Abstract:"Which news releases should I trade" is a golden question that you, as a retail trader, would want to be able to respond to.

We trade the news because it can raise volatility in the short term, so it only makes sense that we would only trade the news with the greatest potential to move the currency market. The news that typically influences price movement and creates volatility includes modifications to central bank monetary policy, government policy changes (fiscal policy), unexpected outcomes in the release of economic data, Tweets at random from a prominent figure, and more.

Being on the wrong side of the market can be avoided by being aware of impending key event risks. This could be efficiently dealt with with the free economic calendar provider in the WikiFX mobile app, which is also free for download in Google Play or App Store.

Economic Calendar highlights the significant occasions and economic data published by the nations with the most active currency markets. On any given week, there may be several scheduled events. Though not all of them share the same level of importance, keeping up with them is tedious. Thankfully, our Economic Calendar also makes it simple to determine the relative significance of each event. All you need is to judge it by the stars!

The most significant events typically involve changes in interest rates, inflation, and economic growth, such as retail sales, manufacturing, and consumer sentiment, as you'll start to notice if you spend some time looking through the Economic Calendar.

Here are a few instances where retail traders should be well-prepared ahead of the huge volatility, which includes interest rate decisions by central banks, inflation-related data (CPI, PCE, PPI), employment-related data (unemployment report, wage growth), economic growth (GDP), retail sales, etc.

While the markets react to the majority of economic news from different nations, the U.S. is the biggest mover and the news that is most closely followed in terms of military affairs, geopolitics, industry, energy, science, culture, and technology. The world's largest economy is still that of the United States, and the dollar serves as the reserve currency. Therefore, the geopolitical news centred around America should not be neglected.

Simultaneously, events that could bring ripple effects on a global basis also play an essential role. For example, looking back at the Covid-19 pandemic and the Russia-Ukraine war, it is evident that they drove all the financial markets wild during their outbreaks.

News can bring increased volatility in the forex market (and more trading opportunities). When news breaks, the price often jumps in one direction or reacts slowly to the information as traders assess the result compared to market expectations. It is crucial that we, as retail traders, trade currencies that are fairly liquid to ensure smooth and timely execution – these are usually the main currency pairs: EUR/USD, GBP/USD, AUD/USD, USD/JPY, EUR/USD, and CAD/USD. Also, notice how they usually involve USD proving the point mentioned above about its importance.

