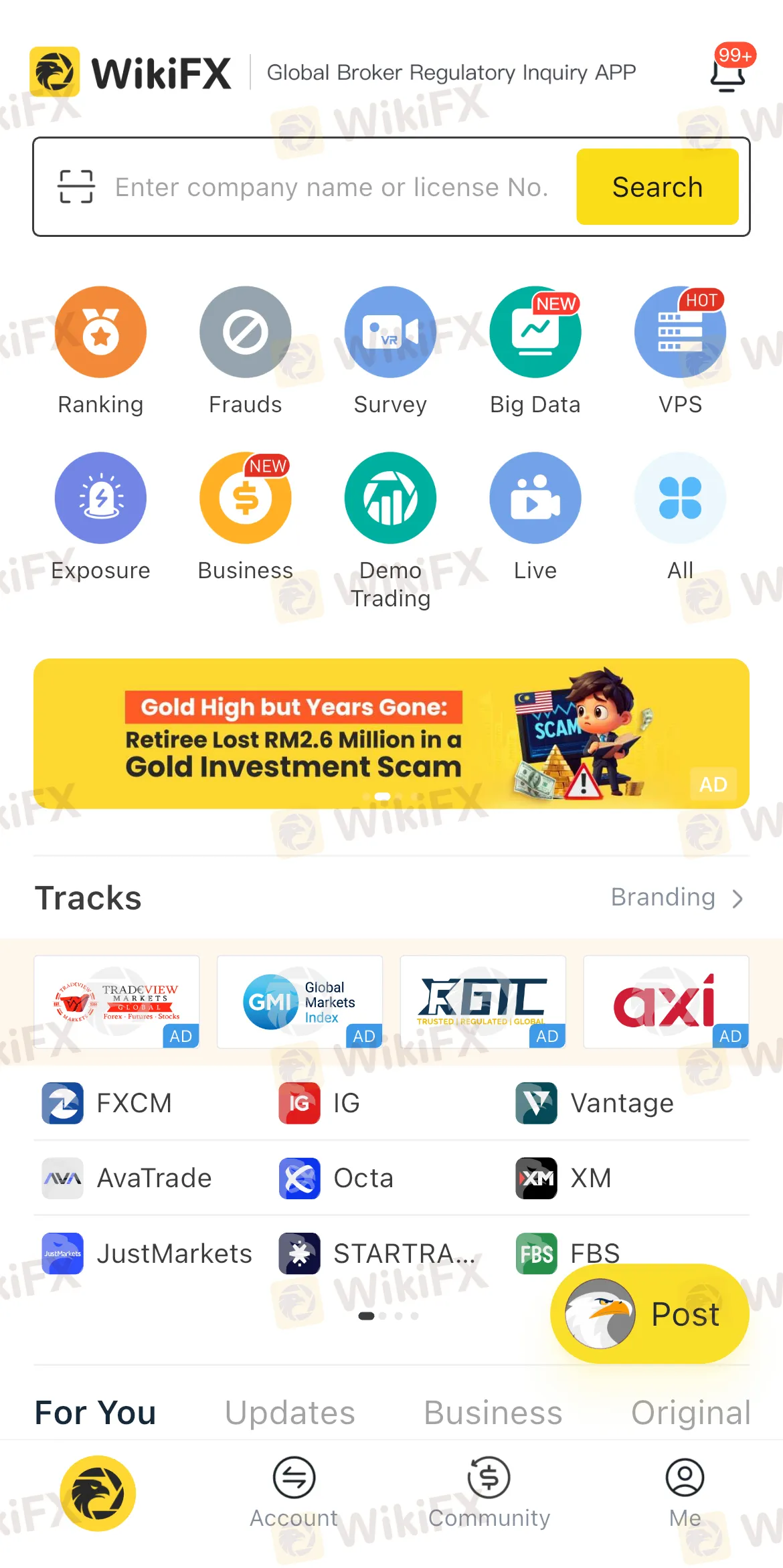

Abstract:A 77-year-old retiree lost his entire life savings after being persuaded by two women, known to him as “Kelly” and “Lydia,” to invest in a non-existent foreign exchange (forex) trading scheme promising high returns.

A 77-year-old retiree lost his entire life savings (amounting to RM104,844) after being persuaded by two women, known to him as “Kelly” and “Lydia,” to invest in a non-existent foreign exchange (forex) trading scheme promising high returns.

Kuala Terengganu District Police Chief, Assistant Commissioner Azli Mohamad Noor, revealed that the victim lodged a police report at 4:47 p.m. yesterday, claiming he had been duped in what turned out to be a fraudulent investment.

According to the police report, the victim first came into contact with a woman identifying herself as Kelly through Facebook at the end of May this year.

During their initial conversations, Kelly allegedly told the victim that her “sister” was making substantial profits through forex trading.

Subsequently, on May 28, a woman claiming to be Lydia, Kellys sister, contacted the victim directly. Lydia introduced a forex investment opportunity and asked the victim to transfer the capital, assuring him that she would handle the trading process herself.

As the investment appeared to generate substantial profits on the account presented to him, the retiree attempted to withdraw the earnings. However, Lydia informed him that in order to access the funds, he would first need to make additional payments.

She claimed the profits had triggered anti-money laundering alerts, and that further payments were required to prevent the funds from being frozen or confiscated.

Believing this to be true, the victim proceeded to make three transactions, withdrawing a total of RM35,844 from his personal savings, thus comprising both capital and supposed profits.

Eventually, the victim became suspicious, especially after he had already deposited a total of RM104,844 into the fraudulent account and was still being asked to make further payments. It was only then that he realized he had been scammed. The case is currently under investigation by the Kuala Terengganu police.

Under no circumstances should you engage with an investment scam advertised on social media that promises high returns or sounds too good to be true without exercising caution. If in doubt, download the free WikiFX mobile application from Google Play or the App Store. This global broker regulatory query platform, at your fingertips, provides detailed information about brokers, including their regulatory status, customer reviews, and safety ratings. It allows users to verify the legitimacy of investment platforms before committing their money. With access to in-depth insights and risk alerts, WikiFX equips potential investors with the tools to make informed decisions and steer clear of unauthorised or unlicensed entities. By using WikiFX, users can safeguard their savings and avoid the costly traps of fraudulent investment syndicates.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.