公司简介

| TD道明道明评论摘要 | |

| 成立时间 | 1998 |

| 注册国家/地区 | 加拿大 |

| 监管 | 无监管 |

| 产品与服务 | 支票和储蓄账户、信用卡、抵押贷款选择、个人投资、借款、在线投资和交易、个性化财富建议 |

| 平台/App | TD道明道明 App |

| 客户支持 | 英语:1-800-983-8472,法语:1-800-983-8472,普通话:1-877-233-5844 |

TD道明道明信息

TD道明道明是一家在线交易公司,提供全面的个人银行服务,包括信用卡、抵押贷款和各种投资选择,可通过其用户友好的TD道明道明 App访问。然而,目前尚未受到任何金融监管机构的监管。

优缺点

| 优点 | 缺点 |

| 各种个人银行服务 | 无监管平台 |

| 费用结构不清晰 |

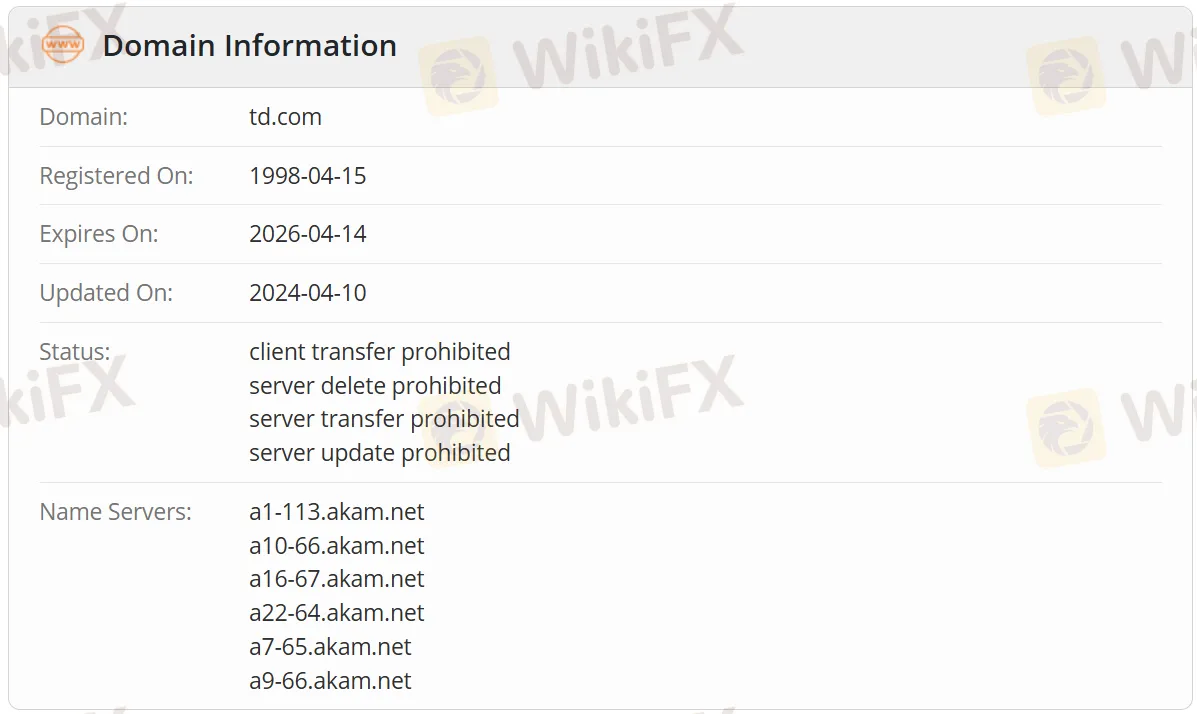

TD道明道明是否合法?

