WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Danske Bank announced a deal with US and Danish authorities in one of the world's worst money-laundering scandals on Tuesday, admitting guilty to bank fraud conspiracy and civil securities fraud and agreeing to pay a total of US$2 billion in penalties.

“The resolutions bring the investigations by US and Danish authorities to a close,” said Martin Blessing, chairman of Danske Bank's Board of Directors. “We sincerely apologize and accept full responsibility for the past's deplorable failures and misbehavior, which have no place at Danske Bank today.”

Danske commissioned an inquiry in 2018, which revealed that a large percentage of the $200 billion that went through its Estonian business from 2007 to 2015 was of dubious origin.

The US Department of Justice (DOJ) accused Danske of tricking US banks about its anti-money laundering procedures and high-risk client base, allowing it to funnel billions of dollars of questionable and illicit payments through the nation's financial system.

The US Securities and Exchange Commission (SEC) has filed a civil securities fraud lawsuit against the bank, accusing it of giving false information to investors, and preventing them from making smart investment choices.

These two cases were resolved with payments to the DOJ of $1.2 billion and the SEC of $178.6 million. The remaining $612.4 million will go to the Danish Special Crime Unit.

The issue was sparked by a former trader at the Estonian division who informed the executive board in Copenhagen of suspicious activity in the office.

An Estonian inquiry eventually revealed how bankers in the branch's international banking division assisted customers in laundering unlawful funds in return for fees and commissions.

The gang of 19 people provided services such as selling offshore corporations, creating bogus contracts and locating proxy directors who were then added to company papers to make it seem more respectable.

The funds were obtained via eight different schemes in Russia, Azerbaijan, Iran, Switzerland, Georgia, and the United States.

Blessing noted that Danske has placed comprehensive control systems in place to avoid such failures in the future.

The whole story may be found at: https://www.justice.gov/opa/pr/danske-bank-pleads-guilty-fraud-us-banks-multi-billion-dollar-scheme-access-us-financial-system

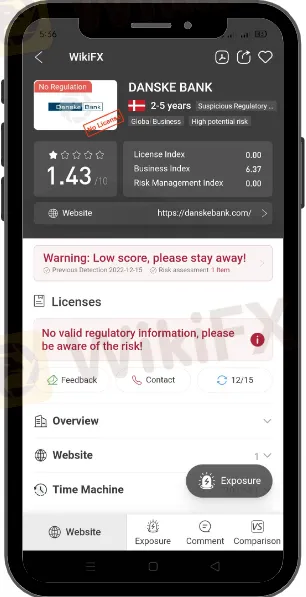

Find out more news about Danske Bank here: https://www.wikifx.com/en/dealer/6451811396.html

You may find the download link below to download and install the WikiApp so you can stay up to date even while you're on the move.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.