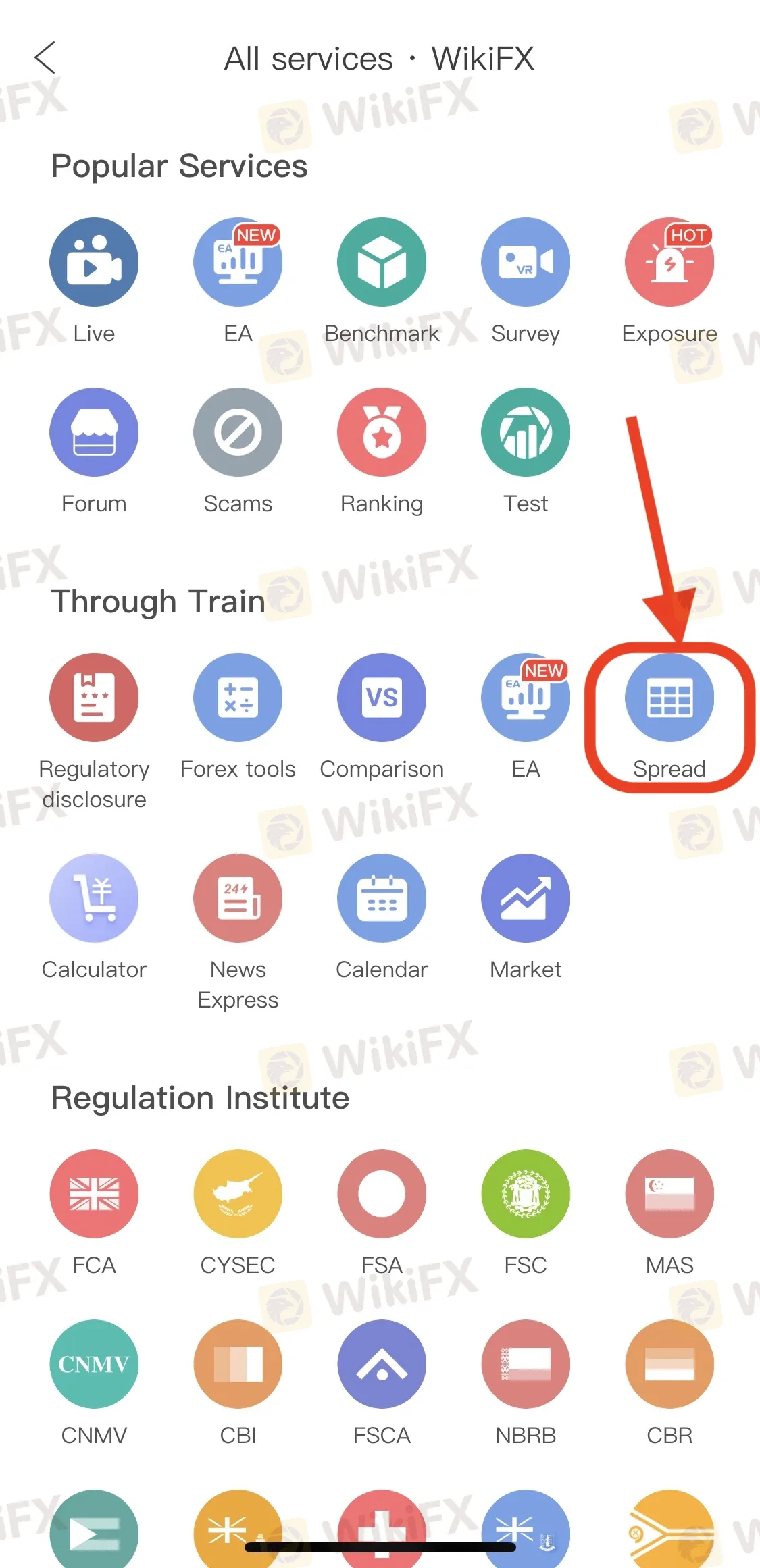

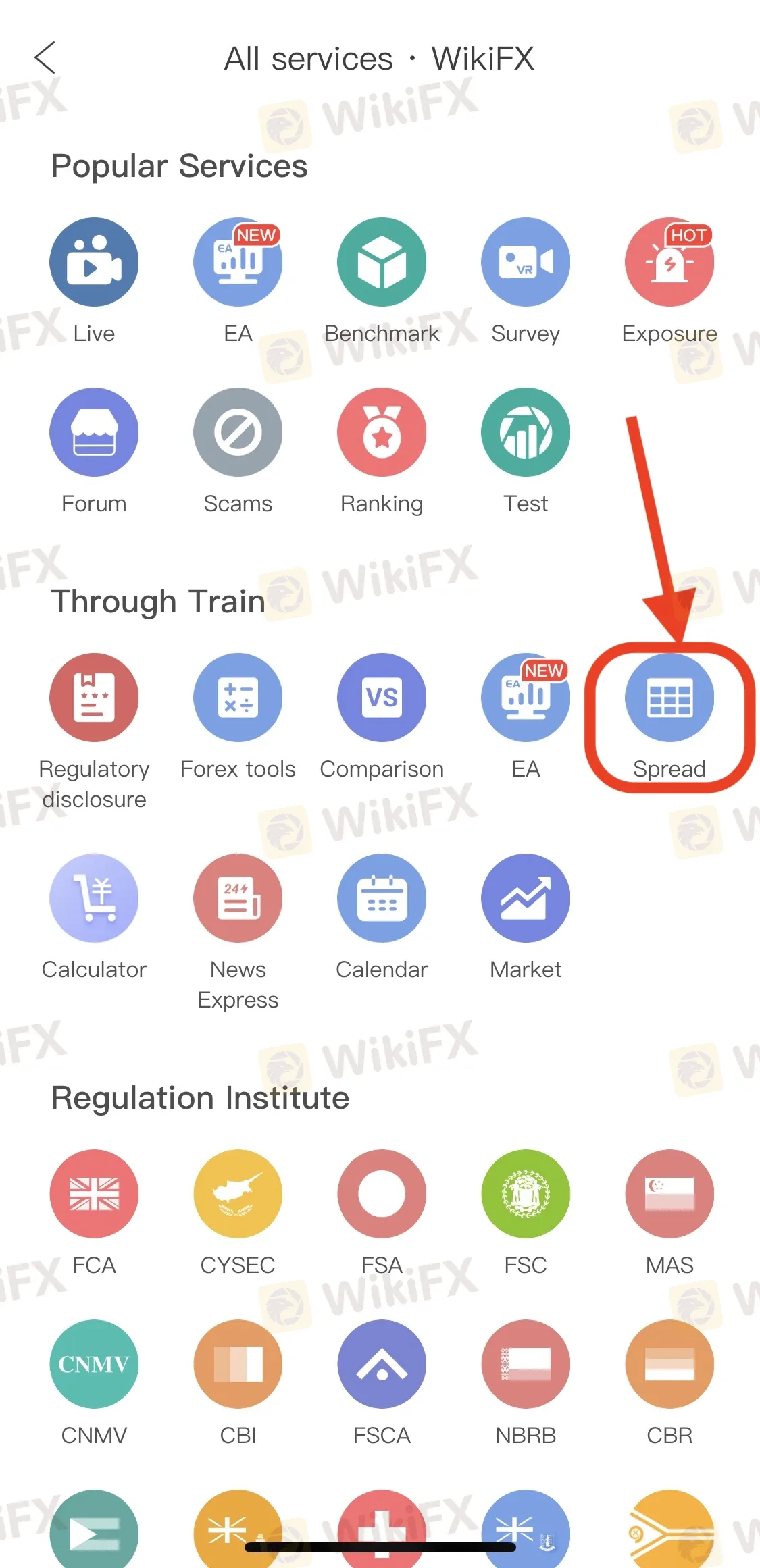

In conjunction with this, follow these steps to find brokers that offer the best spreads to keep your trading costs under control.

There are two primary ways to trade the news:

1) Having a bias in one direction

As soon as the news report is made public, you anticipate the market to move in a specific direction. Knowing what news stories will drive the market is important when looking for a trade opportunity in one particular direction.

2) Not having a bias

This approach ignores directional bias and simply takes advantage of the fact that a significant news event will precipitate a significant move. The direction of the forex market's movement is irrelevant.

No matter which strategy you are using, being equipped with the appropriate trading knowledge and skills is the prerequisite condition to be able to make profits during such volatile market conditions.

Visit the WikiFX education site (https://www.wikifx.com/en/education/education.html) and utilize the free trading-related resources to level up yourself. Have fun trading in 2023!