否。TD道明道明是一家无监管平台。域名td.com于1998年4月15日在WHOIS上注册,有效期至2026年4月14日。目前状态为“客户转移禁止,服务器删除/转移/更新禁止”。

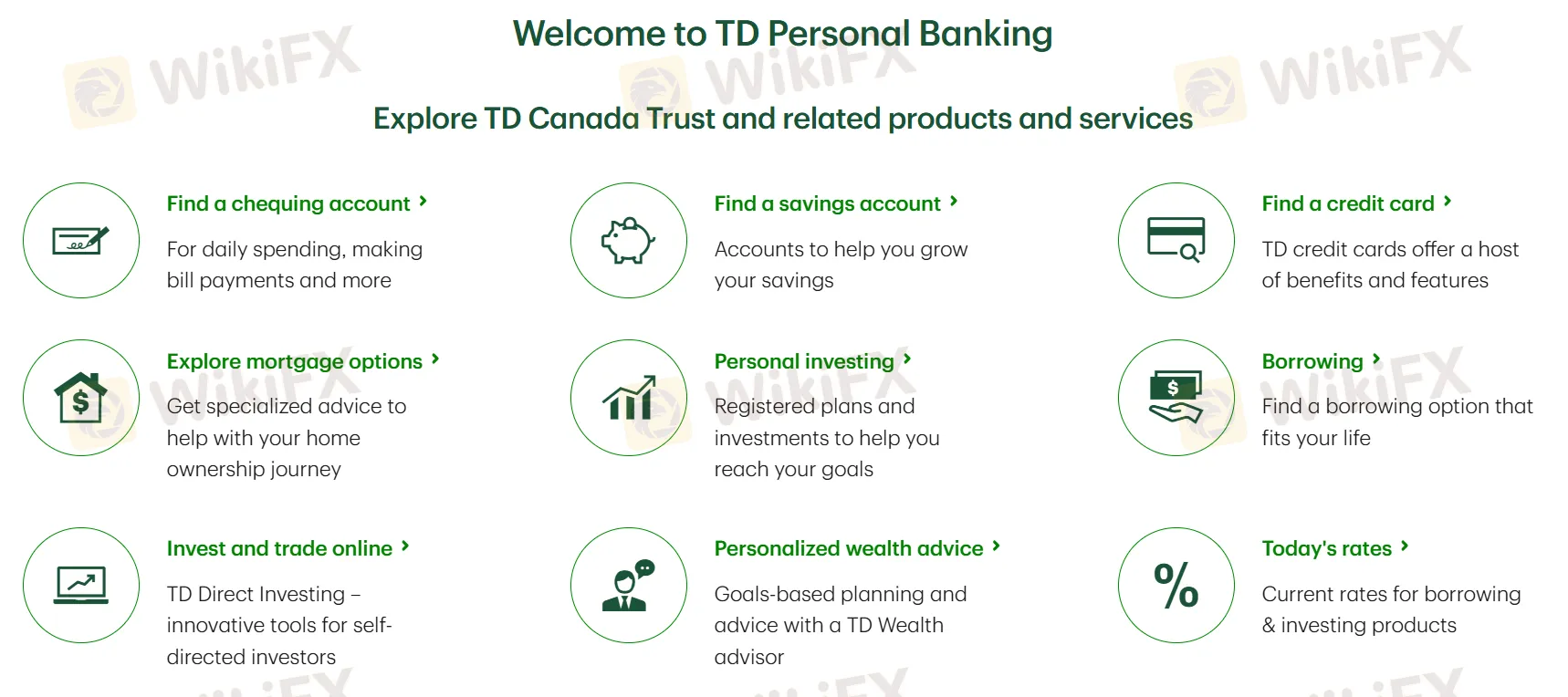

产品与服务

TD道明道明提供的产品和服务包括支票和储蓄账户、信用卡、抵押贷款选择、个人投资、借款、在线投资和交易、个性化财富建议等。

平台/App

| 平台/App | 支持 | 可用设备 |

| TD道明道明 App | ✔ | 苹果,安卓 |